Deep Dive Into Comfort Systems USA Stock: Analyst Perspectives (4 Ratings)

Author: Benzinga Insights | October 13, 2025 04:00pm

4 analysts have shared their evaluations of Comfort Systems USA (NYSE:FIX) during the recent three months, expressing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

0 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

2 |

0 |

0 |

0 |

0 |

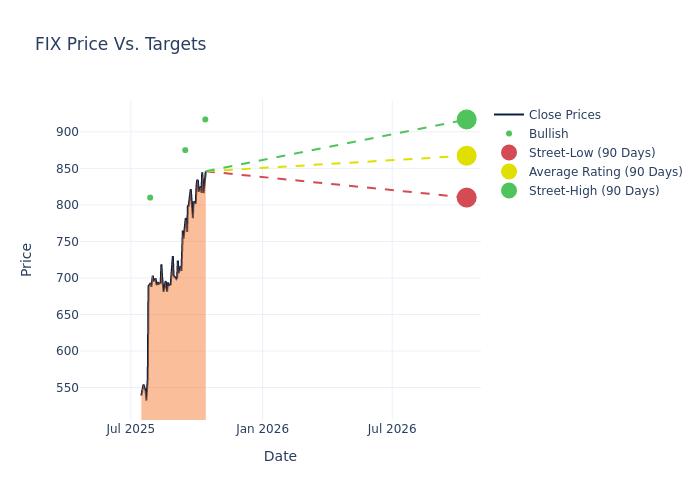

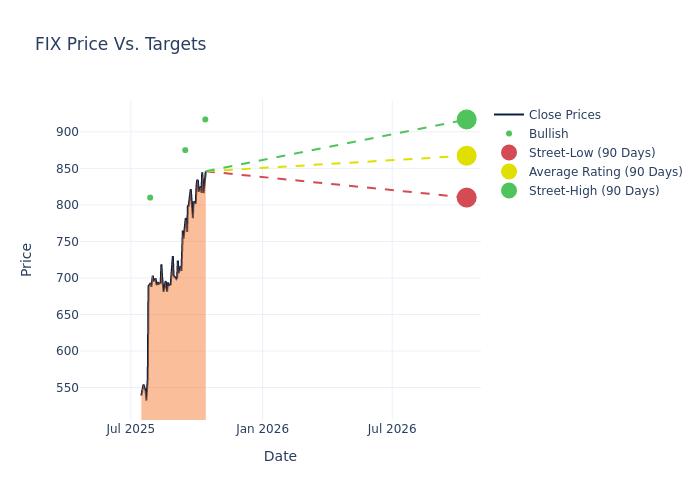

Analysts have set 12-month price targets for Comfort Systems USA, revealing an average target of $828.0, a high estimate of $917.00, and a low estimate of $710.00. This upward trend is evident, with the current average reflecting a 25.88% increase from the previous average price target of $657.75.

Analyzing Analyst Ratings: A Detailed Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive Comfort Systems USA. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Brian Brophy |

Stifel |

Raises |

Buy |

$917.00 |

$746.00 |

| Joshua Chan |

UBS |

Raises |

Buy |

$875.00 |

$710.00 |

| Brent Thielman |

DA Davidson |

Raises |

Buy |

$810.00 |

$630.00 |

| Joshua Chan |

UBS |

Raises |

Buy |

$710.00 |

$545.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Comfort Systems USA. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Comfort Systems USA compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Comfort Systems USA's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Comfort Systems USA's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Comfort Systems USA analyst ratings.

Get to Know Comfort Systems USA Better

Comfort Systems USA Inc provides comprehensive mechanical contracting services, including heating, ventilation, & air conditioning, or HVAC; plumbing; piping & controls; construction; and other electrical components. Projects are mainly for commercial, industrial, & institutional buildings, & tend to be geared toward HVAC. Revenue is roughly split between installation services for newly constructed facilities & maintenance services for existing buildings. The company installs & repairs products and systems throughout the United States. It operates in two segments, Mechanical services & Electrical services, the majority is from the Mechanical services segment.

Comfort Systems USA: Financial Performance Dissected

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Comfort Systems USA's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 20.05%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Comfort Systems USA's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.62% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Comfort Systems USA's ROE excels beyond industry benchmarks, reaching 12.32%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Comfort Systems USA's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.79% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Comfort Systems USA's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.14.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: FIX