Deep Dive Into Jazz Pharmaceuticals Stock: Analyst Perspectives (9 Ratings)

Author: Benzinga Insights | October 20, 2025 01:35pm

In the preceding three months, 9 analysts have released ratings for Jazz Pharmaceuticals (NASDAQ:JAZZ), presenting a wide array of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

5 |

0 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

1 |

0 |

0 |

0 |

| 2M Ago |

3 |

2 |

0 |

0 |

0 |

| 3M Ago |

1 |

1 |

0 |

0 |

0 |

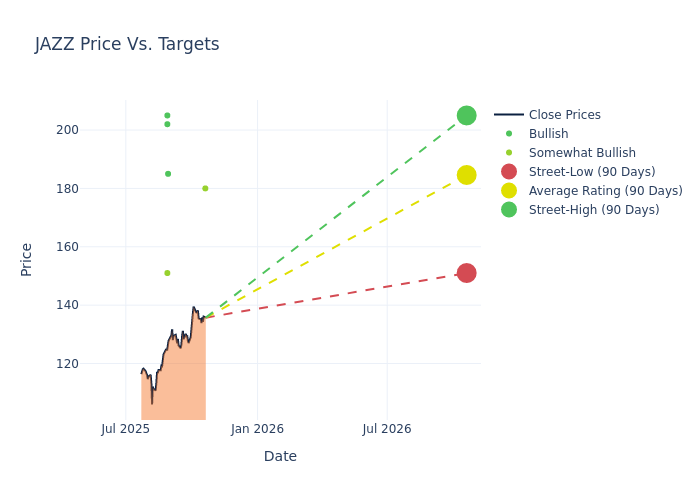

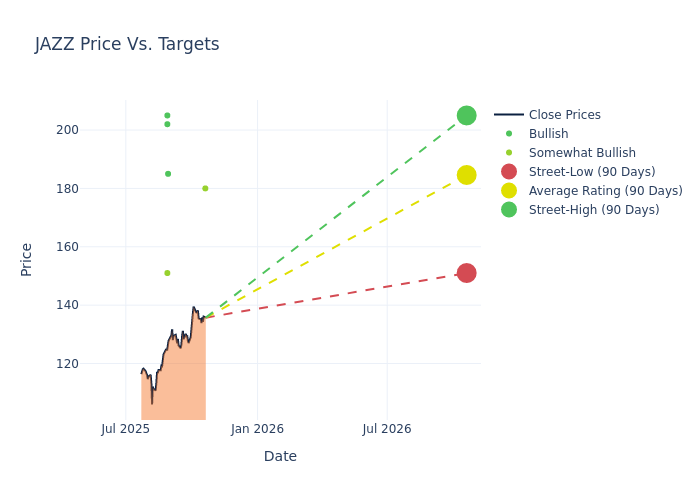

The 12-month price targets, analyzed by analysts, offer insights with an average target of $179.67, a high estimate of $205.00, and a low estimate of $151.00. Witnessing a positive shift, the current average has risen by 3.13% from the previous average price target of $174.22.

Investigating Analyst Ratings: An Elaborate Study

The perception of Jazz Pharmaceuticals by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jeffrey Hung |

Morgan Stanley |

Raises |

Overweight |

$180.00 |

$167.00 |

| Jeffrey Hung |

Morgan Stanley |

Raises |

Overweight |

$167.00 |

$163.00 |

| Madhu Kumar |

Goldman Sachs |

Raises |

Buy |

$185.00 |

$162.00 |

| Jeffrey Hung |

Morgan Stanley |

Raises |

Overweight |

$163.00 |

$162.00 |

| Leonid Timashev |

RBC Capital |

Raises |

Outperform |

$151.00 |

$145.00 |

| Gregory Fraser |

Truist Securities |

Raises |

Buy |

$205.00 |

$200.00 |

| Ami Fadia |

Needham |

Maintains |

Buy |

$202.00 |

$202.00 |

| Ami Fadia |

Needham |

Maintains |

Buy |

$202.00 |

$202.00 |

| Jeffrey Hung |

Morgan Stanley |

Lowers |

Overweight |

$162.00 |

$165.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Jazz Pharmaceuticals. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Jazz Pharmaceuticals compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Jazz Pharmaceuticals's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Jazz Pharmaceuticals's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Jazz Pharmaceuticals analyst ratings.

All You Need to Know About Jazz Pharmaceuticals

Jazz Pharmaceuticals is an Ireland-domiciled biopharmaceutical firm focused primarily on treatments for sleeping disorders and oncology. Jazz has nine approved drugs across neuroscience and oncology indications; its portfolio includes Xyrem and Xywav for narcolepsy, Zepzelca for the treatment of metastatic small cell lung cancer, Rylaze for acute lymphoblastic leukemia, and Vyxeos for acute myeloid leukemia. In May 2021, Jazz acquired GW Pharmaceuticals and gained its leading product, Epidiolex for the treatment of severe, rare forms of epilepsy.

Jazz Pharmaceuticals: Financial Performance Dissected

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Jazz Pharmaceuticals displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 2.14%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Jazz Pharmaceuticals's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -68.71%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Jazz Pharmaceuticals's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -18.23%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Jazz Pharmaceuticals's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -6.39%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Jazz Pharmaceuticals's debt-to-equity ratio surpasses industry norms, standing at 1.47. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: JAZZ