Analyst Expectations For Wolverine World Wide's Future

Author: Benzinga Insights | August 27, 2025 09:01am

Ratings for Wolverine World Wide (NYSE:WWW) were provided by 8 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

2 |

3 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

2 |

2 |

3 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

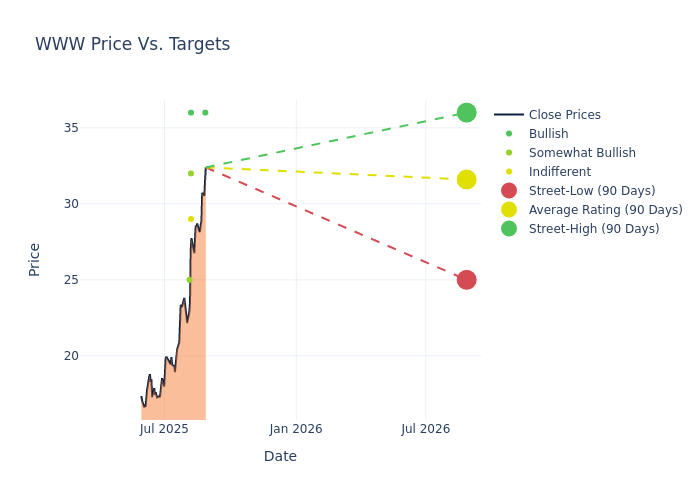

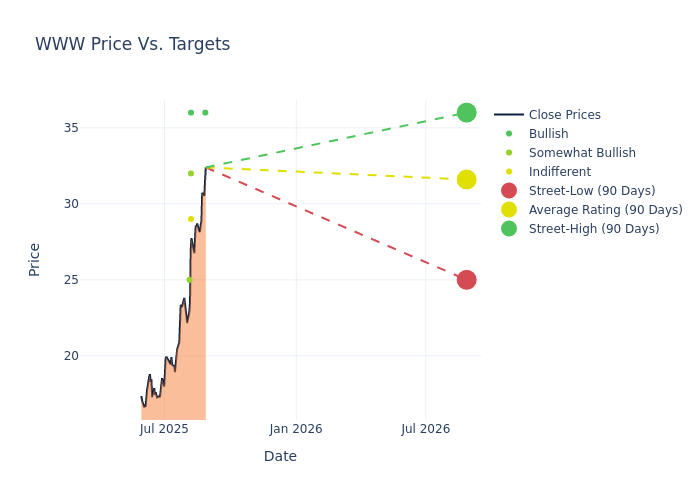

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $27.75, with a high estimate of $36.00 and a low estimate of $17.00. Observing a 24.72% increase, the current average has risen from the previous average price target of $22.25.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of Wolverine World Wide by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jim Duffy |

Stifel |

Raises |

Buy |

$36.00 |

$30.00 |

| Jay Sole |

UBS |

Raises |

Buy |

$36.00 |

$30.00 |

| Ashley Owens |

Keybanc |

Raises |

Overweight |

$32.00 |

$25.00 |

| Dana Telsey |

Telsey Advisory Group |

Raises |

Market Perform |

$29.00 |

$17.00 |

| Dana Telsey |

Telsey Advisory Group |

Maintains |

Market Perform |

$17.00 |

$17.00 |

| Anna Andreeva |

Piper Sandler |

Raises |

Overweight |

$25.00 |

$20.00 |

| Dana Telsey |

Telsey Advisory Group |

Maintains |

Market Perform |

$17.00 |

$17.00 |

| Jay Sole |

UBS |

Raises |

Buy |

$30.00 |

$22.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Wolverine World Wide. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Wolverine World Wide compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Wolverine World Wide's stock. This analysis reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Wolverine World Wide's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Wolverine World Wide analyst ratings.

Get to Know Wolverine World Wide Better

Wolverine World Wide Inc is engaged in designing, manufacturing, sourcing, marketing, licensing, and distributing branded footwear, apparel, and accessories. The company's segment includes Active Group; Work Group; Corporate and Other. It generates maximum revenue from the Active Group segment. Active Group segment consists of Merrell footwear and apparel, Saucony footwear and apparel, Sweaty Betty activewear, and Chaco footwear.

Financial Insights: Wolverine World Wide

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Wolverine World Wide's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 11.52%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 5.46%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Wolverine World Wide's ROE stands out, surpassing industry averages. With an impressive ROE of 7.91%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Wolverine World Wide's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.48% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Wolverine World Wide's debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.5, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: WWW