What 4 Analyst Ratings Have To Say About Cooper Companies

Author: Benzinga Insights | August 28, 2025 08:00am

Cooper Companies (NASDAQ:COO) underwent analysis by 4 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

1 |

1 |

0 |

0 |

| Last 30D |

1 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

1 |

0 |

0 |

0 |

0 |

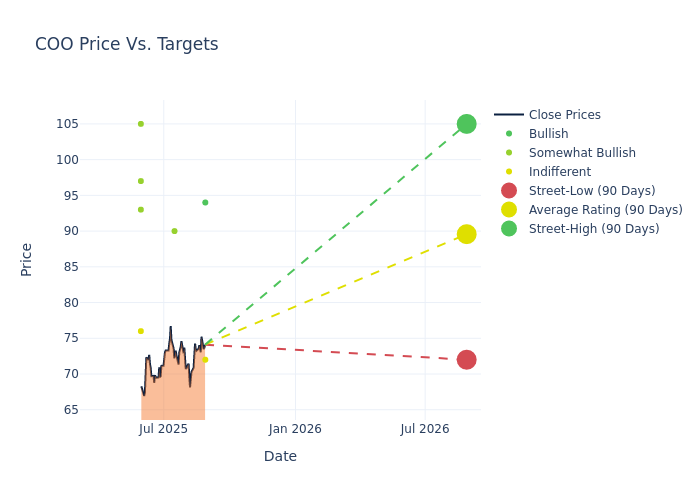

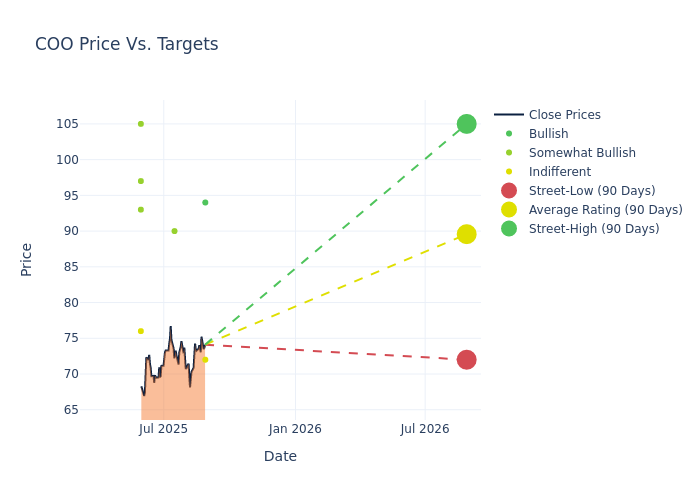

Analysts have recently evaluated Cooper Companies and provided 12-month price targets. The average target is $87.5, accompanied by a high estimate of $94.00 and a low estimate of $72.00. A decline of 10.26% from the prior average price target is evident in the current average.

Diving into Analyst Ratings: An In-Depth Exploration

A clear picture of Cooper Companies's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Joanne Wuensch |

Citigroup |

Lowers |

Neutral |

$72.00 |

$97.00 |

| David Saxon |

Needham |

Maintains |

Buy |

$94.00 |

$94.00 |

| Anthony Petrone |

Mizuho |

Lowers |

Outperform |

$90.00 |

$105.00 |

| David Saxon |

Needham |

Maintains |

Buy |

$94.00 |

$94.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Cooper Companies. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Cooper Companies compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Cooper Companies's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Cooper Companies analyst ratings.

All You Need to Know About Cooper Companies

CooperCompanies is one of the largest eyecare companies in the US. It operates in two segments: CooperVision and CooperSurgical. CooperVision is a pure-play contact lens business with a suite of spherical, multifocal, and toric contact lenses. The company also has one of the most comprehensive specialty lens portfolios in the world. With brands including Proclear, Biofinity, MyDay, and Clariti, Cooper controls roughly one fourth of the US contact lens market. CooperSurgical, founded in 1990, is made up of equipment related to reproductive care, fertility, and women's care. Cooper has the broadest medical device coverage of the entire IVF cycle. It also has Paragard, the only hormone-free IUD in the US, and controls 17% of the US IUD market.

Cooper Companies: A Financial Overview

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Cooper Companies's remarkable performance in 3M is evident. As of 30 April, 2025, the company achieved an impressive revenue growth rate of 6.33%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 8.75%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Cooper Companies's ROE stands out, surpassing industry averages. With an impressive ROE of 1.07%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Cooper Companies's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.71% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Cooper Companies's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.31.

The Significance of Analyst Ratings Explained

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: COO