What Analysts Are Saying About Antero Midstream Stock

Author: Benzinga Insights | August 18, 2025 02:01pm

Antero Midstream (NYSE:AM) has been analyzed by 4 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

0 |

2 |

2 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

1 |

1 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

1 |

0 |

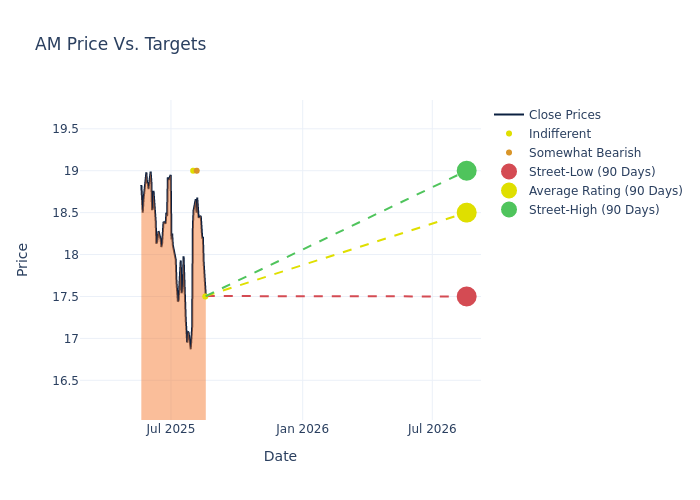

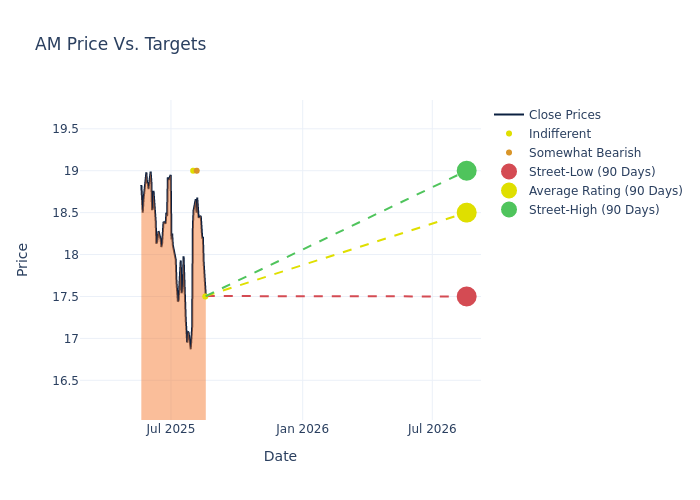

Insights from analysts' 12-month price targets are revealed, presenting an average target of $18.12, a high estimate of $19.00, and a low estimate of $17.00. Observing a 10.62% increase, the current average has risen from the previous average price target of $16.38.

Decoding Analyst Ratings: A Detailed Look

The perception of Antero Midstream by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| John Mackay |

Goldman Sachs |

Raises |

Neutral |

$17.50 |

$15.50 |

| Devin McDermott |

Morgan Stanley |

Raises |

Underweight |

$19.00 |

$17.00 |

| Ned Baramov |

Wells Fargo |

Raises |

Equal-Weight |

$19.00 |

$17.00 |

| Devin McDermott |

Morgan Stanley |

Raises |

Underweight |

$17.00 |

$16.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Antero Midstream. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Antero Midstream compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Antero Midstream's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Antero Midstream's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Antero Midstream analyst ratings.

All You Need to Know About Antero Midstream

Antero Midstream Corp is a midstream company that owns, operates, and develops midstream energy assets that service Antero Resources' production and completion activity in the Appalachian Basin located in West Virginia and Ohio. The company has two operating segments; the Gathering and Processing segment includes a network of gathering pipelines and compressor stations that collect and process production from Antero Resources wells in West Virginia and Ohio and the Water Handling segment includes two independent systems that deliver water from sources including the Ohio River, local reservoirs and several regional waterways. It derives a majority of its revenue from the Gathering and Processing segment.

Financial Milestones: Antero Midstream's Journey

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Antero Midstream's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 12.41%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Energy sector.

Net Margin: Antero Midstream's net margin is impressive, surpassing industry averages. With a net margin of 38.49%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Antero Midstream's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 5.96%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Antero Midstream's ROA stands out, surpassing industry averages. With an impressive ROA of 2.17%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Antero Midstream's debt-to-equity ratio is below the industry average at 1.45, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: AM