A Look at Cerus's Upcoming Earnings Report

Author: Benzinga Insights | April 30, 2025 03:02pm

Cerus (NASDAQ:CERS) will release its quarterly earnings report on Thursday, 2025-05-01. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Cerus to report an earnings per share (EPS) of $-0.05.

The market awaits Cerus's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

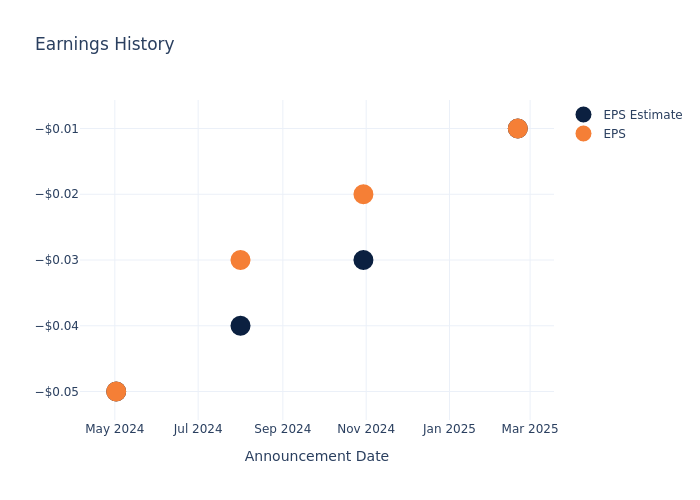

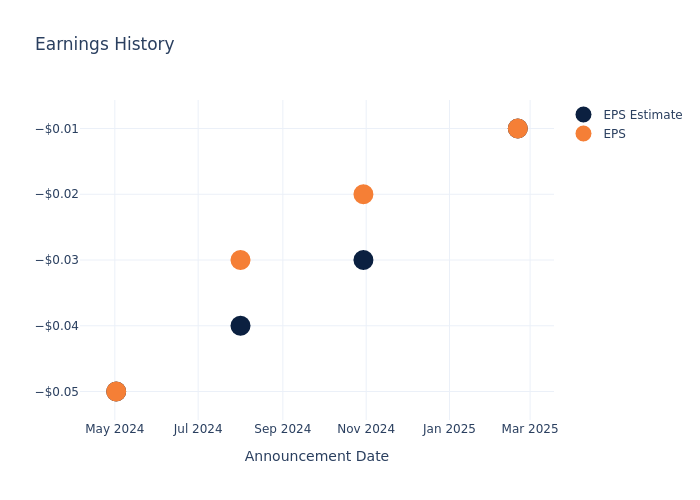

Performance in Previous Earnings

Last quarter the company missed EPS by $0.00, which was followed by a 5.17% drop in the share price the next day.

Here's a look at Cerus's past performance and the resulting price change:

| Quarter |

Q4 2024 |

Q3 2024 |

Q2 2024 |

Q1 2024 |

| EPS Estimate |

-0.01 |

-0.03 |

-0.04 |

-0.05 |

| EPS Actual |

-0.01 |

-0.02 |

-0.03 |

-0.05 |

| Price Change % |

-5.0% |

-9.0% |

15.0% |

-8.0% |

Tracking Cerus's Stock Performance

Shares of Cerus were trading at $1.36 as of April 29. Over the last 52-week period, shares are down 24.15%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Insights on Cerus

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Cerus.

The consensus rating for Cerus is Outperform, based on 1 analyst ratings. With an average one-year price target of $4.0, there's a potential 194.12% upside.

Comparing Ratings with Competitors

In this comparison, we explore the analyst ratings and average 1-year price targets of Sanara MedTech, Bioventus and OrthoPediatrics, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Sanara MedTech, with an average 1-year price target of $48.5, suggesting a potential 3466.18% upside.

- Analysts currently favor an Buy trajectory for Bioventus, with an average 1-year price target of $15.0, suggesting a potential 1002.94% upside.

- Analysts currently favor an Buy trajectory for OrthoPediatrics, with an average 1-year price target of $37.83, suggesting a potential 2681.62% upside.

Summary of Peers Analysis

In the peer analysis summary, key metrics for Sanara MedTech, Bioventus and OrthoPediatrics are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Cerus |

Outperform |

8.64% |

$27.39M |

-4.60% |

| Sanara MedTech |

Buy |

48.70% |

$24.06M |

-3.89% |

| Bioventus |

Buy |

13.45% |

$102.66M |

-0.11% |

| OrthoPediatrics |

Buy |

40.02% |

$35.56M |

-4.43% |

Key Takeaway:

Cerus ranks at the bottom for Revenue Growth among its peers. It is also at the bottom for Gross Profit. For Return on Equity, Cerus is at the bottom compared to its peers.

Delving into Cerus's Background

Cerus Corp is a biomedical products company focused on the field of blood transfusion safety. The INTERCEPT Blood System is designed to reduce the risk of transfusion-transmitted infections by inactivating a broad range of pathogens such as viruses, bacteria, and parasites. The company sells its INTERCEPT platelet and plasma systems in the United States of America, Europe, the Commonwealth of Independent States countries, the Middle East, and selected countries in other regions around the world. The firm continues to operate in only one segment: Blood safety and generates revenue from the same.

Cerus: Financial Performance Dissected

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Positive Revenue Trend: Examining Cerus's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 8.64% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: Cerus's net margin excels beyond industry benchmarks, reaching -4.96%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Cerus's ROE excels beyond industry benchmarks, reaching -4.6%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Cerus's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -1.29% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Cerus's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.75, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

To track all earnings releases for Cerus visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CERS