Demystifying MarketAxess Holdings: Insights From 9 Analyst Reviews

Author: Benzinga Insights | October 07, 2025 05:00pm

Across the recent three months, 9 analysts have shared their insights on MarketAxess Holdings (NASDAQ:MKTX), expressing a variety of opinions spanning from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

2 |

4 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

1 |

0 |

0 |

0 |

| 2M Ago |

1 |

0 |

1 |

0 |

0 |

| 3M Ago |

1 |

1 |

3 |

0 |

0 |

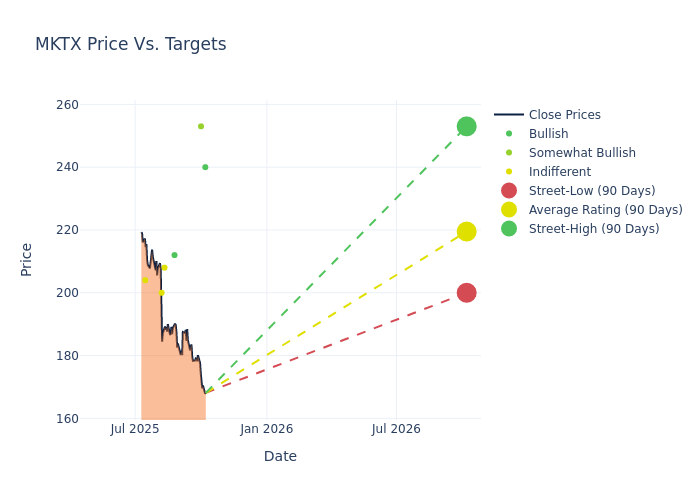

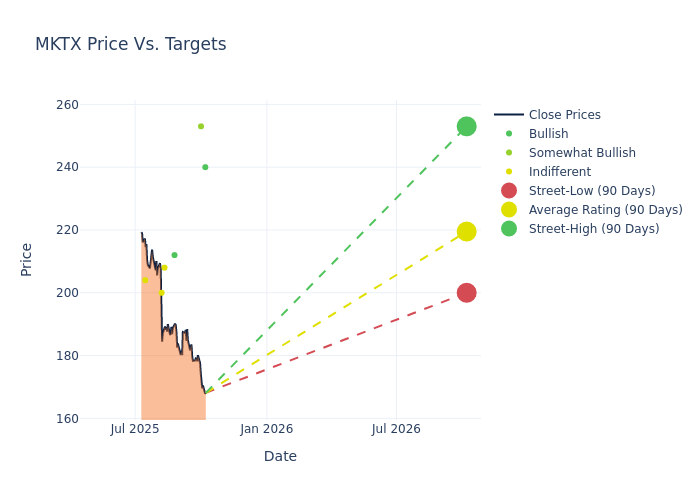

Analysts have recently evaluated MarketAxess Holdings and provided 12-month price targets. The average target is $231.44, accompanied by a high estimate of $274.00 and a low estimate of $200.00. This current average represents a 7.56% decrease from the previous average price target of $250.38.

Diving into Analyst Ratings: An In-Depth Exploration

The perception of MarketAxess Holdings by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Alex Kramm |

UBS |

Lowers |

Buy |

$240.00 |

$255.00 |

| Michael Cyprys |

Morgan Stanley |

Lowers |

Overweight |

$253.00 |

$274.00 |

| Kevin Heal |

Argus Research |

Announces |

Buy |

$212.00 |

- |

| Daniel Fannon |

Jefferies |

Lowers |

Hold |

$208.00 |

$217.00 |

| Alex Kramm |

UBS |

Lowers |

Buy |

$255.00 |

$295.00 |

| Benjamin Budish |

Barclays |

Lowers |

Equal-Weight |

$200.00 |

$237.00 |

| Patrick Moley |

Piper Sandler |

Raises |

Neutral |

$204.00 |

$202.00 |

| Michael Cyprys |

Morgan Stanley |

Lowers |

Overweight |

$274.00 |

$283.00 |

| Benjamin Budish |

Barclays |

Lowers |

Equal-Weight |

$237.00 |

$240.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to MarketAxess Holdings. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of MarketAxess Holdings compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of MarketAxess Holdings's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into MarketAxess Holdings's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on MarketAxess Holdings analyst ratings.

About MarketAxess Holdings

Founded in 2000, MarketAxess is a leading electronic fixed-income trading platform that connects broker/dealers and institutional investors. The company is primarily focused on credit based fixed income securities with its main trading products being US investment-grade and high-yield bonds, Eurobonds, and Emerging Market corporate debt. Recently the company has expanded more aggressively into Treasuries and municipal bonds with the acquisitions of LiquidityEdge and MuniBrokers in 2019 and 2021, respectively. The company also provides pre- and post-trade services with its acquisition of Regulatory Reporting Hub from Deutsche Börse Group in 2020 adding to its product offerings.

MarketAxess Holdings: Financial Performance Dissected

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3M period, MarketAxess Holdings showcased positive performance, achieving a revenue growth rate of 11.03% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: MarketAxess Holdings's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 32.43%, the company may face hurdles in effective cost management.

Return on Equity (ROE): MarketAxess Holdings's ROE excels beyond industry benchmarks, reaching 5.21%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): MarketAxess Holdings's ROA stands out, surpassing industry averages. With an impressive ROA of 3.69%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: MarketAxess Holdings's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.05.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: MKTX