Where Ralph Lauren Stands With Analysts

Author: Benzinga Insights | September 26, 2025 08:01am

Across the recent three months, 16 analysts have shared their insights on Ralph Lauren (NYSE: RL), expressing a variety of opinions spanning from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

5 |

11 |

0 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

2 |

3 |

0 |

0 |

0 |

| 2M Ago |

3 |

6 |

0 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

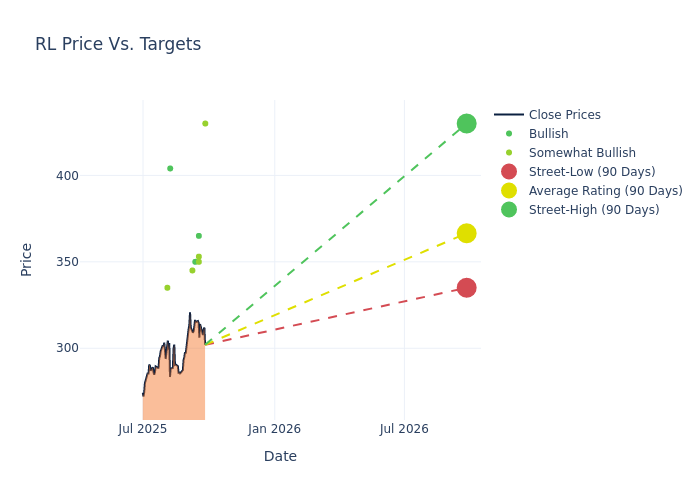

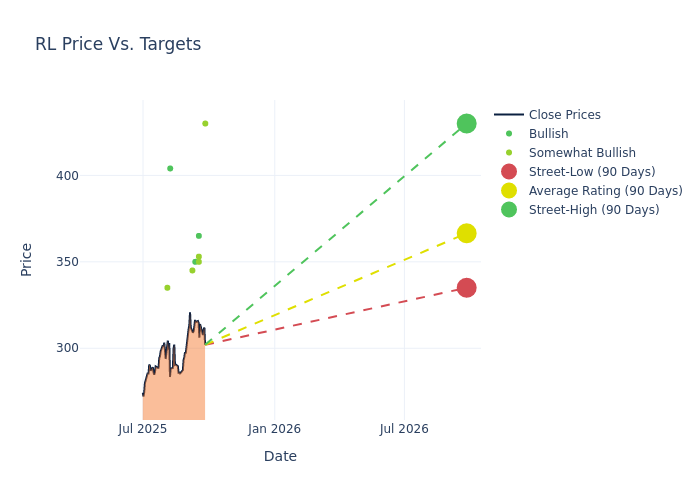

Analysts have recently evaluated Ralph Lauren and provided 12-month price targets. The average target is $358.94, accompanied by a high estimate of $430.00 and a low estimate of $320.00. Observing a 5.22% increase, the current average has risen from the previous average price target of $341.12.

Investigating Analyst Ratings: An Elaborate Study

The perception of Ralph Lauren by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Matthew Boss |

JP Morgan |

Raises |

Overweight |

$430.00 |

$423.00 |

| Ashley Helgans |

Jefferies |

Raises |

Buy |

$365.00 |

$325.00 |

| Adrienne Yih |

Barclays |

Lowers |

Overweight |

$353.00 |

$360.00 |

| Dana Telsey |

Telsey Advisory Group |

Raises |

Outperform |

$350.00 |

$335.00 |

| Tom Nikic |

Needham |

Raises |

Buy |

$350.00 |

$335.00 |

| Ike Boruchow |

Wells Fargo |

Raises |

Overweight |

$345.00 |

$320.00 |

| Jay Sole |

UBS |

Raises |

Buy |

$404.00 |

$385.00 |

| Adrienne Yih |

Barclays |

Raises |

Overweight |

$360.00 |

$321.00 |

| Dana Telsey |

Telsey Advisory Group |

Maintains |

Outperform |

$335.00 |

$335.00 |

| Dana Telsey |

Telsey Advisory Group |

Maintains |

Outperform |

$335.00 |

$335.00 |

| Tom Nikic |

Needham |

Raises |

Buy |

$335.00 |

$310.00 |

| Michael Binetti |

Evercore ISI Group |

Raises |

Outperform |

$335.00 |

$320.00 |

| Dana Telsey |

Telsey Advisory Group |

Raises |

Outperform |

$335.00 |

$315.00 |

| Jay Sole |

UBS |

Raises |

Buy |

$385.00 |

$384.00 |

| Matthew Boss |

JP Morgan |

Raises |

Overweight |

$406.00 |

$355.00 |

| Ike Boruchow |

Wells Fargo |

Raises |

Overweight |

$320.00 |

$300.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Ralph Lauren. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Ralph Lauren compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Ralph Lauren's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Ralph Lauren's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Ralph Lauren analyst ratings.

Get to Know Ralph Lauren Better

Founded by designer Ralph Lauren (current executive chairman and chief creative officer) in 1967 in New York City, Ralph Lauren Corp. designs, markets, and distributes lifestyle merchandise in North America, Europe, and Asia. Best known for its iconic polo shirts, its products also include other types of apparel, footwear, eyewear, jewelry, handbags, home goods, and fragrances. The company's brands include Ralph Lauren Collection, Polo Ralph Lauren, and Lauren Ralph Lauren. Distribution channels for Ralph Lauren include wholesale (department stores and specialty stores), retail (company-owned retail stores and e-commerce), and licensing.

Key Indicators: Ralph Lauren's Financial Health

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Positive Revenue Trend: Examining Ralph Lauren's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 13.68% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Ralph Lauren's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 12.82%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 8.64%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Ralph Lauren's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.98%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 1.29, Ralph Lauren adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: RL