Deep Dive Into Citizens Financial Group Stock: Analyst Perspectives (11 Ratings)

Author: Benzinga Insights | October 16, 2025 07:01am

Ratings for Citizens Financial Group (NYSE:CFG) were provided by 11 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

5 |

2 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

3 |

3 |

1 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

1 |

1 |

0 |

0 |

0 |

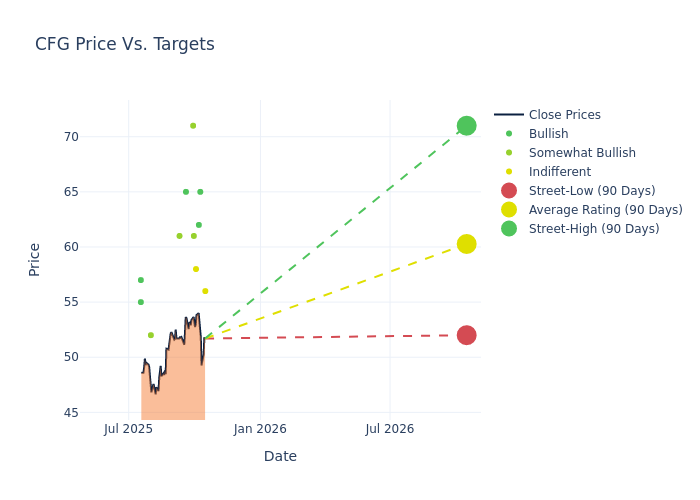

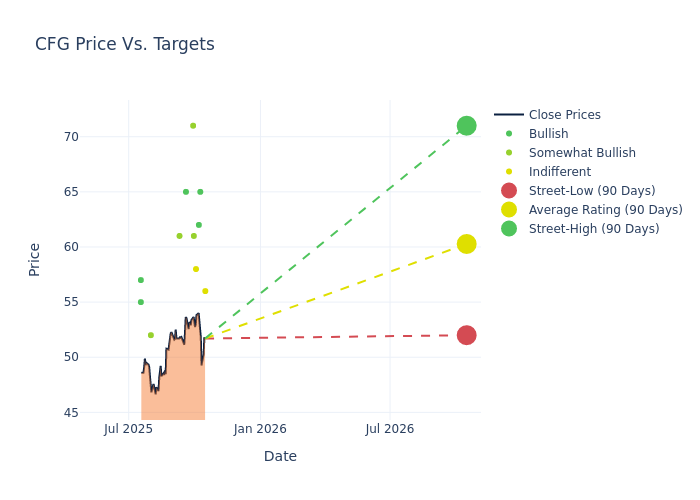

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $60.73, a high estimate of $71.00, and a low estimate of $52.00. Marking an increase of 11.13%, the current average surpasses the previous average price target of $54.65.

Diving into Analyst Ratings: An In-Depth Exploration

In examining recent analyst actions, we gain insights into how financial experts perceive Citizens Financial Group. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jason Goldberg |

Barclays |

Raises |

Equal-Weight |

$56.00 |

$55.00 |

| Ebrahim Poonawala |

B of A Securities |

Raises |

Buy |

$65.00 |

$52.00 |

| Erika Najarian |

UBS |

Raises |

Buy |

$62.00 |

$57.00 |

| Brian Foran |

Truist Securities |

Raises |

Hold |

$58.00 |

$52.00 |

| John Pancari |

Evercore ISI Group |

Raises |

Outperform |

$61.00 |

$57.00 |

| Manan Gosalia |

Morgan Stanley |

Raises |

Overweight |

$71.00 |

$53.00 |

| Keith Horowitz |

Citigroup |

Raises |

Buy |

$65.00 |

$60.00 |

| John Pancari |

Evercore ISI Group |

Raises |

Outperform |

$57.00 |

$55.00 |

| Dave Rochester |

Cantor Fitzgerald |

Announces |

Overweight |

$61.00 |

- |

| Vivek Juneja |

JP Morgan |

Raises |

Overweight |

$52.00 |

$48.50 |

| Keith Horowitz |

Citigroup |

Raises |

Buy |

$60.00 |

$57.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Citizens Financial Group. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Citizens Financial Group compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Citizens Financial Group's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Citizens Financial Group's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Citizens Financial Group analyst ratings.

Delving into Citizens Financial Group's Background

Citizens Financial Group Inc is a bank holding company headquartered in Providence, Rhode Island. Through the bank, it offers various retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions. The company's reportable segments are; Commercial Banking, Consumer Banking, Non-Core, and Others. A majority of its revenue is generated from the Consumer Banking segment, which serves consumer customers and small businesses, offering traditional banking products and services including deposits, mortgage and home equity lending, credit cards, small business loans, education loans, point-of-sale finance loans, and wealth management and investment services.

Breaking Down Citizens Financial Group's Financial Performance

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Citizens Financial Group displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 3.98%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Citizens Financial Group's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 19.73%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Citizens Financial Group's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.75%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Citizens Financial Group's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.18%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Citizens Financial Group's debt-to-equity ratio surpasses industry norms, standing at 0.55. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Significance of Analyst Ratings Explained

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CFG