Breaking Down Lazard: 8 Analysts Share Their Views

Author: Benzinga Insights | October 03, 2025 08:00am

Lazard (NYSE:LAZ) has been analyzed by 8 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

2 |

5 |

1 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

1 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

1 |

4 |

0 |

0 |

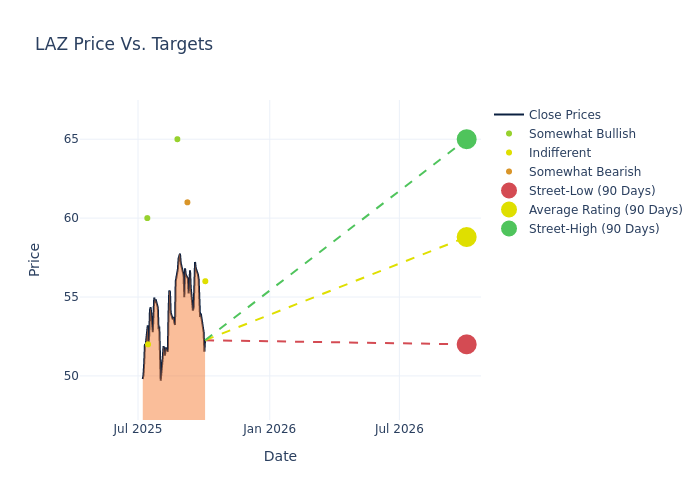

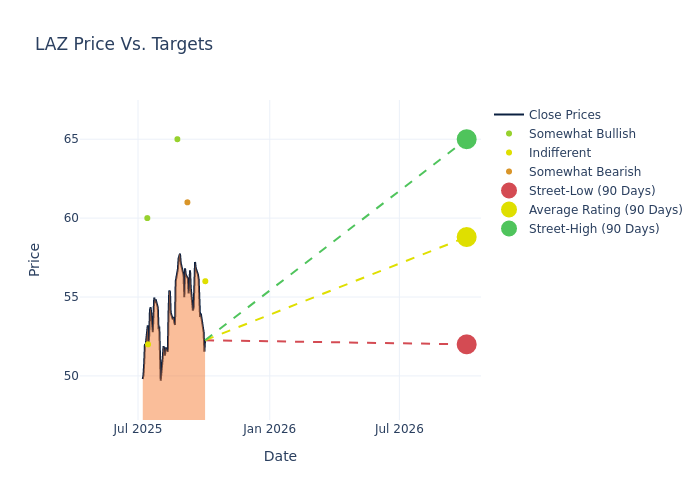

Analysts have set 12-month price targets for Lazard, revealing an average target of $57.62, a high estimate of $65.00, and a low estimate of $50.00. This current average has increased by 14.26% from the previous average price target of $50.43.

Decoding Analyst Ratings: A Detailed Look

A clear picture of Lazard's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Brennan Hawken |

BMO Capital |

Announces |

Market Perform |

$56.00 |

- |

| Ryan Kenny |

Morgan Stanley |

Raises |

Underweight |

$61.00 |

$47.00 |

| Alex Bond |

Keefe, Bruyette & Woods |

Raises |

Outperform |

$65.00 |

$60.00 |

| Alex Bond |

Keefe, Bruyette & Woods |

Raises |

Market Perform |

$60.00 |

$57.00 |

| Michael Brown |

Wells Fargo |

Raises |

Equal-Weight |

$52.00 |

$50.00 |

| Brian Fitzgerald |

JMP Securities |

Raises |

Market Outperform |

$60.00 |

$55.00 |

| Aidan Hall |

Keefe, Bruyette & Woods |

Raises |

Market Perform |

$57.00 |

$46.00 |

| Michael Brown |

Wells Fargo |

Raises |

Equal-Weight |

$50.00 |

$38.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Lazard. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Lazard compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Lazard's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Lazard's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Lazard analyst ratings.

Discovering Lazard: A Closer Look

Lazard Inc has a storied history that can be traced back to 1848. The company's revenue is fairly evenly split between financial advisory, such as acquisition and restructuring advisory, and asset management. The company's asset management business is primarily driven by equities (over 80% of assets under management), has an international focus, and targets institutional clients. By geography, the company earns approximately 60% of revenue in the Americas, 35% in EMEA, and 5% in Asia-Pacific. Lazard has offices across more than 20 countries and over 3,000 employees.

A Deep Dive into Lazard's Financials

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Lazard displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 16.23%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Lazard's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 6.74%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Lazard's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 8.1%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.25%, the company showcases effective utilization of assets.

Debt Management: With a high debt-to-equity ratio of 2.98, Lazard faces challenges in effectively managing its debt levels, indicating potential financial strain.

Analyst Ratings: What Are They?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: LAZ