Deep Dive Into AGCO Stock: Analyst Perspectives (6 Ratings)

Author: Benzinga Insights | September 18, 2025 01:01pm

Throughout the last three months, 6 analysts have evaluated AGCO (NYSE:AGCO), offering a diverse set of opinions from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

5 |

1 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

1 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

1 |

0 |

0 |

| 3M Ago |

0 |

2 |

0 |

0 |

0 |

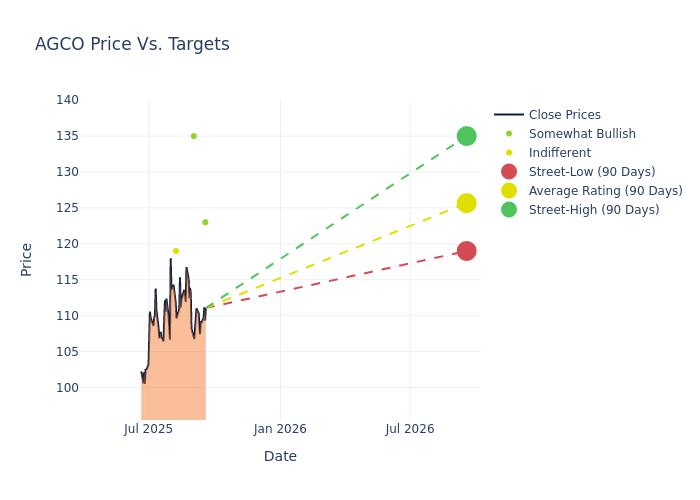

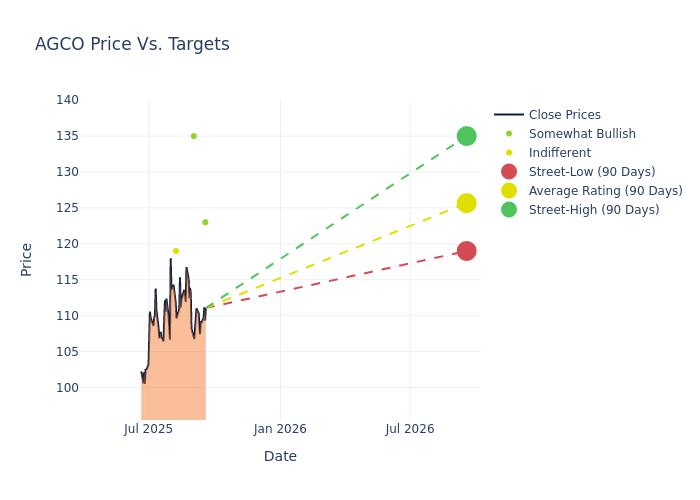

In the assessment of 12-month price targets, analysts unveil insights for AGCO, presenting an average target of $126.5, a high estimate of $137.00, and a low estimate of $115.00. This current average has increased by 6.01% from the previous average price target of $119.33.

Exploring Analyst Ratings: An In-Depth Overview

The analysis of recent analyst actions sheds light on the perception of AGCO by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Kristen Owen |

Oppenheimer |

Lowers |

Outperform |

$123.00 |

$124.00 |

| Tami Zakaria |

JP Morgan |

Lowers |

Overweight |

$135.00 |

$137.00 |

| Steven Fisher |

UBS |

Raises |

Neutral |

$119.00 |

$100.00 |

| Tami Zakaria |

JP Morgan |

Raises |

Overweight |

$137.00 |

$130.00 |

| Kristen Owen |

Oppenheimer |

Raises |

Outperform |

$115.00 |

$108.00 |

| Tami Zakaria |

JP Morgan |

Raises |

Overweight |

$130.00 |

$117.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to AGCO. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of AGCO compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of AGCO's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of AGCO's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on AGCO analyst ratings.

Discovering AGCO: A Closer Look

Agco is a global manufacturer of agricultural equipment. Its main machine brands are Fendt, Massey Ferguson, and Valtra; its initiatives in precision agriculture have been organized under the PTx umbrella following a series of acquisitions. While a global business, Agco's sales skew heavily toward Europe/Middle East, representing 50%-60% of sales and even more of operating profits. The company is trying to increase its exposure to the larger North and South American markets. Its products are available through a global dealer network, which includes over 3,000 dealer and distribution locations and reach into over 140 countries. Additionally, Agco offers retail and wholesale financing to customers through its unconsolidated joint venture with Rabobank of the Netherlands.

Key Indicators: AGCO's Financial Health

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Challenges: AGCO's revenue growth over 3M faced difficulties. As of 30 June, 2025, the company experienced a decline of approximately -18.84%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 11.95%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): AGCO's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 7.89% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): AGCO's ROA stands out, surpassing industry averages. With an impressive ROA of 2.65%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: AGCO's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.74.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: AGCO