Expert Outlook: Blue Owl Capital Through The Eyes Of 7 Analysts

Author: Benzinga Insights | May 15, 2025 02:01pm

Across the recent three months, 7 analysts have shared their insights on Blue Owl Capital (NYSE:OBDC), expressing a variety of opinions spanning from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

3 |

3 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

1 |

1 |

0 |

0 |

| 2M Ago |

1 |

0 |

2 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

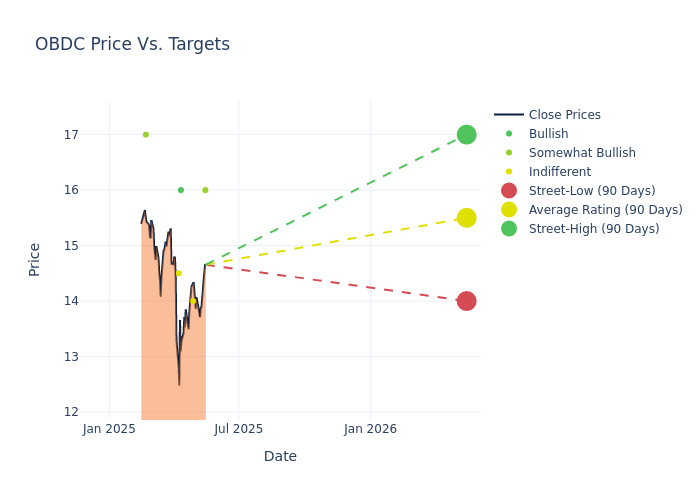

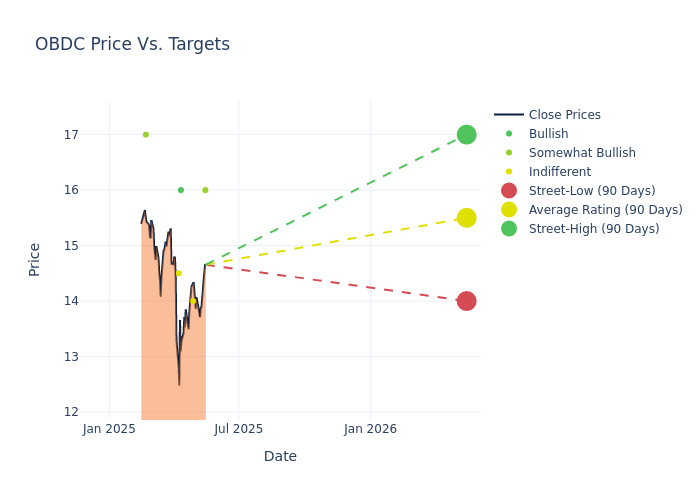

The 12-month price targets, analyzed by analysts, offer insights with an average target of $15.5, a high estimate of $17.00, and a low estimate of $14.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 1.15%.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Blue Owl Capital is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Kenneth Lee |

RBC Capital |

Maintains |

Outperform |

$16.00 |

$16.00 |

| Kenneth Lee |

RBC Capital |

Lowers |

Outperform |

$16.00 |

$17.00 |

| Finian O'Shea |

Wells Fargo |

Lowers |

Equal-Weight |

$14.00 |

$15.00 |

| Matthew Hurwit |

Jefferies |

Announces |

Buy |

$16.00 |

- |

| Paul Johnson |

Keefe, Bruyette & Woods |

Lowers |

Market Perform |

$14.50 |

$15.10 |

| Finian O'Shea |

Wells Fargo |

Raises |

Equal-Weight |

$15.00 |

$14.00 |

| Brian McKenna |

Citizens Capital Markets |

Maintains |

Market Outperform |

$17.00 |

$17.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Blue Owl Capital. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Blue Owl Capital compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Blue Owl Capital's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Blue Owl Capital's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Blue Owl Capital analyst ratings.

All You Need to Know About Blue Owl Capital

Blue Owl Capital Corp is a specialty finance company and business development company (BDC) focused on providing direct lending solutions to U.S. middle-market companies. The company seeks to generate current income and, to a lesser extent, capital appreciation by targeting investment opportunities with favorable risk-adjusted returns, including senior secured, subordinated, or mezzanine loans and equity-related instruments. Its investment strategies are intended to generate favorable returns across credit cycles with an emphasis on preserving capital.

Blue Owl Capital: Financial Performance Dissected

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3M period, Blue Owl Capital showcased positive performance, achieving a revenue growth rate of 29.09% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Financials sector.

Net Margin: Blue Owl Capital's net margin is impressive, surpassing industry averages. With a net margin of 92.26%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Blue Owl Capital's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.54%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Blue Owl Capital's ROA stands out, surpassing industry averages. With an impressive ROA of 1.51%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.31.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: OBDC