Nokia And Ericsson Lose Ground In China After 'Black Box' Audits

Author: Anusuya Lahiri | October 02, 2025 05:51am

China is significantly escalating its restrictions on European telecom stalwarts Nokia (NYSE:NOK) and Ericsson (NASDAQ:ERIC), subjecting their bids for critical infrastructure contracts to protracted national security reviews.

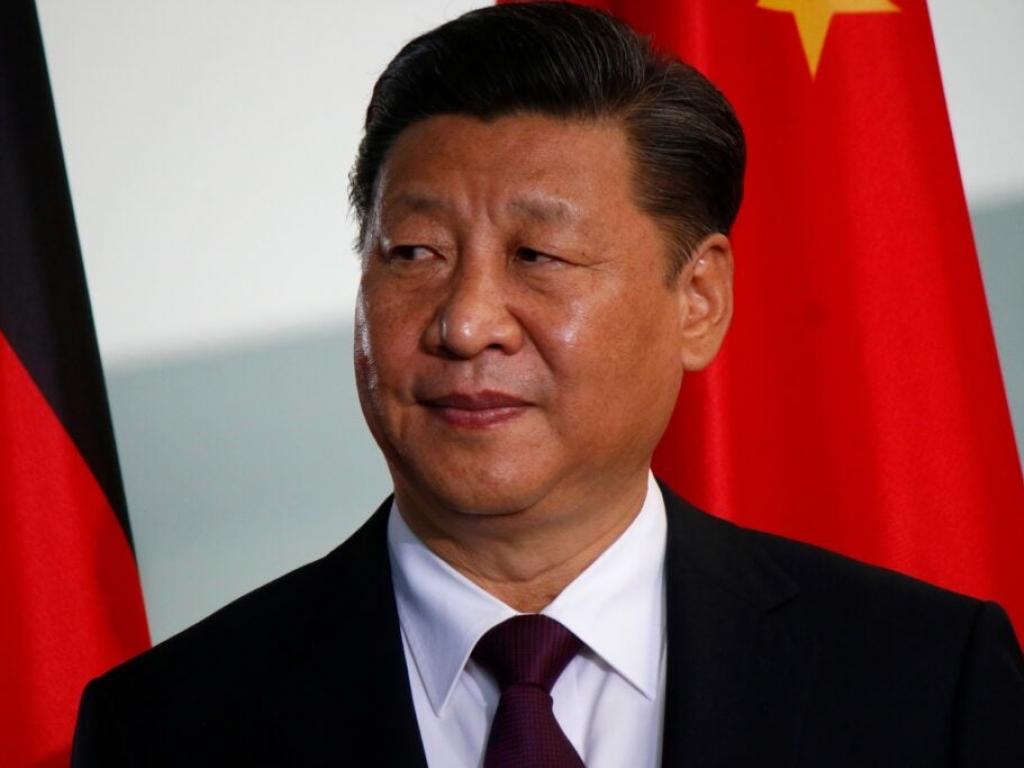

This aggressive move, reported by the Financial Times on Thursday, signals President Xi Jinping’s accelerating drive to decouple the nation’s vital technology apparatus from Western suppliers.

The tightening regulatory environment has exacted a substantial toll on the two companies’ presence in the mainland.

Also Read: Huawei Bets On Brute Force To Outpace Nvidia

Their combined market share in China’s mobile networks has plummeted to a mere 4% in 2024, a steep decline from 12% in 2020, according to data from Dell’Oro Group.

Both firms have reported significant revenue erosion, with Nokia, for instance, seeing double-digit sales plunges since 2023.

Mandatory Security Scrutiny

State-backed buyers of IT equipment, encompassing mobile operators, utilities, and other key industries, are now aggressively scrutinizing foreign bids.

This heightened vigilance is forcing contracts from the European suppliers into mandatory national security reviews overseen by the Cyberspace Administration of China (CAC).

CAC conducts “black box” reviews of foreign technology, including telecom equipment from companies like Nokia and Ericsson, to enforce its cybersecurity regulations.

This process is called “black box” because the criteria and methodologies are opaque, and the affected companies are not informed about how their products are assessed.

These CAC reviews, intensified following a 2022 update to China’s cybersecurity law, can stretch for three months or more and rarely disclose their specific mode of equipment evaluation.

State-owned buyers are now demanding exhaustive documentation, including detailed component breakdowns for every system.

These China-Europe telecom tensions are rooted in the broader U.S.-China tech rivalry, which saw Chinese firms, notably Huawei, make significant inroads into 5G infrastructure globally.

Washington has consistently pressed its European allies to bar Chinese vendors from their networks, citing espionage and security concerns.

The geopolitical friction escalated following U.S. sanctions on semiconductor technology after the 2020 pandemic disrupted global supply chains.

A Two-Sided Geopolitical Struggle

However, the pressure is not one-sided. Huawei and ZTE still command a substantial presence in Europe, collectively holding about 30-35% of the mobile infrastructure market, with Germany, for example, sourcing 59% of its installed 5G gear from Chinese companies.

Simultaneously, the U.S. is applying pressure on Chinese telecom firms operating in the American market. Reports from June 2024 indicated that the Biden administration is investigating China Mobile, China Telecom, and China Unicom over the potential misuse of American data.

Though already barred from offering retail internet and phone services in the U.S., these companies could still access American data by routing wholesale internet traffic and offering cloud services.

Price Action: Shares of Nokia were up 1.24% at $4.880 premarket at last check Thursday, having gained close to 9% year-to-date. Ericsson was up 0.72% premarket, with a 3.5% gain year-to-date.

Read Next:

Photo by 360b via Shutterstock

Posted In: ERIC NOK