Analyst Expectations For Insmed's Future

Author: Benzinga Insights | October 02, 2025 01:00pm

In the last three months, 20 analysts have published ratings on Insmed (NASDAQ:INSM), offering a diverse range of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

9 |

9 |

2 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

1 |

0 |

0 |

0 |

| 2M Ago |

7 |

5 |

2 |

0 |

0 |

| 3M Ago |

0 |

3 |

0 |

0 |

0 |

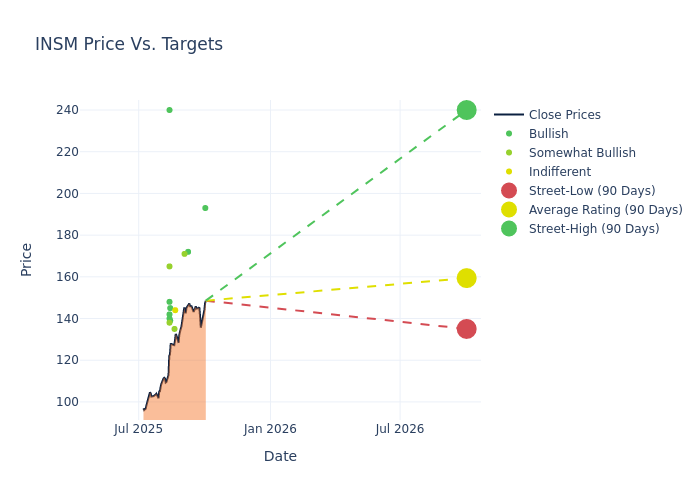

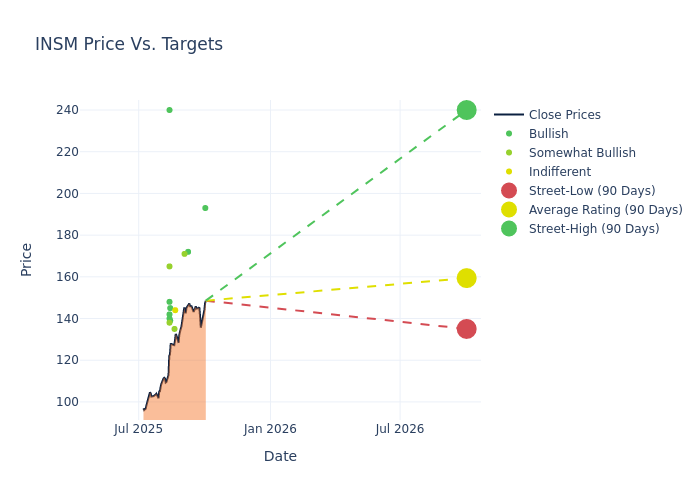

The 12-month price targets, analyzed by analysts, offer insights with an average target of $147.0, a high estimate of $240.00, and a low estimate of $108.00. Observing a 20.79% increase, the current average has risen from the previous average price target of $121.70.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Insmed among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Ritu Baral |

TD Cowen |

Raises |

Buy |

$193.00 |

$154.00 |

| Vamil Divan |

Guggenheim |

Raises |

Buy |

$172.00 |

$125.00 |

| Tiago Fauth |

Wells Fargo |

Raises |

Overweight |

$171.00 |

$140.00 |

| Maxwell Skor |

Morgan Stanley |

Raises |

Equal-Weight |

$144.00 |

$126.00 |

| Jessica Fye |

JP Morgan |

Raises |

Overweight |

$135.00 |

$111.00 |

| Nicole Germino |

Truist Securities |

Raises |

Buy |

$139.00 |

$126.00 |

| Stephen Willey |

Stifel |

Raises |

Buy |

$145.00 |

$121.00 |

| Matthew Harrison |

Morgan Stanley |

Raises |

Equal-Weight |

$126.00 |

$112.00 |

| Andrew S. Fein |

HC Wainwright & Co. |

Raises |

Buy |

$240.00 |

$120.00 |

| Trung Huynh |

UBS |

Raises |

Buy |

$140.00 |

$133.00 |

| Leonid Timashev |

RBC Capital |

Raises |

Outperform |

$138.00 |

$120.00 |

| Andrea Tan |

Goldman Sachs |

Raises |

Buy |

$142.00 |

$114.00 |

| Graig Suvannavejh |

Mizuho |

Raises |

Outperform |

$165.00 |

$130.00 |

| Kelly Shi |

Jefferies |

Raises |

Buy |

$148.00 |

$129.00 |

| Tiago Fauth |

Wells Fargo |

Raises |

Overweight |

$140.00 |

$130.00 |

| Leonid Timashev |

RBC Capital |

Raises |

Outperform |

$120.00 |

$108.00 |

| Trung Huynh |

UBS |

Raises |

Buy |

$133.00 |

$124.00 |

| Tiago Fauth |

Wells Fargo |

Raises |

Overweight |

$130.00 |

$119.00 |

| Matthew Harrison |

Morgan Stanley |

Raises |

Overweight |

$108.00 |

$102.00 |

| Jessica Fye |

JP Morgan |

Raises |

Overweight |

$111.00 |

$90.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Insmed. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Insmed compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Insmed's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Insmed's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Insmed analyst ratings.

All You Need to Know About Insmed

Insmed Inc is a biopharmaceutical company transforming the lives of patients with serious and rare diseases. The company's first commercial product is ARIKAYCE (amikacin liposome inhalation suspension), approved in the United States for the treatment of Mycobacterium Avium Complex (MAC) lung disease as part of a combination antibacterial drug regimen for adult patients with limited or no alternative treatment options. It is also developing Brensocatib, an oral reversible dipeptidyl peptidase 1 inhibitor for bronchiectasis and other neutrophil-mediated diseases, and Treprostinil Palmitil Inhalation Powder, an inhaled treprostinil prodrug for pulmonary hypertension linked to interstitial lung disease and pulmonary arterial hypertension.

Insmed's Financial Performance

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Insmed's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 18.9%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -299.48%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -47.7%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Insmed's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -15.02%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Insmed's debt-to-equity ratio is below the industry average. With a ratio of 0.46, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: INSM