Analyst Expectations For SpringWorks Therapeutics's Future

Author: Benzinga Insights | April 28, 2025 04:00pm

6 analysts have expressed a variety of opinions on SpringWorks Therapeutics (NASDAQ:SWTX) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

2 |

1 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

3 |

2 |

0 |

0 |

0 |

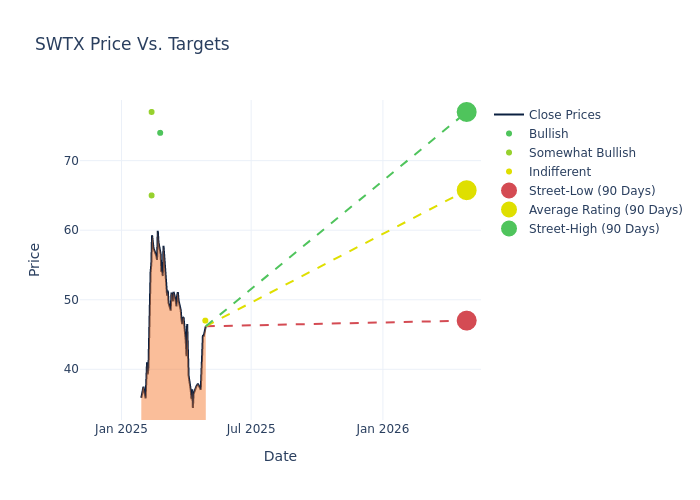

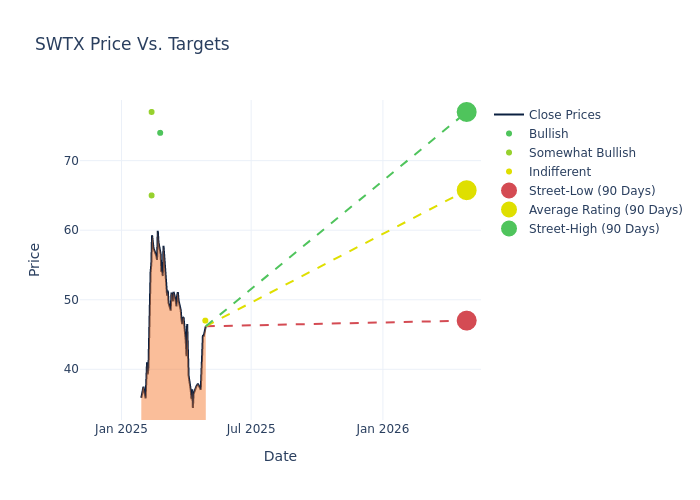

In the assessment of 12-month price targets, analysts unveil insights for SpringWorks Therapeutics, presenting an average target of $68.5, a high estimate of $77.00, and a low estimate of $47.00. Observing a downward trend, the current average is 2.6% lower than the prior average price target of $70.33.

Interpreting Analyst Ratings: A Closer Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive SpringWorks Therapeutics. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target |

|--------------------|--------------------|---------------|---------------|--------------------|--------------------|

|Peter Lawson |Barclays |Lowers |Equal-Weight | $47.00|$63.00 |

|Robert Burns |HC Wainwright & Co. |Maintains |Buy | $74.00|$74.00 |

|Robert Burns |HC Wainwright & Co. |Maintains |Buy | $74.00|$74.00 |

|David Nierengarten |Wedbush |Maintains |Outperform | $77.00|$77.00 |

|Cory Kasimov |Evercore ISI Group |Raises |Outperform | $65.00|$60.00 |

|Robert Burns |HC Wainwright & Co. |Maintains |Buy | $74.00|$74.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to SpringWorks Therapeutics. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of SpringWorks Therapeutics compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of SpringWorks Therapeutics's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of SpringWorks Therapeutics's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on SpringWorks Therapeutics analyst ratings.

All You Need to Know About SpringWorks Therapeutics

SpringWorks Therapeutics Inc is a clinical-stage biopharmaceutical company applying a precision medicine approach to acquiring, developing, and commercializing life-changing medicines for underserved patient populations suffering from devastating rare diseases and cancer. The company has a differentiated portfolio of small molecule targeted oncology product candidates and is advancing two potentially registrational clinical trials in rare tumor types, as well as several other programs addressing prevalent, genetically defined cancers. OGSIVEO, the first commercial product, is a novel, oral, selective gamma-secretase inhibitor. GOMEKLI, the second commercial product, is an oral, small molecule mitogen-activated protein kinase, or MEK, inhibitor.

Unraveling the Financial Story of SpringWorks Therapeutics

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: SpringWorks Therapeutics's remarkable performance in 3M is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 1029.96%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -125.59%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): SpringWorks Therapeutics's ROE excels beyond industry benchmarks, reaching -15.25%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): SpringWorks Therapeutics's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -12.92%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.02.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: SWTX