Expert Outlook: APA Through The Eyes Of 17 Analysts

Author: Benzinga Insights | October 09, 2025 05:01pm

In the preceding three months, 17 analysts have released ratings for APA (NASDAQ:APA), presenting a wide array of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

2 |

11 |

3 |

1 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

1 |

0 |

1 |

0 |

| 2M Ago |

0 |

0 |

4 |

1 |

1 |

| 3M Ago |

0 |

1 |

6 |

1 |

0 |

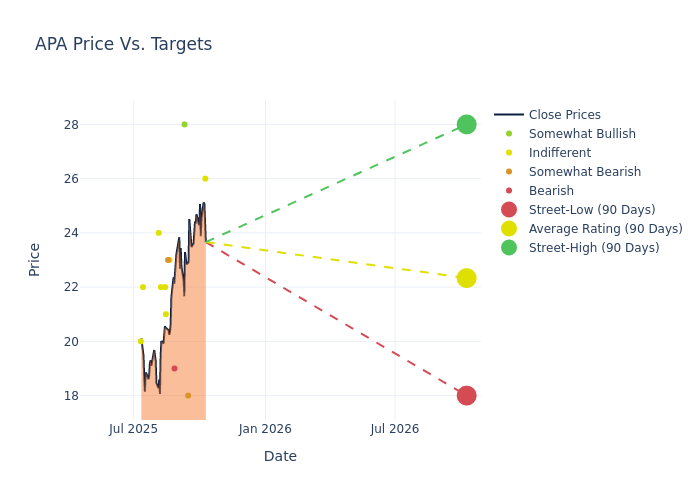

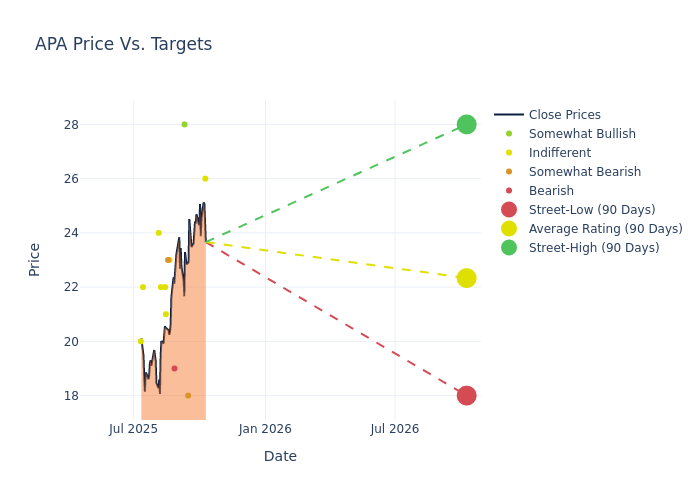

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $22.18, along with a high estimate of $28.00 and a low estimate of $18.00. Surpassing the previous average price target of $21.00, the current average has increased by 5.62%.

Decoding Analyst Ratings: A Detailed Look

The perception of APA by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Paul Cheng |

Scotiabank |

Raises |

Sector Perform |

$26.00 |

$22.00 |

| William Janela |

Mizuho |

Lowers |

Underperform |

$18.00 |

$19.00 |

| John Freeman |

Raymond James |

Raises |

Outperform |

$28.00 |

$26.00 |

| Neil Mehta |

Goldman Sachs |

Raises |

Sell |

$19.00 |

$17.00 |

| Josh Silverstein |

UBS |

Raises |

Neutral |

$23.00 |

$21.00 |

| Devin McDermott |

Morgan Stanley |

Raises |

Underweight |

$23.00 |

$22.00 |

| Hanwen Chang |

Wells Fargo |

Raises |

Equal-Weight |

$21.00 |

$20.00 |

| Mark Lear |

Piper Sandler |

Raises |

Neutral |

$22.00 |

$21.00 |

| Josh Silverstein |

UBS |

Raises |

Neutral |

$21.00 |

$19.00 |

| Betty Jiang |

Barclays |

Raises |

Equal-Weight |

$22.00 |

$21.00 |

| Mike Scialla |

Stephens & Co. |

Announces |

Equal-Weight |

$24.00 |

- |

| John Freeman |

Raymond James |

Raises |

Outperform |

$26.00 |

$25.00 |

| Roger Read |

Wells Fargo |

Lowers |

Equal-Weight |

$20.00 |

$21.00 |

| Mark Lear |

Piper Sandler |

Raises |

Neutral |

$21.00 |

$19.00 |

| Devin McDermott |

Morgan Stanley |

Raises |

Underweight |

$22.00 |

$21.00 |

| Scott Hanold |

RBC Capital |

Lowers |

Sector Perform |

$22.00 |

$24.00 |

| Josh Silverstein |

UBS |

Raises |

Neutral |

$19.00 |

$18.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to APA. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of APA compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of APA's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on APA analyst ratings.

Get to Know APA Better

APA Corp is an independent exploration and production company. It develops, and produces crude oil, natural gas, and natural gas liquids. The Company's business has oil and gas operations in three geographic areas: the United States (U.S.), Egypt, and offshore the U.K. in the North Sea (North Sea). APA also has active development, exploration, and appraisal operations ongoing in Suriname, as well as exploration interests in Uruguay, Alaska, and other international locations.

Financial Milestones: APA's Journey

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Challenges: APA's revenue growth over 3M faced difficulties. As of 30 June, 2025, the company experienced a decline of approximately -14.35%. This indicates a decrease in top-line earnings. When compared to others in the Energy sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 27.69%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): APA's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 10.63%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 3.29%, the company showcases effective utilization of assets.

Debt Management: With a high debt-to-equity ratio of 0.79, APA faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: APA