Breaking Down Ovintiv: 6 Analysts Share Their Views

Author: Benzinga Insights | August 18, 2025 07:00am

In the preceding three months, 6 analysts have released ratings for Ovintiv (NYSE:OVV), presenting a wide array of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

3 |

2 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

1 |

0 |

0 |

0 |

| 2M Ago |

1 |

2 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

1 |

0 |

0 |

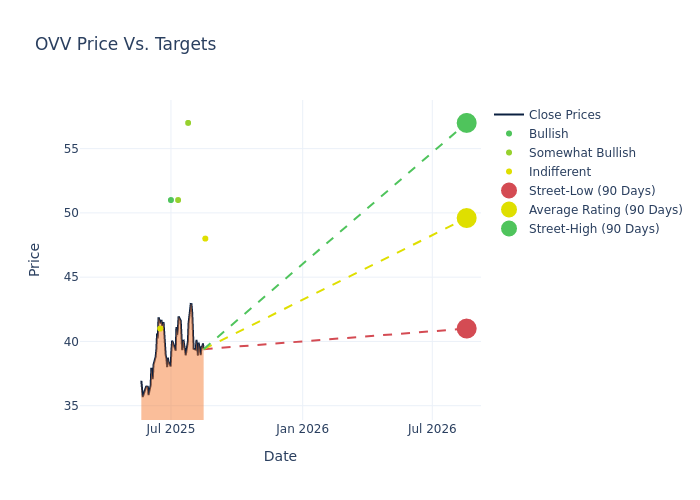

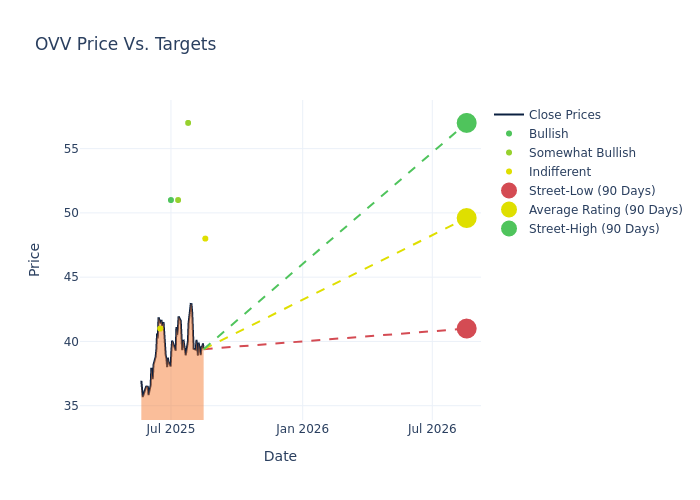

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $50.5, along with a high estimate of $57.00 and a low estimate of $41.00. Marking an increase of 0.66%, the current average surpasses the previous average price target of $50.17.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of Ovintiv's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Devin McDermott |

Morgan Stanley |

Lowers |

Equal-Weight |

$48.00 |

$52.00 |

| Betty Jiang |

Barclays |

Raises |

Overweight |

$57.00 |

$55.00 |

| Jason Bouvier |

Scotiabank |

Raises |

Sector Outperform |

$51.00 |

$48.00 |

| Betty Jiang |

Barclays |

Raises |

Overweight |

$55.00 |

$53.00 |

| Neil Mehta |

Goldman Sachs |

Raises |

Buy |

$51.00 |

$47.00 |

| Roger Read |

Wells Fargo |

Lowers |

Equal-Weight |

$41.00 |

$46.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Ovintiv. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Ovintiv compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Ovintiv's stock. This analysis reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Ovintiv's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Ovintiv analyst ratings.

Delving into Ovintiv's Background

Ovintiv Inc is a North American oil and natural gas exploration and production company that is focused on developing its multi-basin portfolio of high-quality assets located in the United States and Canada. Its operations also include the marketing of oil, NGLs and natural gas. The company has two operating segments: USA Operations, and Canadian Operations. The USA Operations include the exploration for, development of, and production and marketing of oil, NGLs, natural gas and other related activities within the United States. The Canadian Operations include the exploration for, development of, and production and marketing of oil, NGLs, natural gas and other related activities within Canada.

Understanding the Numbers: Ovintiv's Finances

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Ovintiv's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 1.31%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Energy sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 13.24%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 3.0%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 1.56%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Ovintiv's debt-to-equity ratio is below the industry average at 0.64, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: OVV