Spotlight on Coupang: Analyzing the Surge in Options Activity

Author: Benzinga Insights | September 10, 2025 11:01am

Financial giants have made a conspicuous bullish move on Coupang. Our analysis of options history for Coupang (NYSE:CPNG) revealed 21 unusual trades.

Delving into the details, we found 47% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $93,005, and 19 were calls, valued at $2,238,846.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $22.0 to $40.0 for Coupang during the past quarter.

Analyzing Volume & Open Interest

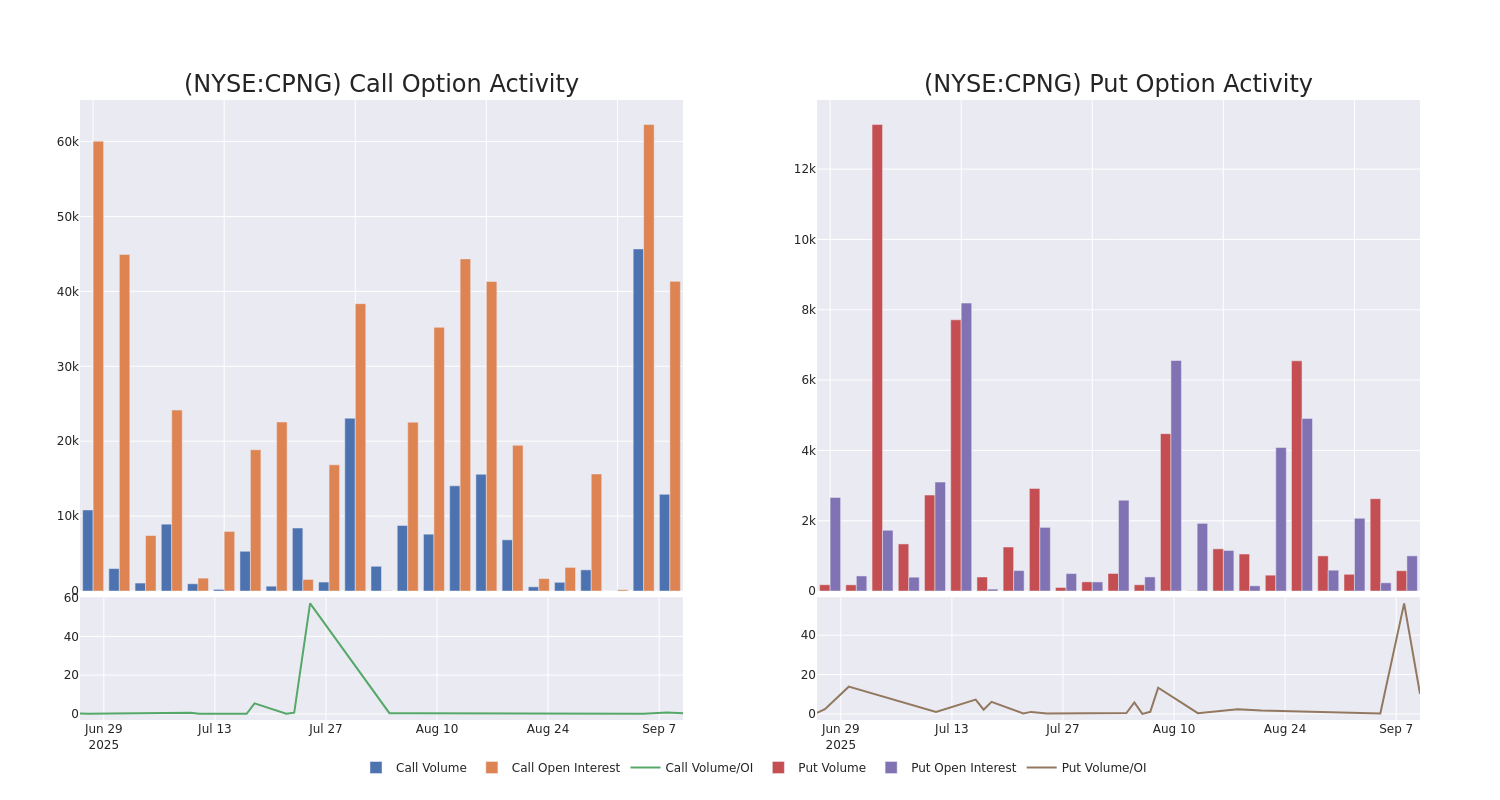

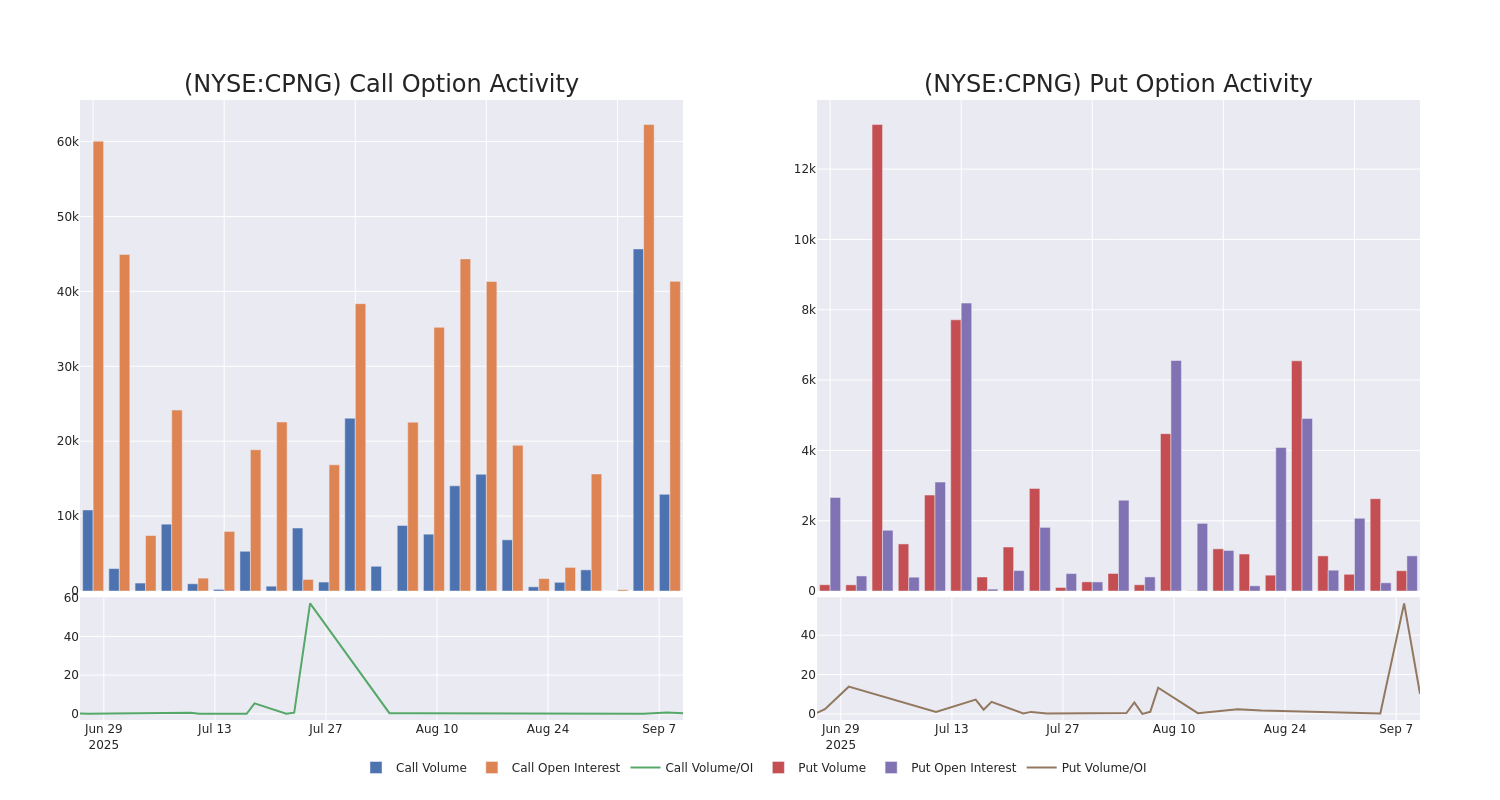

In terms of liquidity and interest, the mean open interest for Coupang options trades today is 3528.17 with a total volume of 13,491.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Coupang's big money trades within a strike price range of $22.0 to $40.0 over the last 30 days.

Coupang Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CPNG |

CALL |

TRADE |

BULLISH |

06/18/26 |

$1.8 |

$1.64 |

$1.75 |

$40.00 |

$875.0K |

10.6K |

5.0K |

| CPNG |

CALL |

SWEEP |

BULLISH |

01/15/27 |

$12.7 |

$12.6 |

$12.7 |

$22.00 |

$224.7K |

466 |

0 |

| CPNG |

CALL |

TRADE |

NEUTRAL |

01/16/26 |

$8.55 |

$8.45 |

$8.5 |

$25.00 |

$170.0K |

14.0K |

561 |

| CPNG |

CALL |

TRADE |

NEUTRAL |

01/16/26 |

$8.55 |

$8.45 |

$8.5 |

$25.00 |

$106.2K |

14.0K |

788 |

| CPNG |

CALL |

TRADE |

BULLISH |

03/20/26 |

$8.9 |

$8.9 |

$8.9 |

$25.00 |

$89.0K |

900 |

400 |

About Coupang

Coupang is South Korea's largest e-commerce platform that sells both owned and third-party inventory. Headquartered in the US, Coupang operates e-commerce businesses mainly in South Korea and Taiwan. The company has built an integrated logistics network that covers the entirety of South Korea, with extensive fulfillment centers that ensure timely delivery, even for orders placed seconds before midnight. Outside of its bread-and-butter e-commerce business, Coupang has expanded into provision of its Rocket delivery services to third-party merchants (fulfillment and logistics by Coupang), online grocery delivery Rocket Fresh, online meal delivery (Eats), e-commerce in Taiwan, luxury e-commerce (Farfetch), and travel.

Following our analysis of the options activities associated with Coupang, we pivot to a closer look at the company's own performance.

Present Market Standing of Coupang

- Currently trading with a volume of 6,251,155, the CPNG's price is up by 0.37%, now at $32.45.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 55 days.

What Analysts Are Saying About Coupang

In the last month, 1 experts released ratings on this stock with an average target price of $35.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Coupang, targeting a price of $35.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Coupang options trades with real-time alerts from Benzinga Pro.

Posted In: CPNG