A Closer Look at Sea's Options Market Dynamics

Author: Benzinga Insights | September 08, 2025 02:02pm

Deep-pocketed investors have adopted a bullish approach towards Sea (NYSE:SE), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Sea. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 71% leaning bullish and 14% bearish. Among these notable options, 3 are puts, totaling $168,525, and 11 are calls, amounting to $524,330.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $25.0 to $280.0 for Sea during the past quarter.

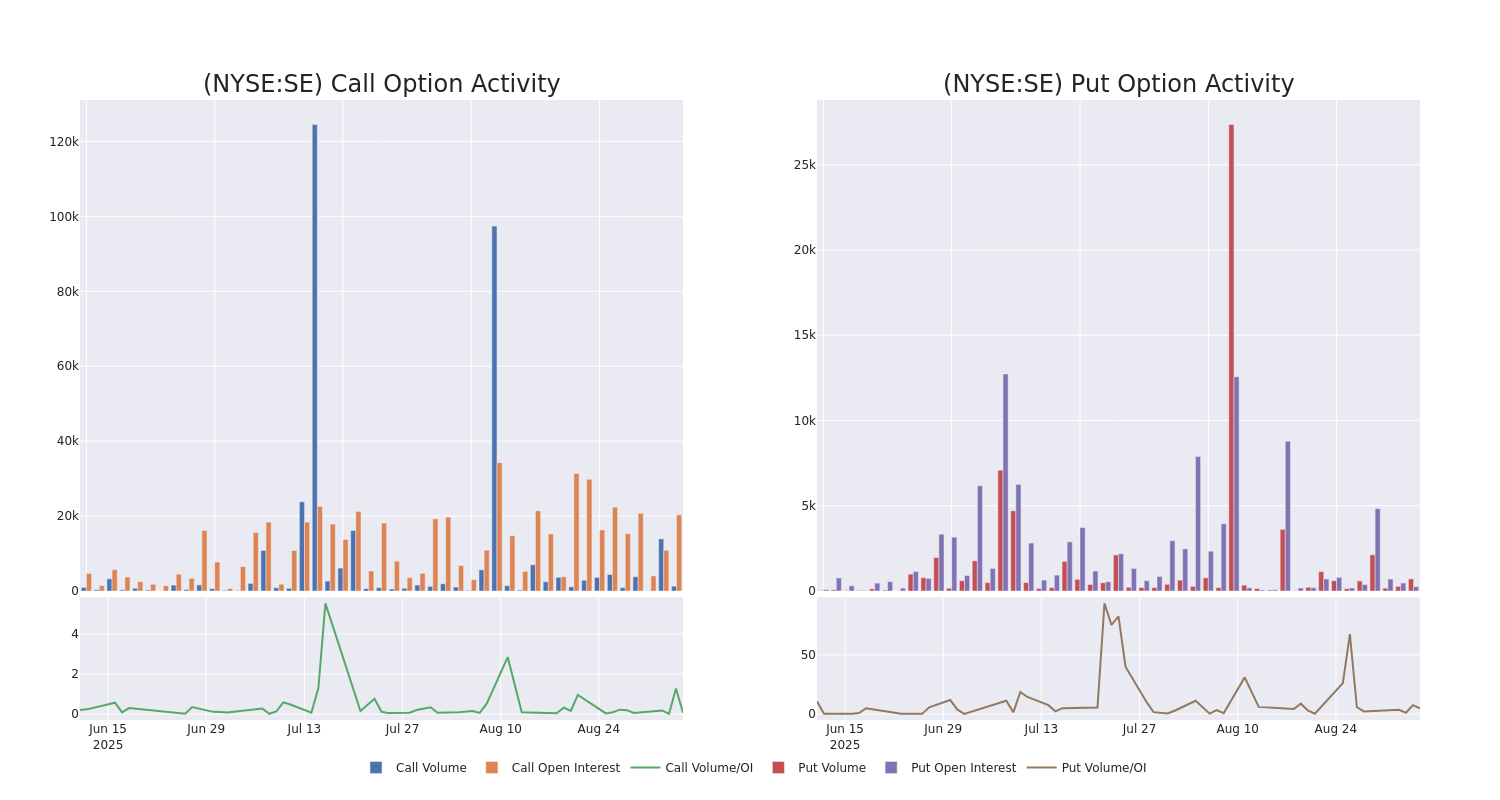

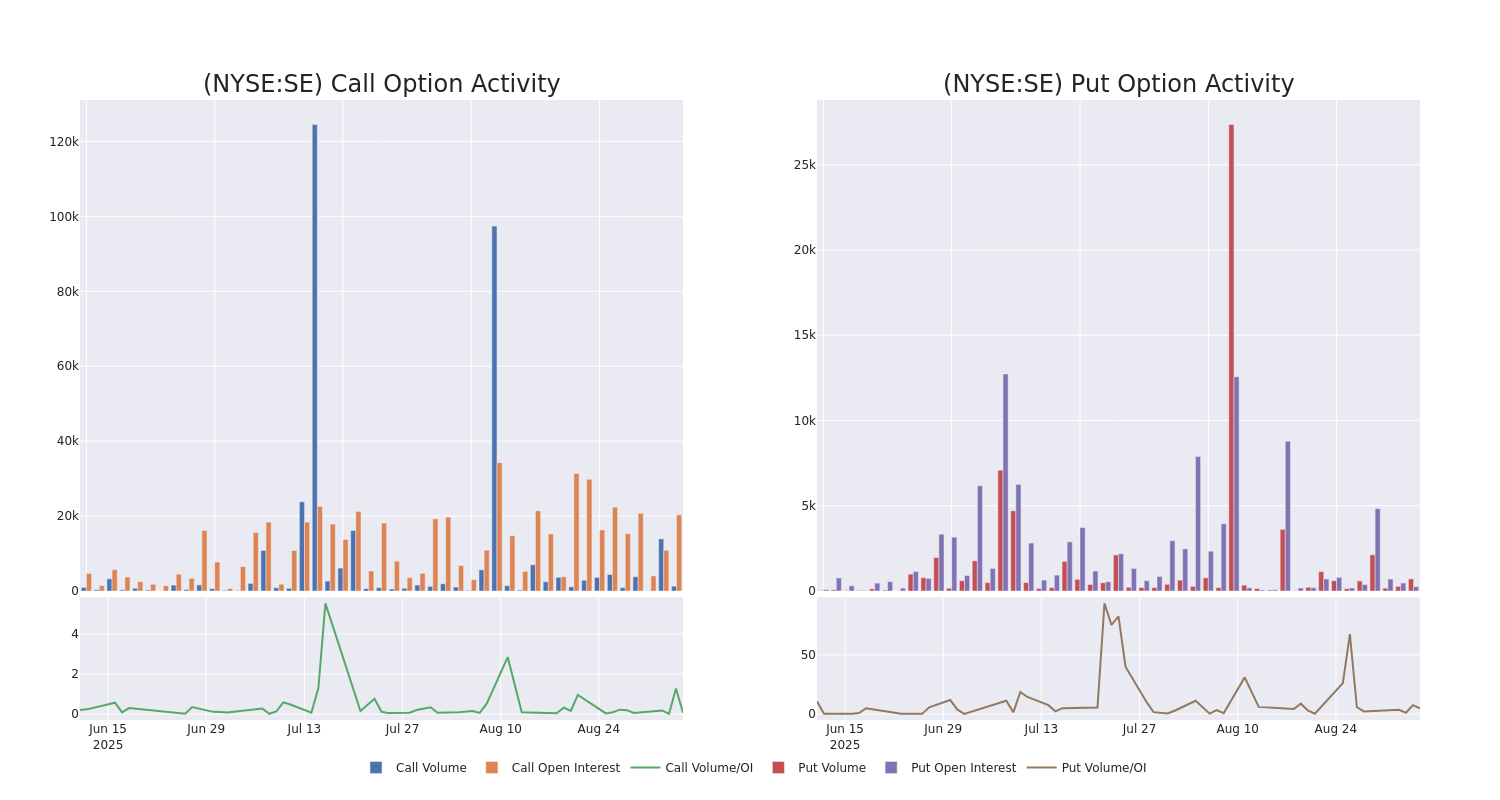

Analyzing Volume & Open Interest

In today's trading context, the average open interest for options of Sea stands at 1053.82, with a total volume reaching 394.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Sea, situated within the strike price corridor from $25.0 to $280.0, throughout the last 30 days.

Sea 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| SE |

CALL |

TRADE |

BULLISH |

01/16/26 |

$167.4 |

$166.75 |

$167.4 |

$25.00 |

$117.1K |

38 |

7 |

| SE |

PUT |

TRADE |

BULLISH |

10/17/25 |

$8.8 |

$8.5 |

$8.6 |

$195.00 |

$86.0K |

210 |

117 |

| SE |

CALL |

SWEEP |

BULLISH |

01/16/26 |

$14.0 |

$13.65 |

$14.0 |

$210.00 |

$61.6K |

2.2K |

130 |

| SE |

CALL |

TRADE |

NEUTRAL |

01/15/27 |

$104.65 |

$102.55 |

$103.65 |

$97.50 |

$51.8K |

8 |

8 |

| SE |

CALL |

TRADE |

BEARISH |

01/16/26 |

$63.0 |

$62.5 |

$62.5 |

$135.00 |

$50.0K |

1.4K |

8 |

About Sea

