Deep Dive Into Commercial Metals Stock: Analyst Perspectives (5 Ratings)

Author: Benzinga Insights | October 13, 2025 02:01pm

Ratings for Commercial Metals (NYSE:CMC) were provided by 5 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

2 |

2 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

1 |

1 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

1 |

0 |

0 |

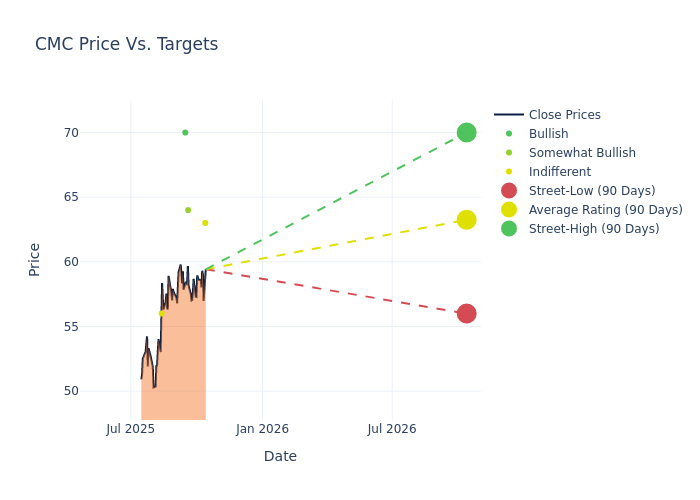

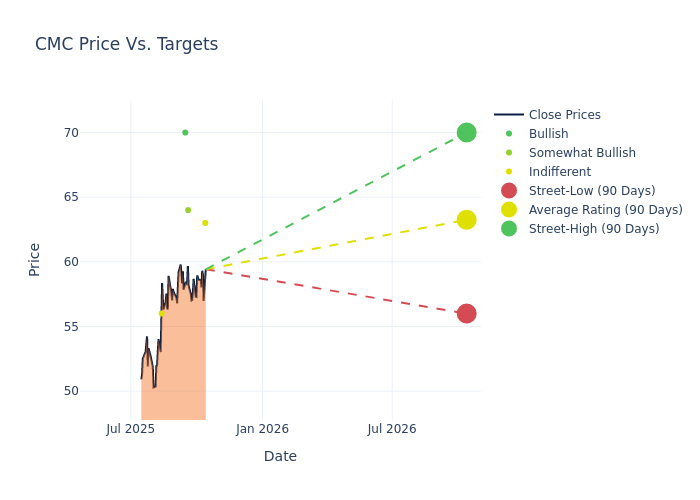

In the assessment of 12-month price targets, analysts unveil insights for Commercial Metals, presenting an average target of $62.8, a high estimate of $70.00, and a low estimate of $56.00. Surpassing the previous average price target of $55.75, the current average has increased by 12.65%.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Commercial Metals among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Bill Peterson |

JP Morgan |

Raises |

Neutral |

$63.00 |

$54.00 |

| Timna Tanners |

Wells Fargo |

Raises |

Overweight |

$64.00 |

$61.00 |

| Sathish Kasinathan |

B of A Securities |

Raises |

Buy |

$70.00 |

$60.00 |

| Timna Tanners |

Wells Fargo |

Announces |

Overweight |

$61.00 |

- |

| Andrew Jones |

UBS |

Raises |

Neutral |

$56.00 |

$48.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Commercial Metals. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Commercial Metals compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Commercial Metals's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

To gain a panoramic view of Commercial Metals's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Commercial Metals analyst ratings.

Unveiling the Story Behind Commercial Metals

Commercial Metals Co operates steel mills, steel fabrication plants, and metal recycling facilities in the United States and manufactures rebar and structural steel, which are key product categories for the nonresidential construction sector. The Company has three operating and reportable segments: North America Steel Group, Europe Steel Group and Emerging Businesses Group.

Commercial Metals: A Financial Overview

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Challenges: Commercial Metals's revenue growth over 3M faced difficulties. As of 31 May, 2025, the company experienced a decline of approximately -2.81%. This indicates a decrease in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Materials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 4.12%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 2.05%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.21%, the company showcases effective utilization of assets.

Debt Management: Commercial Metals's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.33.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CMC