Preview: Sociedad Quimica Y Minera's Earnings

Author: Benzinga Insights | August 18, 2025 09:02am

Sociedad Quimica Y Minera (NYSE:SQM) will release its quarterly earnings report on Tuesday, 2025-08-19. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Sociedad Quimica Y Minera to report an earnings per share (EPS) of $0.53.

Investors in Sociedad Quimica Y Minera are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

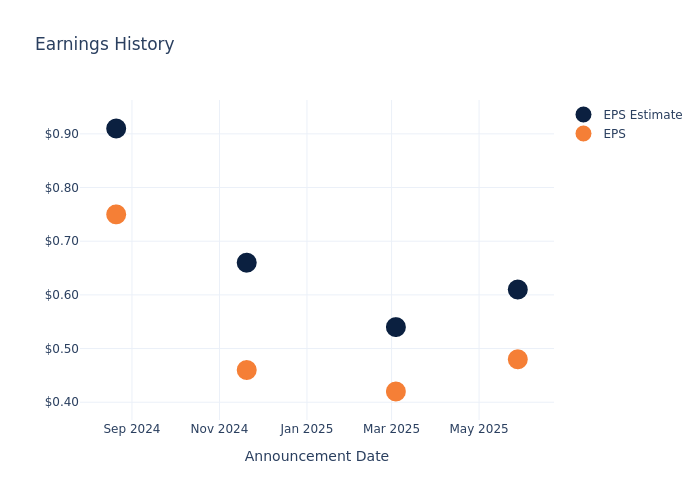

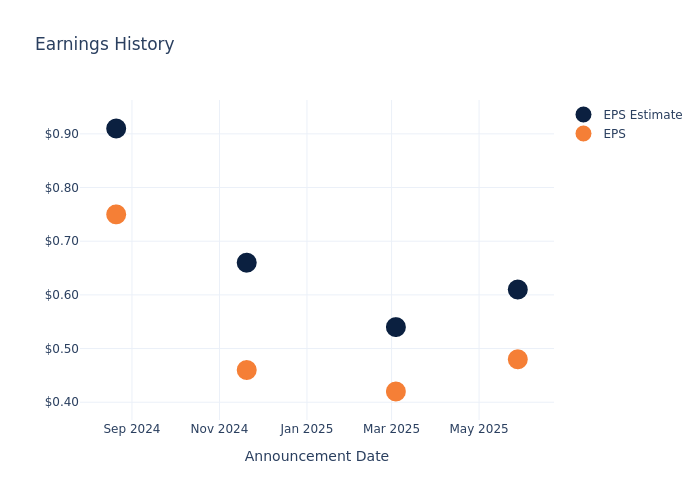

Earnings History Snapshot

Last quarter the company missed EPS by $0.13, which was followed by a 0.41% increase in the share price the next day.

Here's a look at Sociedad Quimica Y Minera's past performance and the resulting price change:

| Quarter |

Q1 2025 |

Q4 2024 |

Q3 2024 |

Q2 2024 |

| EPS Estimate |

0.61 |

0.54 |

0.66 |

0.91 |

| EPS Actual |

0.48 |

0.42 |

0.46 |

0.75 |

| Price Change % |

0.0% |

4.0% |

2.0% |

-2.0% |

Tracking Sociedad Quimica Y Minera's Stock Performance

Shares of Sociedad Quimica Y Minera were trading at $45.08 as of August 15. Over the last 52-week period, shares are up 23.5%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on Sociedad Quimica Y Minera

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Sociedad Quimica Y Minera.

A total of 4 analyst ratings have been received for Sociedad Quimica Y Minera, with the consensus rating being Neutral. The average one-year price target stands at $42.5, suggesting a potential 5.72% downside.

Peer Ratings Comparison

The analysis below examines the analyst ratings and average 1-year price targets of Albemarle, Intl Flavors & Fragrances and Eastman Chemical, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Albemarle, with an average 1-year price target of $70.12, suggesting a potential 55.55% upside.

- Analysts currently favor an Outperform trajectory for Intl Flavors & Fragrances, with an average 1-year price target of $86.75, suggesting a potential 92.44% upside.

- Analysts currently favor an Outperform trajectory for Eastman Chemical, with an average 1-year price target of $81.89, suggesting a potential 81.65% upside.

Key Findings: Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for Albemarle, Intl Flavors & Fragrances and Eastman Chemical, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| RPM International |

Outperform |

3.68% |

$881.77M |

8.09% |

| Albemarle |

Neutral |

-7.02% |

$196.88M |

-0.24% |

| Intl Flavors & Fragrances |

Outperform |

-4.33% |

$1.03B |

4.44% |

| Eastman Chemical |

Outperform |

-3.22% |

$506M |

2.39% |

Key Takeaway:

Sociedad Quimica Y Minera ranks at the top for Revenue Growth and Gross Profit among its peers. It is in the middle for Return on Equity.

Get to Know Sociedad Quimica Y Minera Better

Sociedad Quimica Y Minera De Chile SA is a Chilean commodities producer with significant operations in lithium (primarily used in batteries for electric vehicles and energy storage systems), specialty and standard potassium fertilizers, iodine (primarily used in X-ray contrast media), and solar salts. The company extracts these materials through its high-quality salt brine deposits and caliche ore. SQM also sells lithium concentrate from a joint venture hard rock lithium project in Australia and expanding its lithium refining assets in China.

Financial Insights: Sociedad Quimica Y Minera

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Negative Revenue Trend: Examining Sociedad Quimica Y Minera's financials over 3 months reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -4.42% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Materials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 13.27%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Sociedad Quimica Y Minera's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 2.64%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Sociedad Quimica Y Minera's ROA excels beyond industry benchmarks, reaching 1.2%. This signifies efficient management of assets and strong financial health.

Debt Management: Sociedad Quimica Y Minera's debt-to-equity ratio is below the industry average at 0.9, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Sociedad Quimica Y Minera visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: SQM