Sea started as a gaming business, Garena, but in 2015 expanded into e-commerce. Sea operates Southeast Asia's largest e-commerce company, Shopee, in terms of gross merchandise value. Shopee is a hybrid C2C and B2C marketplace platform operating in Indonesia, Taiwan, Vietnam, Thailand, Malaysia, the Philippines, and Brazil. For Garena, Free Fire is the key revenue generating game. Sea's third business, SeaMoney, provides lending, payment, digital banking, and insurance services.As of March 31, 2024, Forrest Xiaodong Li, the founder, chairman and CEO, owned 59.8% of voting power and 18.5% of issued shares. Tencent owned 18.2% of issued shares with no voting power.

Sea's Current Market Status

- With a trading volume of 2,087,434, the price of SE is up by 0.28%, reaching $192.15.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 64 days from now.

Professional Analyst Ratings for Sea

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $209.72.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Macquarie keeps a Outperform rating on Sea with a target price of $219.

* An analyst from Wedbush has decided to maintain their Outperform rating on Sea, which currently sits at a price target of $200.

* An analyst from Barclays persists with their Overweight rating on Sea, maintaining a target price of $214.

* Consistent in their evaluation, an analyst from Benchmark keeps a Buy rating on Sea with a target price of $205.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Sea options trades with real-time alerts from Benzinga Pro.

Posted In: SE