What Analysts Are Saying About Amprius Technologies Stock

Author: Benzinga Insights | August 08, 2025 09:02am

Ratings for Amprius Technologies (NYSE:AMPX) were provided by 4 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

0 |

0 |

0 |

0 |

| Last 30D |

2 |

0 |

0 |

0 |

0 |

| 1M Ago |

2 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

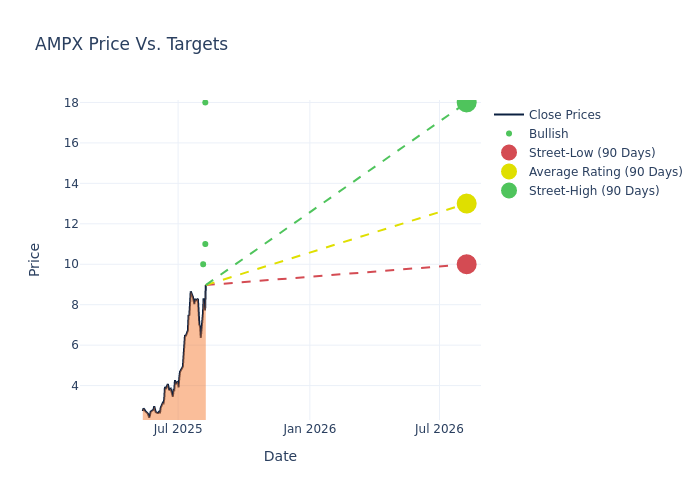

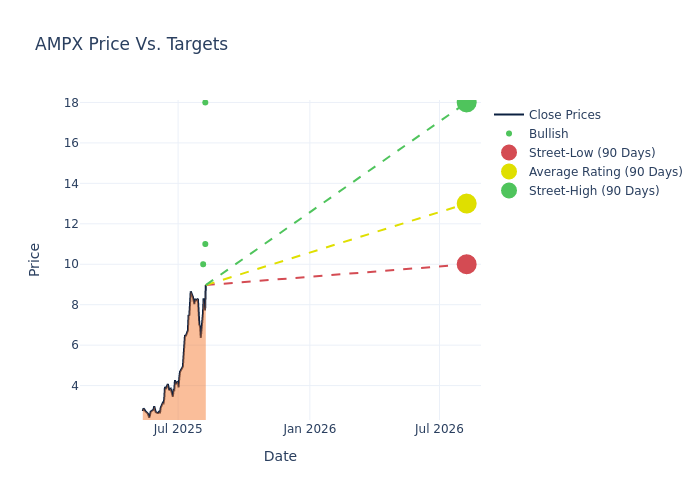

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $12.25, a high estimate of $18.00, and a low estimate of $10.00. This current average reflects an increase of 53.12% from the previous average price target of $8.00.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Amprius Technologies among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Christopher Souther |

B. Riley Securities |

Raises |

Buy |

$11.00 |

$10.00 |

| Amit Dayal |

HC Wainwright & Co. |

Raises |

Buy |

$18.00 |

$10.00 |

| Chip Moore |

Roth Capital |

Raises |

Buy |

$10.00 |

$6.00 |

| Christopher Souther |

B. Riley Securities |

Raises |

Buy |

$10.00 |

$6.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Amprius Technologies. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Amprius Technologies compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Capture valuable insights into Amprius Technologies's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Amprius Technologies analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Amprius Technologies: A Closer Look

Amprius Technologies Inc is engaged in the production of silicon anodes for high-energy-density lithium-ion batteries. The company develops, manufactures and markets lithium-ion batteries for mobility applications, including the aviation, electric vehicle (EV) and light electric vehicle (LEV) industries. The company's batteries are used for existing and emerging aviation applications, including unmanned aerial systems, such as drones and high-altitude pseudo satellites.

Financial Insights: Amprius Technologies

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Amprius Technologies displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 383.05%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Amprius Technologies's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -83.05%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Amprius Technologies's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -13.4%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Amprius Technologies's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -7.82%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 0.54, Amprius Technologies adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: AMPX