17 Analysts Have This To Say About Exelixis

Author: Benzinga Insights | September 17, 2025 07:03am

17 analysts have shared their evaluations of Exelixis (NASDAQ:EXEL) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

6 |

5 |

6 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

3 |

3 |

3 |

0 |

0 |

| 3M Ago |

3 |

2 |

2 |

0 |

0 |

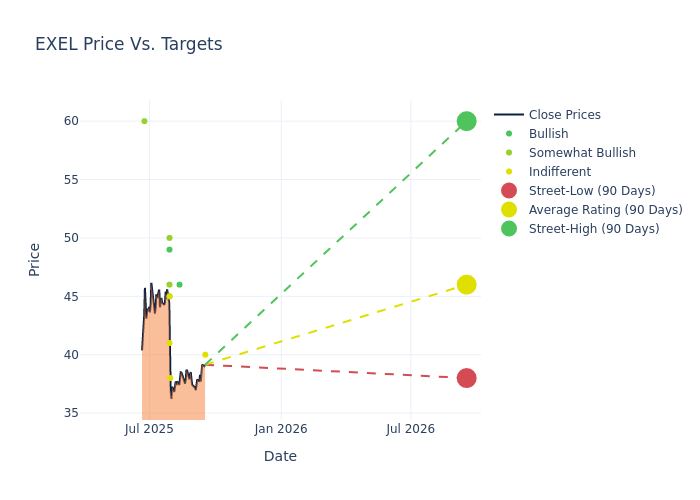

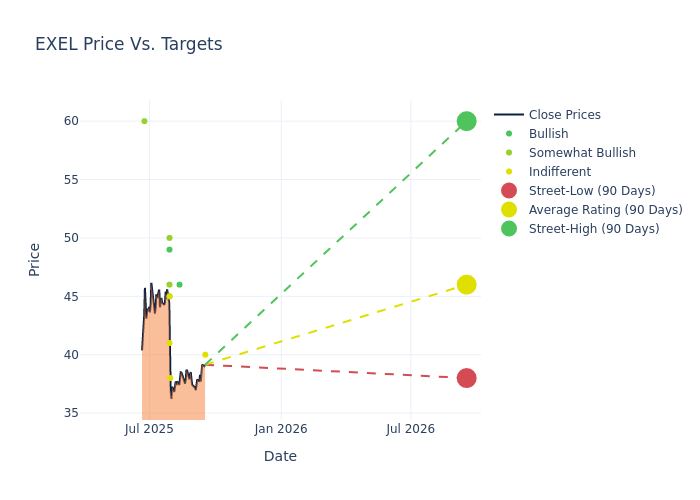

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $47.35, along with a high estimate of $60.00 and a low estimate of $38.00. Witnessing a positive shift, the current average has risen by 5.5% from the previous average price target of $44.88.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Exelixis among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Etzer Darout |

Barclays |

Announces |

Equal-Weight |

$40.00 |

- |

| Robert Burns |

HC Wainwright & Co. |

Lowers |

Buy |

$46.00 |

$53.00 |

| Ashwani Verma |

UBS |

Lowers |

Neutral |

$38.00 |

$43.00 |

| Asthika Goonewardene |

Truist Securities |

Lowers |

Buy |

$49.00 |

$56.00 |

| Sean Laaman |

Morgan Stanley |

Lowers |

Overweight |

$46.00 |

$48.00 |

| Leonid Timashev |

RBC Capital |

Lowers |

Sector Perform |

$45.00 |

$50.00 |

| Silvan Tuerkcan |

JMP Securities |

Maintains |

Market Outperform |

$50.00 |

$50.00 |

| Michael Schmitz |

Guggenheim |

Maintains |

Buy |

$45.00 |

$45.00 |

| Stephen Willey |

Stifel |

Raises |

Hold |

$41.00 |

$38.00 |

| Jefferson Harralson |

Morgan Stanley |

Raises |

Overweight |

$48.00 |

$47.00 |

| Asthika Goonewardene |

Truist Securities |

Raises |

Buy |

$56.00 |

$55.00 |

| Ashwani Verma |

UBS |

Raises |

Neutral |

$43.00 |

$38.00 |

| Peter Lawson |

Barclays |

Raises |

Equal-Weight |

$40.00 |

$29.00 |

| Robert Burns |

HC Wainwright & Co. |

Raises |

Buy |

$53.00 |

$47.00 |

| Sudan Loganathan |

Stephens & Co. |

Raises |

Overweight |

$60.00 |

$29.00 |

| Asthika Goonewardene |

Truist Securities |

Raises |

Buy |

$55.00 |

$43.00 |

| Silvan Tuerkcan |

JMP Securities |

Raises |

Market Outperform |

$50.00 |

$47.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Exelixis. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Exelixis compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Exelixis's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Exelixis's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Exelixis analyst ratings.

Unveiling the Story Behind Exelixis

Exelixis Inc is a biopharmaceutical firm that discovers, develops, and commercializes treatments for cancer. Its molecule, cabozantinib, is indicated for the treatment of patients with metastatic medullary thyroid cancer under the name Cometriq and for the treatment of kidney and liver cancer under the name Cabometyx. Exelixis and its partner Roche have also brought Cotellic to market for the treatment of melanoma.

Exelixis: Financial Performance Dissected

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, Exelixis faced challenges, resulting in a decline of approximately -10.82% in revenue growth as of 30 June, 2025. This signifies a reduction in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Exelixis's net margin is impressive, surpassing industry averages. With a net margin of 32.53%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Exelixis's ROE stands out, surpassing industry averages. With an impressive ROE of 8.88%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Exelixis's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 6.7%, the company showcases efficient use of assets and strong financial health.

Debt Management: Exelixis's debt-to-equity ratio is below the industry average at 0.09, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: EXEL