Assessing Sea: Insights From 6 Financial Analysts

Author: Benzinga Insights | October 16, 2025 07:00am

In the last three months, 6 analysts have published ratings on Sea (NYSE:SE), offering a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

4 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

1 |

3 |

0 |

0 |

0 |

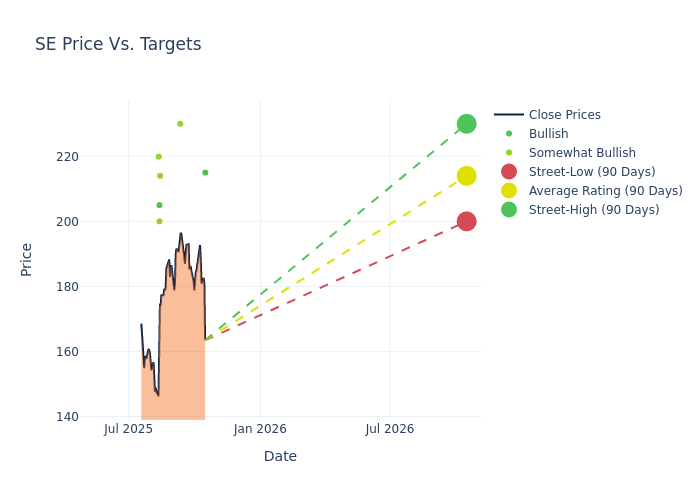

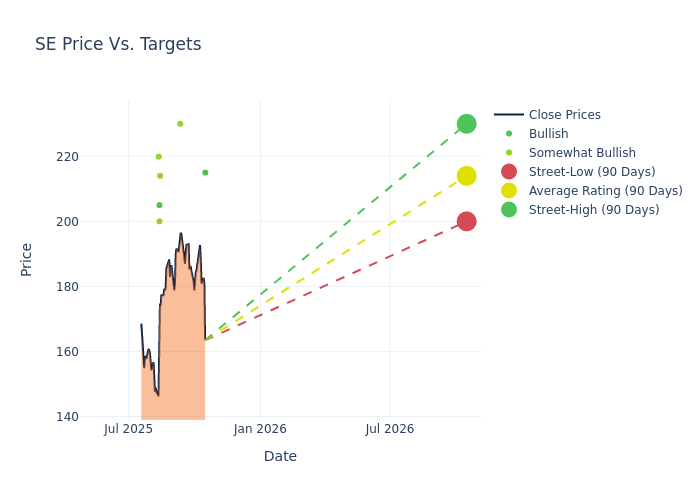

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $213.98, with a high estimate of $230.00 and a low estimate of $200.00. This upward trend is evident, with the current average reflecting a 12.4% increase from the previous average price target of $190.37.

Breaking Down Analyst Ratings: A Detailed Examination

In examining recent analyst actions, we gain insights into how financial experts perceive Sea. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Sachin Salgaonkar |

B of A Securities |

Raises |

Buy |

$215.00 |

$206.00 |

| Ranjan Sharma |

JP Morgan |

Raises |

Overweight |

$230.00 |

$208.00 |

| Jiong Shao |

Barclays |

Raises |

Overweight |

$214.00 |

$200.00 |

| Scott Devitt |

Wedbush |

Raises |

Outperform |

$200.00 |

$170.00 |

| Fawne Jiang |

Benchmark |

Raises |

Buy |

$205.00 |

$180.00 |

| Esme Pau |

Macquarie |

Raises |

Outperform |

$219.90 |

$178.20 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Sea. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Sea compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Sea's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Sea's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Sea analyst ratings.

All You Need to Know About Sea

Sea started as a gaming business, Garena, but in 2015 expanded into e-commerce. Sea operates Southeast Asia's largest e-commerce company, Shopee, in terms of gross merchandise value. Shopee is a hybrid C2C and B2C marketplace platform operating in Indonesia, Taiwan, Vietnam, Thailand, Malaysia, the Philippines, and Brazil. For Garena, Free Fire is the key revenue generating game. Sea's third business, SeaMoney, provides lending, payment, digital banking, and insurance services.As of March 31, 2024, Forrest Xiaodong Li, the founder, chairman and CEO, owned 59.8% of voting power and 18.5% of issued shares. Tencent owned 18.2% of issued shares with no voting power.

Sea's Economic Impact: An Analysis

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Sea's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 38.16%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Sea's net margin is impressive, surpassing industry averages. With a net margin of 7.72%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 4.36%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.65%, the company showcases effective utilization of assets.

Debt Management: Sea's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.43.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: SE