Assessing PROCEPT BioRobotics: Insights From 4 Financial Analysts

Author: Benzinga Insights | September 02, 2025 04:00pm

Throughout the last three months, 4 analysts have evaluated PROCEPT BioRobotics (NASDAQ:PRCT), offering a diverse set of opinions from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

4 |

0 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

2 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

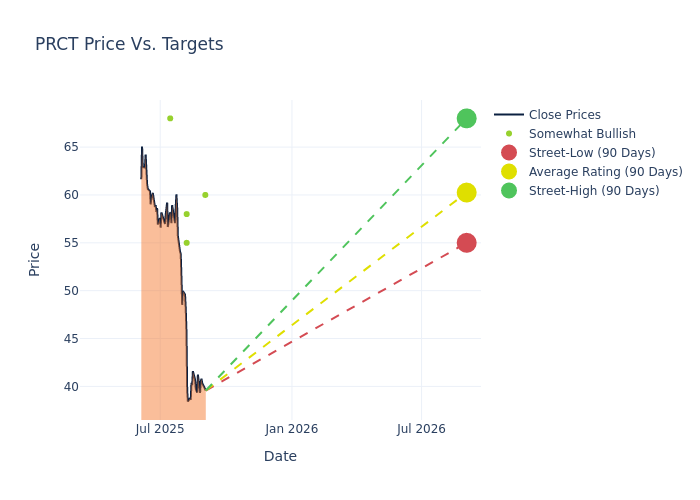

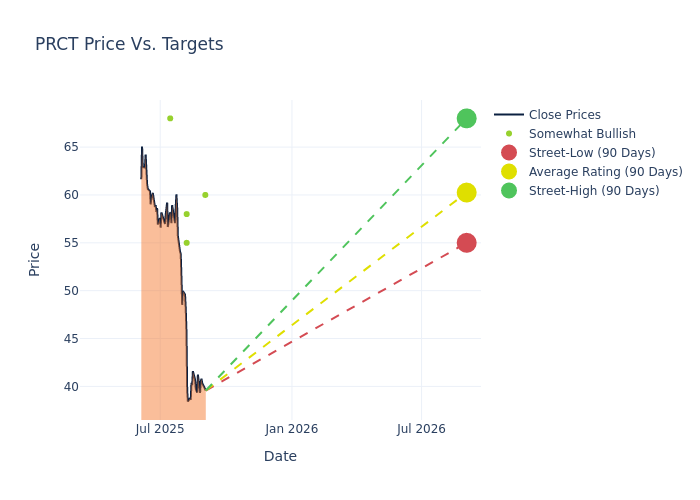

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $60.25, with a high estimate of $68.00 and a low estimate of $55.00. Experiencing a 20.02% decline, the current average is now lower than the previous average price target of $75.33.

Interpreting Analyst Ratings: A Closer Look

The perception of PROCEPT BioRobotics by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Suraj Kalia |

Oppenheimer |

Announces |

Outperform |

$60.00 |

- |

| Nathan Treybeck |

Wells Fargo |

Lowers |

Overweight |

$58.00 |

$75.00 |

| Matt O'Brien |

Piper Sandler |

Lowers |

Overweight |

$55.00 |

$80.00 |

| Patrick Wood |

Morgan Stanley |

Lowers |

Overweight |

$68.00 |

$71.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to PROCEPT BioRobotics. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of PROCEPT BioRobotics compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of PROCEPT BioRobotics's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of PROCEPT BioRobotics's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on PROCEPT BioRobotics analyst ratings.

Delving into PROCEPT BioRobotics's Background

PROCEPT BioRobotics Corp is a surgical robotics company focused on advancing patient care by developing transformative solutions in urology. It develops, manufactures, and sells the AquaBeam Robotic System and HYDROS Robotic System, which are image-guided, surgical robotic systems for use in minimally invasive urologic surgery, with an initial focus on treating benign prostatic hyperplasia, or BPH. Geographically, the company generates a majority of its revenue from the United States and also has a presence in markets outside the U.S.

PROCEPT BioRobotics's Financial Performance

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Positive Revenue Trend: Examining PROCEPT BioRobotics's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 48.41% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -24.73%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): PROCEPT BioRobotics's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -5.05%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): PROCEPT BioRobotics's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -3.79%, the company may face hurdles in achieving optimal financial performance.

Debt Management: PROCEPT BioRobotics's debt-to-equity ratio is below the industry average. With a ratio of 0.21, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: PRCT