Deep Dive Into Atmus Filtration Techs Stock: Analyst Perspectives (4 Ratings)

Author: Benzinga Insights | October 14, 2025 01:01pm

Analysts' ratings for Atmus Filtration Techs (NYSE:ATMU) over the last quarter vary from bullish to bearish, as provided by 4 analysts.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

1 |

3 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

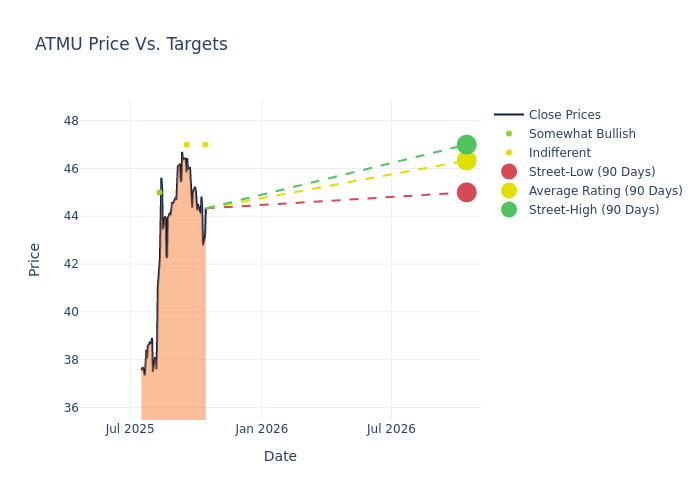

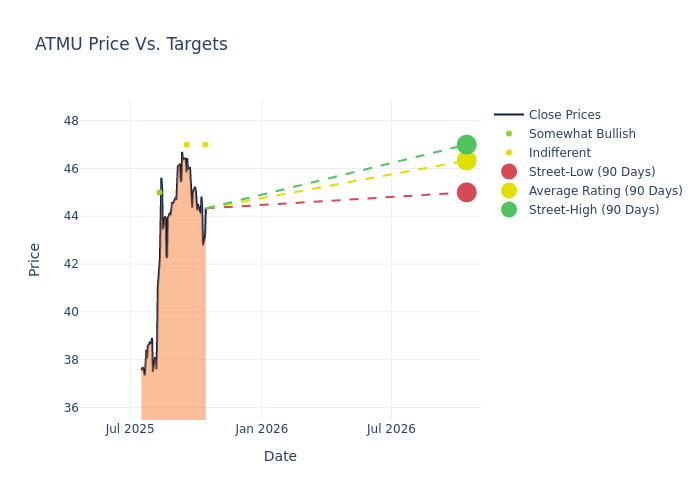

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $46.25, along with a high estimate of $47.00 and a low estimate of $45.00. Witnessing a positive shift, the current average has risen by 6.94% from the previous average price target of $43.25.

Interpreting Analyst Ratings: A Closer Look

The analysis of recent analyst actions sheds light on the perception of Atmus Filtration Techs by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Tami Zakaria |

JP Morgan |

Raises |

Neutral |

$47.00 |

$46.00 |

| Joseph O'Dea |

Wells Fargo |

Raises |

Equal-Weight |

$47.00 |

$42.00 |

| Tami Zakaria |

JP Morgan |

Raises |

Neutral |

$46.00 |

$44.00 |

| Robert Mason |

Baird |

Raises |

Outperform |

$45.00 |

$41.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Atmus Filtration Techs. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Atmus Filtration Techs compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Atmus Filtration Techs's stock. This examination reveals shifts in analysts' expectations over time.

For valuable insights into Atmus Filtration Techs's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Atmus Filtration Techs analyst ratings.

Discovering Atmus Filtration Techs: A Closer Look

Atmus Filtration Technologies Inc manufactures filtration products for on-highway commercial vehicles and off-highway agriculture, construction, mining, and power generation vehicles and equipment. The company designs and manufactures Developed filtration products, principally under the Fleetguard brand, that enable lower emissions and provide asset protection. The company designs, manufactures, and sells filters, coolants, and chemical products. The company offers products including air filtration, coolants and chemicals, crankcase ventilation, fuel filtration, fuel cells, lube filtration, and others.

Atmus Filtration Techs: Delving into Financials

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Atmus Filtration Techs's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 4.83%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Atmus Filtration Techs's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 13.21% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 20.6%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Atmus Filtration Techs's ROA stands out, surpassing industry averages. With an impressive ROA of 4.71%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Atmus Filtration Techs's debt-to-equity ratio surpasses industry norms, standing at 1.97. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: ATMU