A Peek at Telos's Future Earnings

Author: Benzinga Insights | August 08, 2025 01:05pm

Telos (NASDAQ:TLS) will release its quarterly earnings report on Monday, 2025-08-11. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Telos to report an earnings per share (EPS) of $-0.09.

Telos bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

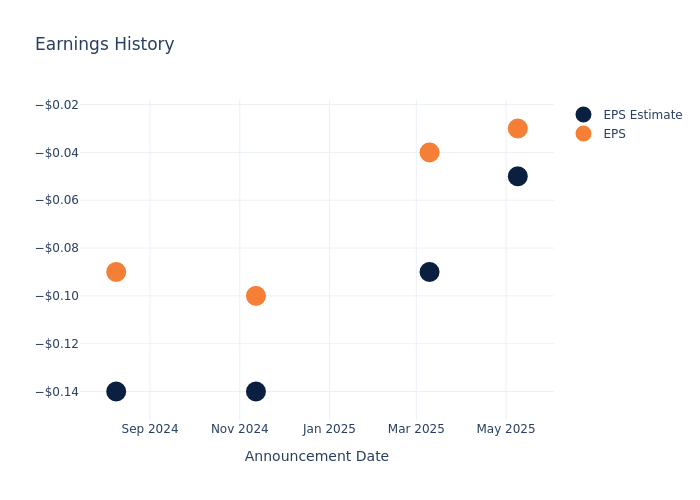

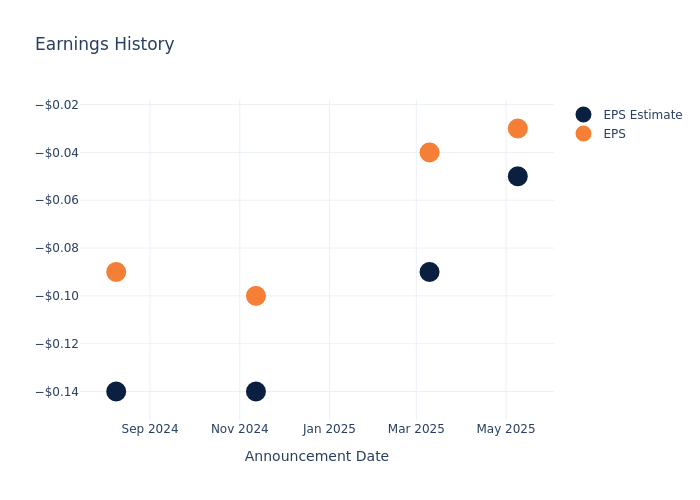

Overview of Past Earnings

During the last quarter, the company reported an EPS beat by $0.02, leading to a 0.0% drop in the share price on the subsequent day.

Here's a look at Telos's past performance and the resulting price change:

| Quarter |

Q1 2025 |

Q4 2024 |

Q3 2024 |

Q2 2024 |

| EPS Estimate |

-0.05 |

-0.09 |

-0.14 |

-0.14 |

| EPS Actual |

-0.03 |

-0.04 |

-0.10 |

-0.09 |

| Price Change % |

-20.0% |

-0.0% |

-5.0% |

-47.0% |

Telos Share Price Analysis

Shares of Telos were trading at $2.47 as of August 07. Over the last 52-week period, shares are down 7.62%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analysts' Take on Telos

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Telos.

The consensus rating for Telos is Neutral, derived from 1 analyst ratings. An average one-year price target of $2.25 implies a potential 8.91% downside.

Analyzing Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of Silvaco Group, Alarum Technologies and Xperi, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Silvaco Group, with an average 1-year price target of $11.0, suggesting a potential 345.34% upside.

- Analysts currently favor an Buy trajectory for Alarum Technologies, with an average 1-year price target of $15.0, suggesting a potential 507.29% upside.

- Analysts currently favor an Buy trajectory for Xperi, with an average 1-year price target of $13.5, suggesting a potential 446.56% upside.

Snapshot: Peer Analysis

The peer analysis summary offers a detailed examination of key metrics for Silvaco Group, Alarum Technologies and Xperi, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Telos |

Neutral |

3.37% |

$12.18M |

-6.79% |

| Silvaco Group |

Buy |

-11.31% |

$11.08M |

-20.99% |

| Alarum Technologies |

Buy |

-14.84% |

$4.82M |

1.51% |

| Xperi |

Buy |

-4.05% |

$84.43M |

-4.33% |

Key Takeaway:

Telos ranks at the top for Revenue Growth among its peers. It is in the middle for Gross Profit. Telos is at the bottom for Return on Equity.

Get to Know Telos Better

Telos Corp offers technologically forwarded, software-based security solutions that empower and protect the world's security-conscious organizations against rapidly evolving, sophisticated, and pervasive threats. Its business has two reportable and operating segments namely Security Solutions and Secure Networks. The Security Solutions segment focuses on cybersecurity, cloud, and identity solutions, and the Secure Networks focuses on enterprise security. The company derives maximum revenue from the Security Solutions segment.

Telos's Economic Impact: An Analysis

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Telos displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 3.37%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -28.1%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Telos's ROE excels beyond industry benchmarks, reaching -6.79%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Telos's ROA excels beyond industry benchmarks, reaching -5.44%. This signifies efficient management of assets and strong financial health.

Debt Management: Telos's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.08.

To track all earnings releases for Telos visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: TLS