4 Analysts Assess Fate Therapeutics: What You Need To Know

Author: Benzinga Insights | May 14, 2025 09:00am

Throughout the last three months, 4 analysts have evaluated Fate Therapeutics (NASDAQ:FATE), offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

0 |

4 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

3 |

0 |

0 |

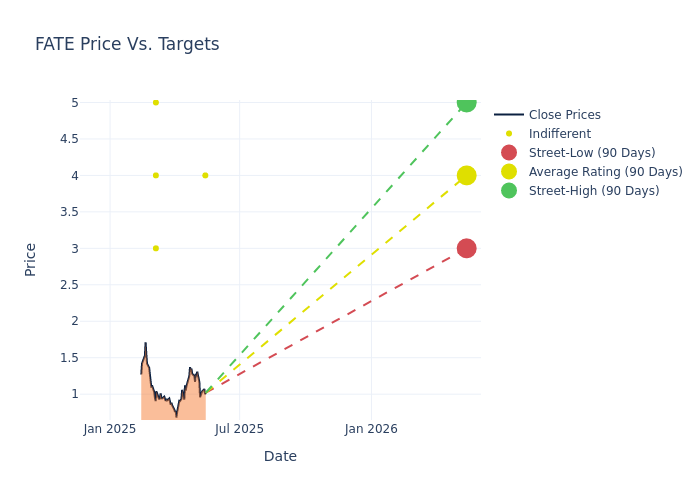

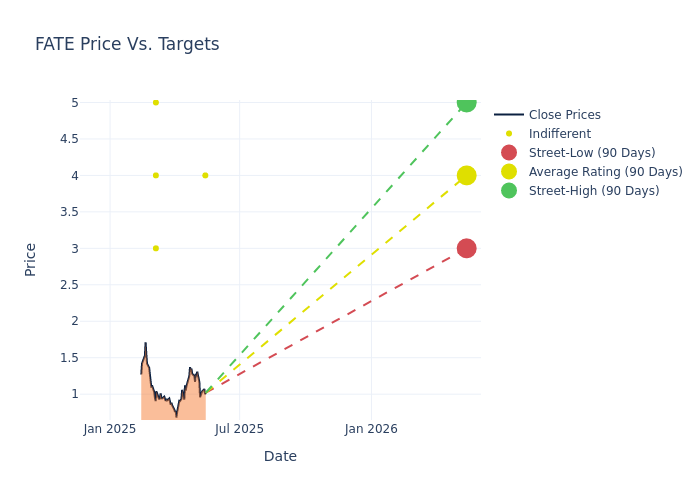

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $4.0, a high estimate of $5.00, and a low estimate of $3.00. Observing a downward trend, the current average is 20.0% lower than the prior average price target of $5.00.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Fate Therapeutics. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jack Allen |

Baird |

Lowers |

Neutral |

$4.00 |

$5.00 |

| Benjamin Burnett |

Stifel |

Lowers |

Hold |

$3.00 |

$5.00 |

| David Nierengarten |

Wedbush |

Maintains |

Neutral |

$5.00 |

$5.00 |

| Yanan Zhu |

Wells Fargo |

Lowers |

Equal-Weight |

$4.00 |

$5.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Fate Therapeutics. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Fate Therapeutics compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of Fate Therapeutics's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Fate Therapeutics analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Fate Therapeutics

Fate Therapeutics Inc is a clinical-stage biopharmaceutical company based in the United States. It is engaged in the development of programmed cellular immunotherapies for cancer and autoimmune disorders. The company's cell therapy pipeline is comprised of NK- and T-cell immuno-oncology programs, including off-the-shelf engineered product candidates derived from clonal master iPSC lines, and immuno-regulatory programs, including product candidates to prevent life-threatening complications in patients.

Financial Insights: Fate Therapeutics

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3M period, Fate Therapeutics showcased positive performance, achieving a revenue growth rate of 10.98% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Fate Therapeutics's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -2803.92%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Fate Therapeutics's ROE stands out, surpassing industry averages. With an impressive ROE of -15.32%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Fate Therapeutics's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -11.15% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.27, Fate Therapeutics adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: FATE