ResMed Stock: A Deep Dive Into Analyst Perspectives (9 Ratings)

Author: Benzinga Insights | September 18, 2025 03:00pm

Analysts' ratings for ResMed (NYSE:RMD) over the last quarter vary from bullish to bearish, as provided by 9 analysts.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

5 |

2 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

1 |

3 |

2 |

0 |

0 |

| 3M Ago |

0 |

2 |

0 |

0 |

0 |

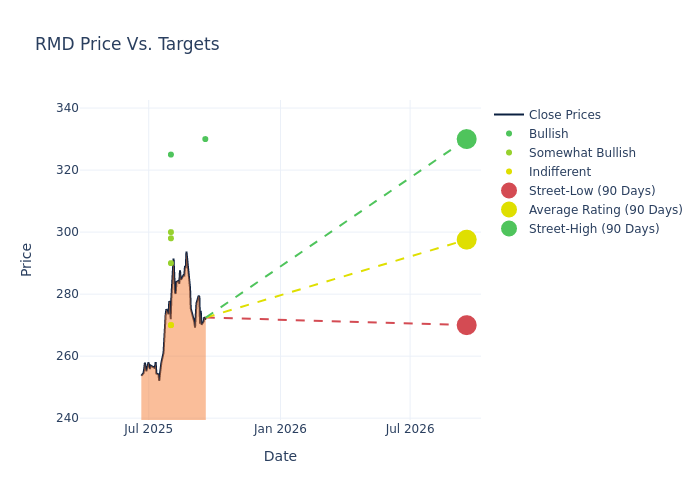

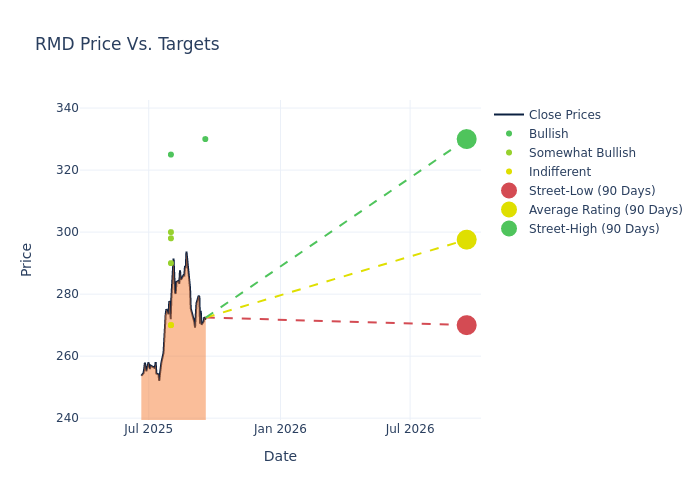

In the assessment of 12-month price targets, analysts unveil insights for ResMed, presenting an average target of $294.11, a high estimate of $330.00, and a low estimate of $270.00. Observing a 11.19% increase, the current average has risen from the previous average price target of $264.50.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of ResMed's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Laura Sutcliffe |

Citigroup |

Announces |

Buy |

$330.00 |

- |

| Anthony Petrone |

Mizuho |

Raises |

Outperform |

$290.00 |

$270.00 |

| Jonathan Block |

Stifel |

Raises |

Hold |

$270.00 |

$240.00 |

| Craig Wong-Pan |

RBC Capital |

Raises |

Outperform |

$300.00 |

$294.00 |

| Laura Sutcliffe |

UBS |

Raises |

Buy |

$325.00 |

$285.00 |

| Brett Fishbin |

Keybanc |

Raises |

Overweight |

$298.00 |

$274.00 |

| Adam Maeder |

Piper Sandler |

Raises |

Neutral |

$270.00 |

$248.00 |

| Craig Wong-Pan |

RBC Capital |

Raises |

Outperform |

$294.00 |

$255.00 |

| Anthony Petrone |

Mizuho |

Raises |

Outperform |

$270.00 |

$250.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to ResMed. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of ResMed compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for ResMed's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of ResMed's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on ResMed analyst ratings.

Get to Know ResMed Better

ResMed is one of the largest respiratory care device companies globally, primarily developing and supplying flow generators, masks and accessories for the treatment of sleep apnea. Increasing diagnosis of sleep apnea combined with ageing populations and increasing prevalence of obesity is resulting in a structurally growing market. The company earns roughly two thirds of its revenue in the Americas and the balance across other regions dominated by Europe, Japan and Australia. Recent developments and acquisitions have focused on digital health as ResMed is aiming to differentiate itself through the provision of clinical data for use by the patient, medical care advisor and payer in the out-of-hospital setting.

A Deep Dive into ResMed's Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: ResMed displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 10.2%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: ResMed's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 28.17%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): ResMed's ROE stands out, surpassing industry averages. With an impressive ROE of 6.6%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): ResMed's ROA excels beyond industry benchmarks, reaching 4.82%. This signifies efficient management of assets and strong financial health.

Debt Management: ResMed's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.14.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: RMD