Assessing Medtronic: Insights From 11 Financial Analysts

Author: Benzinga Insights | October 09, 2025 02:01pm

11 analysts have expressed a variety of opinions on Medtronic (NYSE:MDT) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

4 |

4 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

2 |

2 |

3 |

0 |

0 |

| 3M Ago |

0 |

2 |

0 |

0 |

0 |

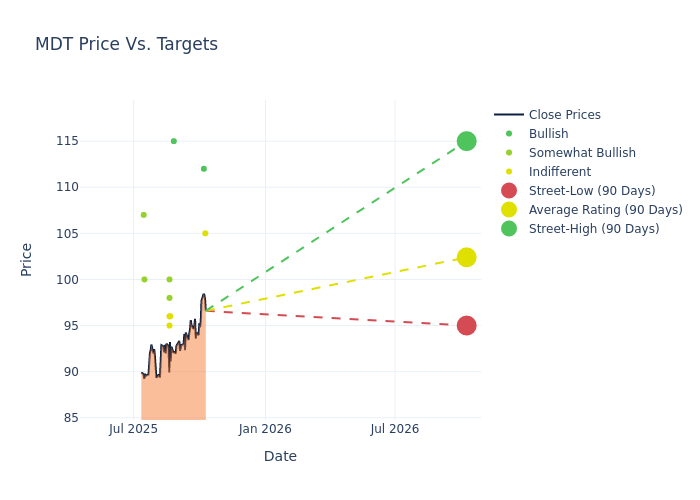

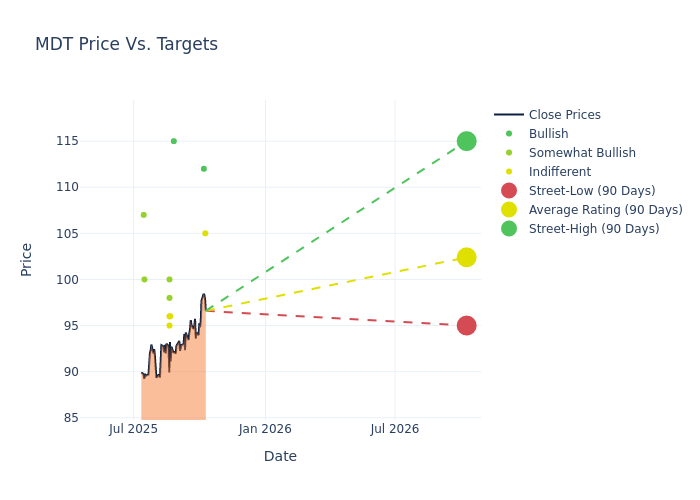

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $102.27, a high estimate of $115.00, and a low estimate of $95.00. This current average has increased by 5.53% from the previous average price target of $96.91.

Breaking Down Analyst Ratings: A Detailed Examination

An in-depth analysis of recent analyst actions unveils how financial experts perceive Medtronic. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Rick Wise |

Stifel |

Raises |

Hold |

$105.00 |

$90.00 |

| Joanne Wuensch |

Citigroup |

Raises |

Buy |

$112.00 |

$101.00 |

| David Toung |

Argus Research |

Raises |

Buy |

$115.00 |

$105.00 |

| Joanne Wuensch |

Citigroup |

Raises |

Buy |

$101.00 |

$99.00 |

| Richard Newitter |

Truist Securities |

Raises |

Hold |

$96.00 |

$92.00 |

| Larry Biegelsen |

Wells Fargo |

Raises |

Overweight |

$100.00 |

$98.00 |

| Danielle Antalffy |

UBS |

Raises |

Neutral |

$95.00 |

$94.00 |

| David Rescott |

Baird |

Raises |

Neutral |

$96.00 |

$94.00 |

| Lee Hambright |

Bernstein |

Raises |

Outperform |

$98.00 |

$97.00 |

| Anthony Petrone |

Mizuho |

Raises |

Outperform |

$100.00 |

$98.00 |

| Cecilia Furlong |

Morgan Stanley |

Raises |

Overweight |

$107.00 |

$98.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Medtronic. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Medtronic compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Medtronic's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Medtronic's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Medtronic analyst ratings.

All You Need to Know About Medtronic

One of the largest medical-device companies, Medtronic develops and manufactures therapeutic medical devices for chronic diseases. Its portfolio includes pacemakers, defibrillators, transcatheter heart valves, stents, insulin pumps, spinal fixation devices, neurovascular products, advanced energy, ablation laser therapy, and surgical tools. The company primarily markets its products to healthcare institutions and physicians in the United States, Western Europe, and Japan. Foreign sales account for roughly 50% of the company's total sales.

Breaking Down Medtronic's Financial Performance

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Positive Revenue Trend: Examining Medtronic's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 8.38% as of 31 July, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Medtronic's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 12.12%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Medtronic's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 2.17%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Medtronic's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.14%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.6, Medtronic adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: MDT