A Glimpse Into The Expert Outlook On Synopsys Through 22 Analysts

Author: Benzinga Insights | October 02, 2025 05:02pm

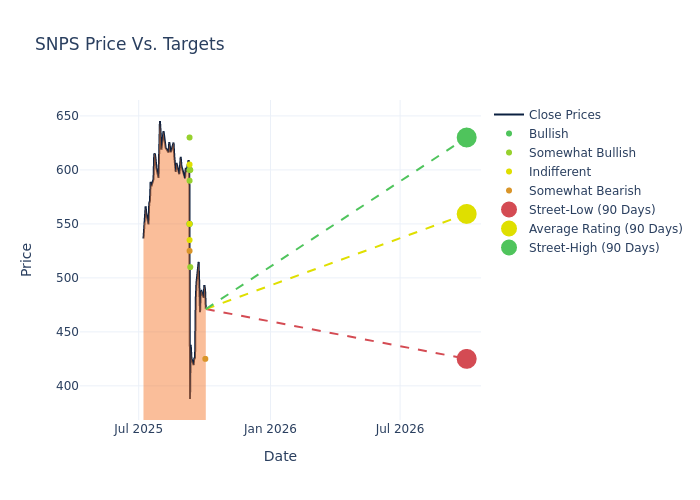

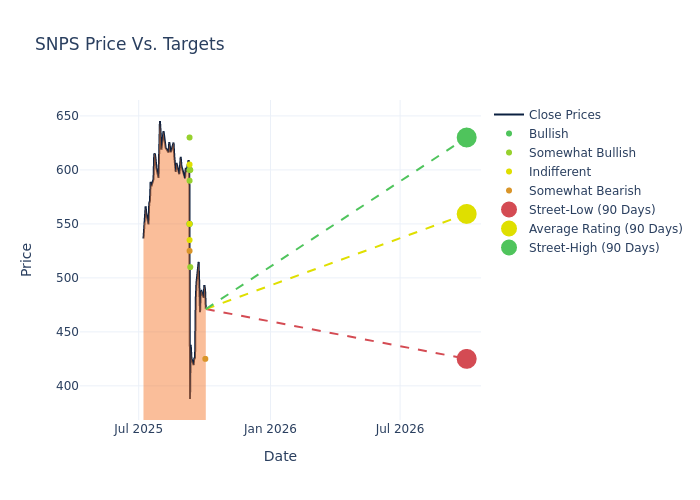

Across the recent three months, 22 analysts have shared their insights on Synopsys (NASDAQ:SNPS), expressing a variety of opinions spanning from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

7 |

9 |

4 |

2 |

0 |

| Last 30D |

0 |

0 |

0 |

1 |

0 |

| 1M Ago |

3 |

6 |

3 |

1 |

0 |

| 2M Ago |

0 |

1 |

1 |

0 |

0 |

| 3M Ago |

4 |

2 |

0 |

0 |

0 |

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $595.45, along with a high estimate of $715.00 and a low estimate of $425.00. Experiencing a 6.08% decline, the current average is now lower than the previous average price target of $634.00.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Synopsys among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Andrew DeGasperi |

Exane BNP Paribas |

Announces |

Underperform |

$425.00 |

- |

| Siti Panigrahi |

Mizuho |

Lowers |

Outperform |

$600.00 |

$700.00 |

| Lee Simpson |

Morgan Stanley |

Lowers |

Overweight |

$510.00 |

$715.00 |

| Vivek Arya |

B of A Securities |

Lowers |

Underperform |

$525.00 |

$625.00 |

| James Schneider |

Goldman Sachs |

Lowers |

Buy |

$600.00 |

$700.00 |

| Jason Celino |

Keybanc |

Lowers |

Overweight |

$590.00 |

$660.00 |

| Ruben Roy |

Stifel |

Lowers |

Buy |

$550.00 |

$650.00 |

| Joe Quatrochi |

Wells Fargo |

Lowers |

Equal-Weight |

$550.00 |

$630.00 |

| Harlan Sur |

JP Morgan |

Lowers |

Overweight |

$600.00 |

$685.00 |

| Joe Vruwink |

Baird |

Lowers |

Neutral |

$535.00 |

$670.00 |

| Blair Abernethy |

Rosenblatt |

Lowers |

Neutral |

$605.00 |

$650.00 |

| Charles Shi |

Needham |

Lowers |

Buy |

$550.00 |

$660.00 |

| Clarke Jeffries |

Piper Sandler |

Lowers |

Overweight |

$630.00 |

$660.00 |

| Jason Celino |

Keybanc |

Raises |

Overweight |

$660.00 |

$610.00 |

| Joe Quatrochi |

Wells Fargo |

Raises |

Equal-Weight |

$630.00 |

$520.00 |

| Lee Simpson |

Morgan Stanley |

Raises |

Overweight |

$715.00 |

$540.00 |

| Blair Abernethy |

Rosenblatt |

Raises |

Buy |

$650.00 |

$625.00 |

| Clarke Jeffries |

Piper Sandler |

Raises |

Overweight |

$660.00 |

$615.00 |

| Vivek Arya |

B of A Securities |

Raises |

Buy |

$625.00 |

$575.00 |

| Charles Shi |

Needham |

Raises |

Buy |

$660.00 |

$650.00 |

| Jason Celino |

Keybanc |

Raises |

Overweight |

$610.00 |

$540.00 |

| James Schneider |

Goldman Sachs |

Announces |

Buy |

$620.00 |

- |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Synopsys. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Synopsys compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Synopsys's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Synopsys analyst ratings.

Discovering Synopsys: A Closer Look

Synopsys is a provider of electronic design automation software and intellectual property products. EDA software automates and aids in the chip design process, enhancing design accuracy, productivity, and complexity in a full-flow end-to-end solution. Synopsys' comprehensive portfolio is benefiting from a convergence of semiconductor companies moving up the stack of technologies toward systems-like companies, and systems companies moving down-stack toward in-house chip design. The resulting expansion in EDA customers alongside secular digitalization of various end markets benefits EDA vendors like Synopsys.

Synopsys: Delving into Financials

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Synopsys's revenue growth over a period of 3M has been noteworthy. As of 31 July, 2025, the company achieved a revenue growth rate of approximately 14.03%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Synopsys's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 13.94%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Synopsys's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 1.29%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Synopsys's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.67%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Synopsys's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.55, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: SNPS