A Look at American Woodmark's Upcoming Earnings Report

Author: Benzinga Insights | August 25, 2025 10:01am

American Woodmark (NASDAQ:AMWD) is preparing to release its quarterly earnings on Tuesday, 2025-08-26. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect American Woodmark to report an earnings per share (EPS) of $1.14.

Investors in American Woodmark are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Overview of Past Earnings

In the previous earnings release, the company beat EPS by $0.19, leading to a 3.33% drop in the share price the following trading session.

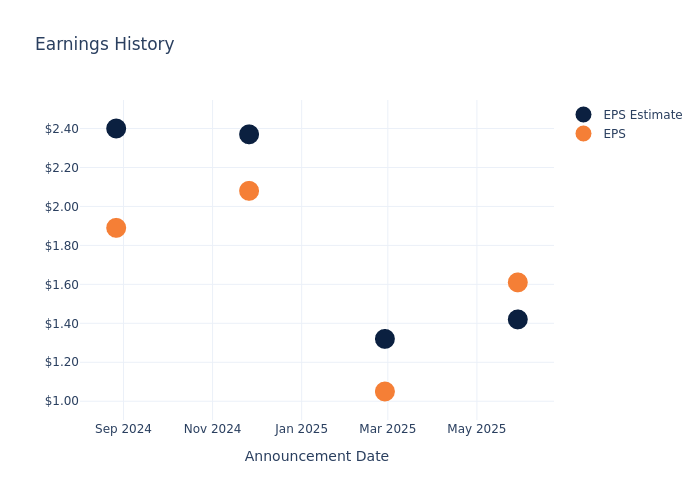

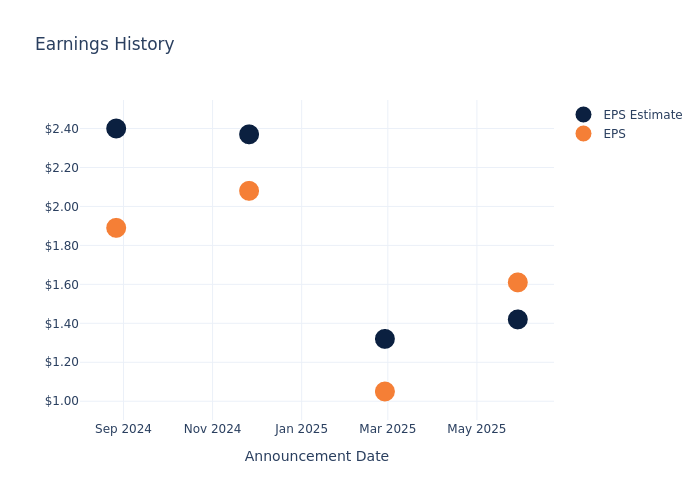

Here's a look at American Woodmark's past performance and the resulting price change:

| Quarter |

Q4 2025 |

Q3 2025 |

Q2 2025 |

Q1 2025 |

| EPS Estimate |

1.42 |

1.32 |

2.37 |

2.40 |

| EPS Actual |

1.61 |

1.05 |

2.08 |

1.89 |

| Price Change % |

-3.0% |

0.0% |

-3.0% |

-1.0% |

Performance of American Woodmark Shares

Shares of American Woodmark were trading at $67.18 as of August 22. Over the last 52-week period, shares are down 24.67%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analyst Insights on American Woodmark

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on American Woodmark.

Analysts have provided American Woodmark with 2 ratings, resulting in a consensus rating of Buy. The average one-year price target stands at $70.0, suggesting a potential 4.2% upside.

Analyzing Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Apogee Enterprises, JELD-WEN Holding and Janus Intl Gr, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Apogee Enterprises, with an average 1-year price target of $45.0, suggesting a potential 33.02% downside.

- Analysts currently favor an Neutral trajectory for JELD-WEN Holding, with an average 1-year price target of $5.33, suggesting a potential 92.07% downside.

- Analysts currently favor an Neutral trajectory for Janus Intl Gr, with an average 1-year price target of $10.67, suggesting a potential 84.12% downside.

Comprehensive Peer Analysis Summary

Within the peer analysis summary, vital metrics for Apogee Enterprises, JELD-WEN Holding and Janus Intl Gr are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| American Woodmark |

Buy |

-11.67% |

$68.21M |

2.79% |

| Apogee Enterprises |

Neutral |

4.56% |

$75.12M |

-0.55% |

| JELD-WEN Holding |

Neutral |

-16.46% |

$143.40M |

-4.63% |

| Janus Intl Gr |

Neutral |

-8.17% |

$93.20M |

3.87% |

Key Takeaway:

American Woodmark ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit. For Return on Equity, it is at the top among its peers.

Delving into American Woodmark's Background

American Woodmark Corp manufactures and distributes cabinets and vanities for the remodeling and new home construction markets. It offers several products that fall into product lines including kitchen cabinetry, bath cabinetry, office cabinetry, home organization, and hardware. The products are sold under the brand names American Woodmark, Timberlake, Shenandoah Cabinetry, and Waypoint Living Spaces among others.

Breaking Down American Woodmark's Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: American Woodmark's revenue growth over a period of 3 months has faced challenges. As of 30 April, 2025, the company experienced a revenue decline of approximately -11.67%. This indicates a decrease in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: American Woodmark's net margin is impressive, surpassing industry averages. With a net margin of 6.39%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): American Woodmark's ROE excels beyond industry benchmarks, reaching 2.79%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): American Woodmark's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.62% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: American Woodmark's debt-to-equity ratio is below the industry average at 0.56, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for American Woodmark visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: AMWD