A Preview Of Constellation Brands's Earnings

Author: Benzinga Insights | October 03, 2025 09:01am

Constellation Brands (NYSE:STZ) is gearing up to announce its quarterly earnings on Monday, 2025-10-06. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Constellation Brands will report an earnings per share (EPS) of $3.40.

Anticipation surrounds Constellation Brands's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

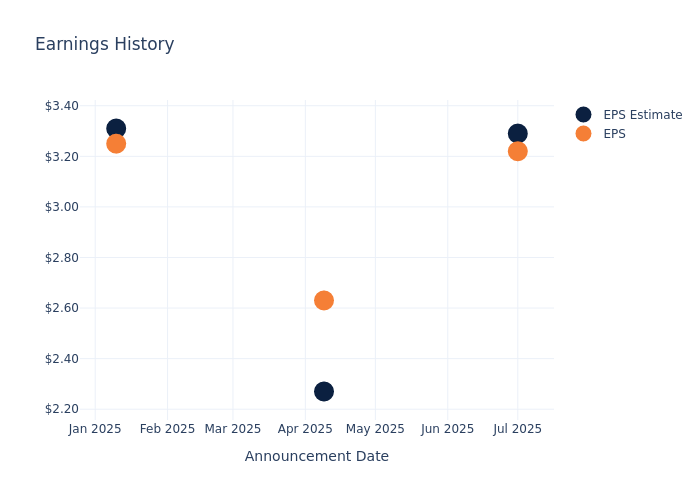

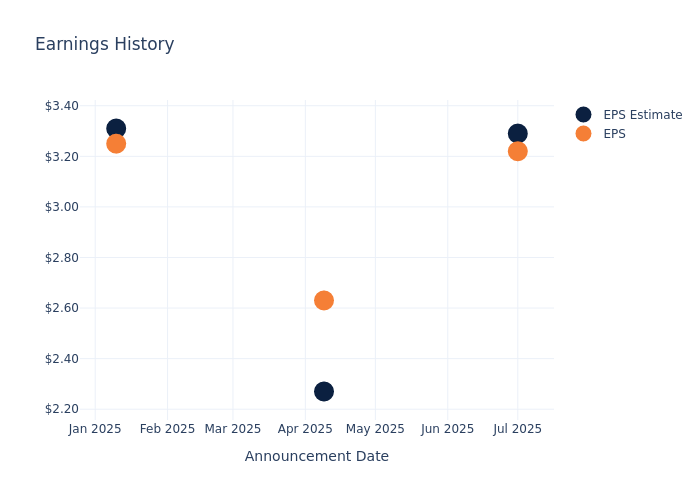

Overview of Past Earnings

In the previous earnings release, the company missed EPS by $0.07, leading to a 4.48% increase in the share price the following trading session.

Here's a look at Constellation Brands's past performance and the resulting price change:

| Quarter |

Q1 2026 |

Q4 2025 |

Q3 2025 |

Q2 2025 |

| EPS Estimate |

3.29 |

2.27 |

3.31 |

4.08 |

| EPS Actual |

3.22 |

2.63 |

3.25 |

4.32 |

| Price Change % |

4.00% |

1.00% |

-17.00% |

1.00% |

Market Performance of Constellation Brands's Stock

Shares of Constellation Brands were trading at $140.51 as of October 02. Over the last 52-week period, shares are down 41.91%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analyst Insights on Constellation Brands

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Constellation Brands.

With 18 analyst ratings, Constellation Brands has a consensus rating of Buy. The average one-year price target is $172.22, indicating a potential 22.57% upside.

Peer Ratings Comparison

The analysis below examines the analyst ratings and average 1-year price targets of and Constellation Brands, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

Comprehensive Peer Analysis Summary

In the peer analysis summary, key metrics for and Constellation Brands are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Constellation Brands |

Buy |

-5.52% |

$1.27B |

7.30% |

Key Takeaway:

Constellation Brands ranks at the bottom for Revenue Growth among its peers. It is also at the bottom for Gross Profit. However, it is in the middle for Return on Equity.

All You Need to Know About Constellation Brands

Constellation Brands is the largest provider of alcoholic beverages across the beer, wine, and spirits categories in the US, generating 84% of revenue from Mexican beer imports under top-selling brands such as Modelo and Corona. The rest of the business includes some remaining wine and spirits brands, categories where the company has pruned assets in recent years. With its exclusive rights tied to the Mexican beer brands effective only in the US, the firm has limited revenue exposure to international markets. Constellation owns a 26% stake in no-moat Canopy Growth, a medicinal and recreational cannabis producer in Canada, and has a 50/50 joint venture with glass manufacturer Owens-Illinois in Mexico.

Financial Milestones: Constellation Brands's Journey

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Negative Revenue Trend: Examining Constellation Brands's financials over 3 months reveals challenges. As of 31 May, 2025, the company experienced a decline of approximately -5.52% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Staples sector.

Net Margin: Constellation Brands's net margin excels beyond industry benchmarks, reaching 20.52%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Constellation Brands's ROE excels beyond industry benchmarks, reaching 7.3%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.35%, the company showcases effective utilization of assets.

Debt Management: Constellation Brands's debt-to-equity ratio stands notably higher than the industry average, reaching 1.59. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for Constellation Brands visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: STZ