The Analyst Verdict: TechnipFMC In The Eyes Of 6 Experts

Author: Benzinga Insights | October 02, 2025 03:01pm

6 analysts have expressed a variety of opinions on TechnipFMC (NYSE:FTI) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

5 |

0 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

1 |

4 |

0 |

0 |

0 |

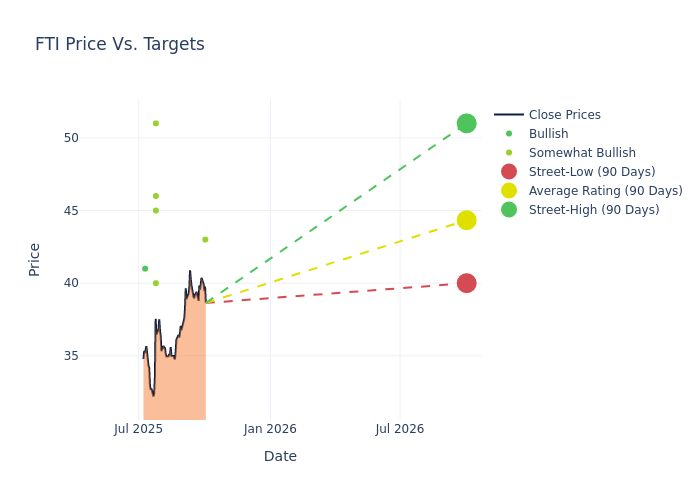

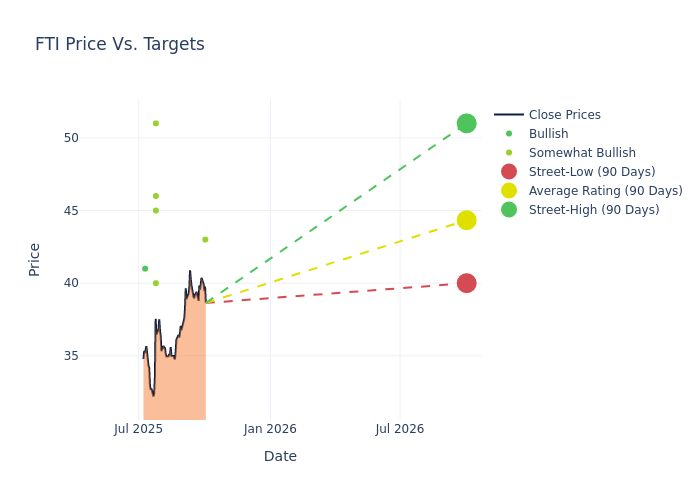

The 12-month price targets, analyzed by analysts, offer insights with an average target of $44.33, a high estimate of $51.00, and a low estimate of $40.00. Observing a 10.82% increase, the current average has risen from the previous average price target of $40.00.

Analyzing Analyst Ratings: A Detailed Breakdown

The analysis of recent analyst actions sheds light on the perception of TechnipFMC by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Arun Jayaram |

JP Morgan |

Raises |

Overweight |

$43.00 |

$41.00 |

| David Anderson |

Barclays |

Raises |

Overweight |

$51.00 |

$45.00 |

| Victoria McCulloch |

RBC Capital |

Raises |

Outperform |

$40.00 |

$37.00 |

| Stephen Richardson |

Evercore ISI Group |

Raises |

Outperform |

$46.00 |

$42.00 |

| Charles Minervino |

Susquehanna |

Raises |

Positive |

$45.00 |

$40.00 |

| Scott Gruber |

Citigroup |

Raises |

Buy |

$41.00 |

$35.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to TechnipFMC. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of TechnipFMC compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of TechnipFMC's stock. This examination reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into TechnipFMC's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on TechnipFMC analyst ratings.

Delving into TechnipFMC's Background

TechnipFMC is the largest provider of offshore oilfield services, offering integrated deep-water offshore oil and gas development solutions that span the full spectrum of subsea equipment and subsea construction services. The company also provides various pieces of surface equipment used with onshore oil and gas wells. TechnipFMC originated with the 2017 merger of Technip and FMC Technologies.

Financial Milestones: TechnipFMC's Journey

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Positive Revenue Trend: Examining TechnipFMC's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 8.99% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Energy sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: TechnipFMC's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.63% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): TechnipFMC's ROE excels beyond industry benchmarks, reaching 8.52%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): TechnipFMC's ROA excels beyond industry benchmarks, reaching 2.69%. This signifies efficient management of assets and strong financial health.

Debt Management: TechnipFMC's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.49.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: FTI