Insights into Arhaus's Upcoming Earnings

Author: Benzinga Insights | August 06, 2025 02:03pm

Arhaus (NASDAQ:ARHS) will release its quarterly earnings report on Thursday, 2025-08-07. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Arhaus to report an earnings per share (EPS) of $0.15.

The market awaits Arhaus's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

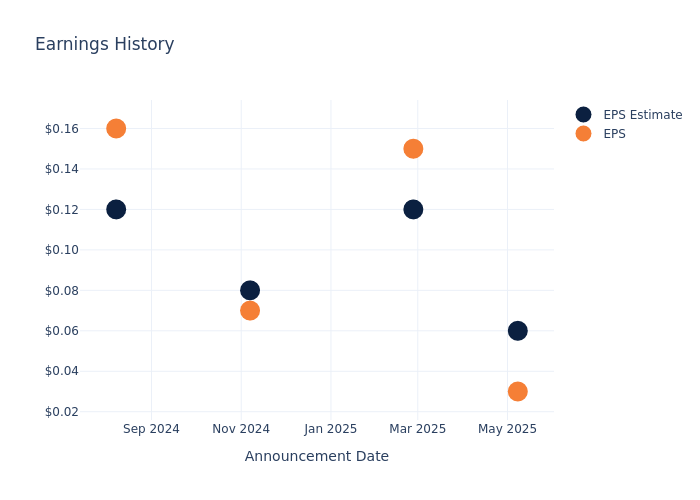

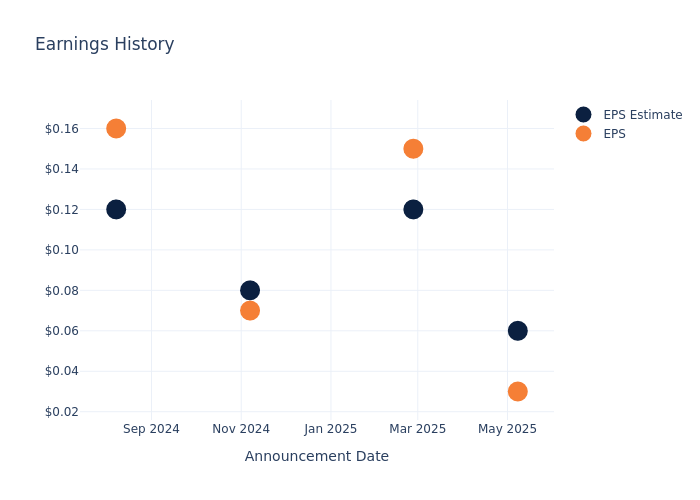

Earnings Track Record

The company's EPS missed by $0.03 in the last quarter, leading to a 0.38% increase in the share price on the following day.

Here's a look at Arhaus's past performance and the resulting price change:

| Quarter |

Q1 2025 |

Q4 2024 |

Q3 2024 |

Q2 2024 |

| EPS Estimate |

0.06 |

0.12 |

0.08 |

0.12 |

| EPS Actual |

0.03 |

0.15 |

0.07 |

0.16 |

| Price Change % |

0.0% |

-14.000000000000002% |

-0.0% |

5.0% |

Arhaus Share Price Analysis

Shares of Arhaus were trading at $9.515 as of August 05. Over the last 52-week period, shares are down 18.6%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analyst Insights on Arhaus

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Arhaus.

With 8 analyst ratings, Arhaus has a consensus rating of Neutral. The average one-year price target is $9.88, indicating a potential 3.84% upside.

Comparing Ratings with Peers

This comparison focuses on the analyst ratings and average 1-year price targets of Beyond and Williams-Sonoma, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Beyond, with an average 1-year price target of $13.0, suggesting a potential 36.63% upside.

- Analysts currently favor an Outperform trajectory for Williams-Sonoma, with an average 1-year price target of $191.0, suggesting a potential 1907.36% upside.

Key Findings: Peer Analysis Summary

Within the peer analysis summary, vital metrics for Beyond and Williams-Sonoma are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Arhaus |

Neutral |

5.49% |

$115.59M |

1.41% |

| Beyond |

Outperform |

-29.10% |

$66.97M |

-14.08% |

| Williams-Sonoma |

Outperform |

4.20% |

$765.81M |

10.75% |

Key Takeaway:

Arhaus has the highest revenue growth among its peers. It has the lowest gross profit margin. Arhaus has the lowest return on equity compared to its peers.

Delving into Arhaus's Background

Arhaus Inc is a growing lifestyle brand and omnichannel retailer of premium home furniture. The company offers merchandise in several categories, including furniture, outdoor, lighting, textiles, and decor through its Retail and e-commerce sales channels.

A Deep Dive into Arhaus's Financials

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Arhaus's revenue growth over a period of 3 months has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 5.49%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Arhaus's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 1.57%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Arhaus's ROE stands out, surpassing industry averages. With an impressive ROE of 1.41%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Arhaus's ROA stands out, surpassing industry averages. With an impressive ROA of 0.4%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.5, caution is advised due to increased financial risk.

To track all earnings releases for Arhaus visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: ARHS