Examining the Future: Copart's Earnings Outlook

Author: Benzinga Insights | September 03, 2025 09:01am

Copart (NASDAQ:CPRT) is preparing to release its quarterly earnings on Thursday, 2025-09-04. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Copart to report an earnings per share (EPS) of $0.37.

Anticipation surrounds Copart's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

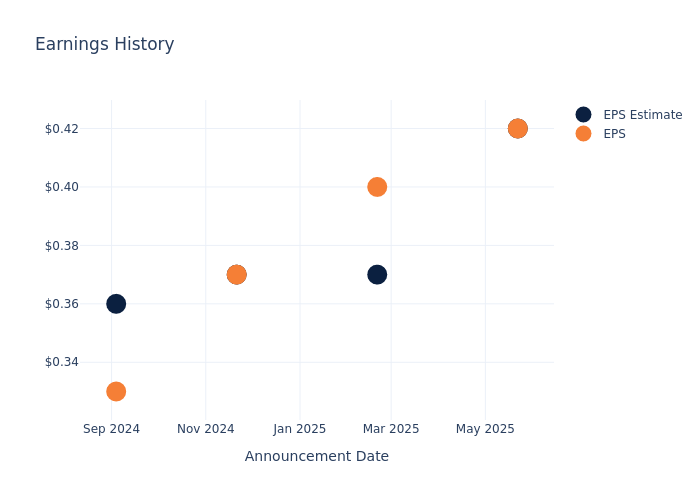

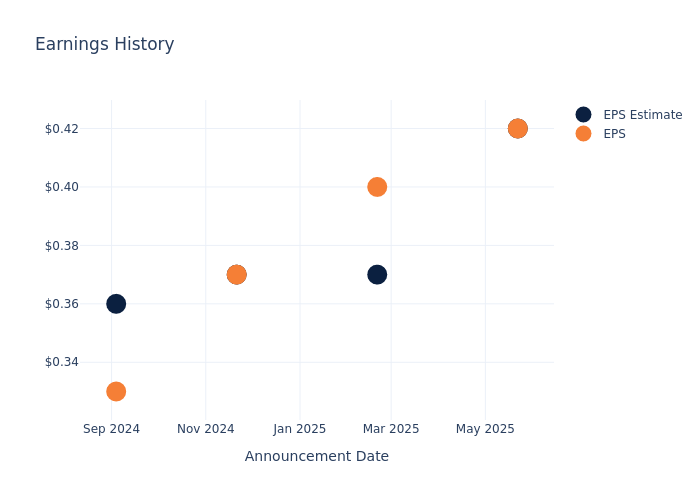

Past Earnings Performance

During the last quarter, the company reported an EPS missed by $0.00, leading to a 11.52% drop in the share price on the subsequent day.

Here's a look at Copart's past performance and the resulting price change:

| Quarter |

Q3 2025 |

Q2 2025 |

Q1 2025 |

Q4 2024 |

| EPS Estimate |

0.42 |

0.37 |

0.37 |

0.36 |

| EPS Actual |

0.42 |

0.40 |

0.37 |

0.33 |

| Price Change % |

-12.0% |

-3.0% |

10.0% |

-7.000000000000001% |

Stock Performance

Shares of Copart were trading at $48.48 as of September 02. Over the last 52-week period, shares are down 2.26%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analysts' Perspectives on Copart

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Copart.

The consensus rating for Copart is Neutral, based on 2 analyst ratings. With an average one-year price target of $52.5, there's a potential 8.29% upside.

Understanding Analyst Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of RB Global, Cintas and UniFirst, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for RB Global, with an average 1-year price target of $127.67, suggesting a potential 163.35% upside.

- Analysts currently favor an Neutral trajectory for Cintas, with an average 1-year price target of $237.75, suggesting a potential 390.41% upside.

- Analysts currently favor an Neutral trajectory for UniFirst, with an average 1-year price target of $184.5, suggesting a potential 280.57% upside.

Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for RB Global, Cintas and UniFirst, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Copart |

Neutral |

7.49% |

$552.27M |

4.76% |

| RB Global |

Outperform |

8.20% |

$545.70M |

1.85% |

| Cintas |

Neutral |

7.96% |

$1.33B |

9.63% |

| UniFirst |

Neutral |

1.23% |

$225.59M |

1.84% |

Key Takeaway:

Copart ranks at the top for Revenue Growth among its peers. It is in the middle for Gross Profit. Copart is at the bottom for Return on Equity.

Delving into Copart's Background

Based in Dallas, Copart operates an online salvage vehicle auction with operations in 11 countries across North America, Europe, and the Middle East, facilitating over 3.5 million transactions annually. The company utilizes its virtual bidding platform, VB3, to connect vehicle sellers with over 750,000 registered buyers around the world. Buyers primarily consist of vehicle dismantlers, rebuilders, individuals and used vehicle retailers. About 80% of Copart's vehicle volume is supplied by auto insurance companies holding vehicles deemed a total loss. Copart also offers services such as vehicle transportation, storage, title transfer, and salvage value estimation. The company primarily operates on a consignment basis and collects fees based on the vehicle's final selling price.

Breaking Down Copart's Financial Performance

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Copart's remarkable performance in 3 months is evident. As of 30 April, 2025, the company achieved an impressive revenue growth rate of 7.49%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: Copart's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 33.56% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Copart's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.76% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Copart's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 4.31%, the company showcases efficient use of assets and strong financial health.

Debt Management: Copart's debt-to-equity ratio is below the industry average. With a ratio of 0.01, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Copart visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CPRT