Demystifying Beta Bionics: Insights From 5 Analyst Reviews

Author: Benzinga Insights | October 21, 2025 03:00pm

5 analysts have shared their evaluations of Beta Bionics (NASDAQ:BBNX) during the recent three months, expressing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

0 |

1 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

2 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

1 |

0 |

1 |

0 |

0 |

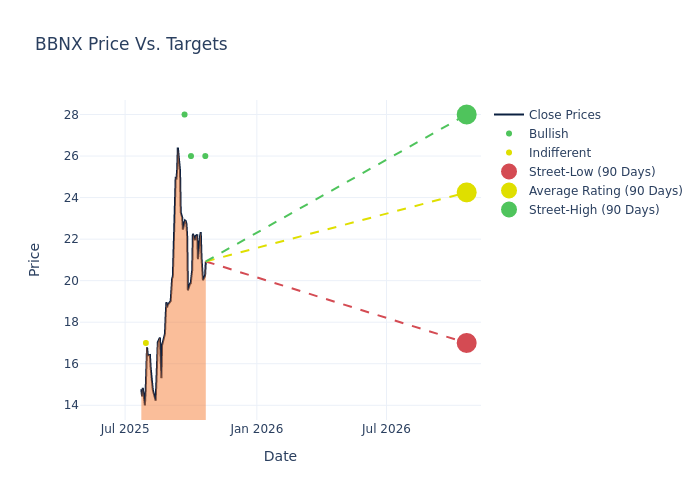

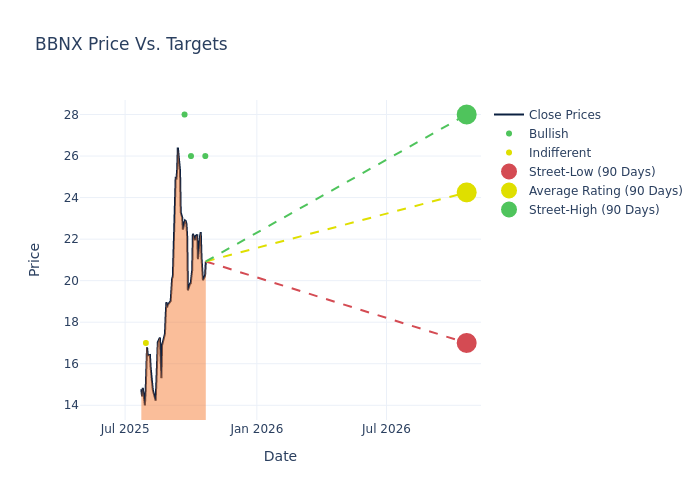

Analysts have set 12-month price targets for Beta Bionics, revealing an average target of $23.6, a high estimate of $28.00, and a low estimate of $17.00. Surpassing the previous average price target of $18.00, the current average has increased by 31.11%.

Breaking Down Analyst Ratings: A Detailed Examination

The analysis of recent analyst actions sheds light on the perception of Beta Bionics by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jonathan Block |

Stifel |

Announces |

Buy |

$26.00 |

- |

| David Roman |

Goldman Sachs |

Raises |

Buy |

$26.00 |

$18.00 |

| Richard Newitter |

Truist Securities |

Raises |

Buy |

$28.00 |

$21.00 |

| Richard Newitter |

Truist Securities |

Raises |

Buy |

$21.00 |

$18.00 |

| Jeff Johnson |

Baird |

Raises |

Neutral |

$17.00 |

$15.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Beta Bionics. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Beta Bionics compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Beta Bionics's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Beta Bionics's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Beta Bionics analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Beta Bionics: A Closer Look

Beta Bionics Inc is a commercial-stage medical device company engaged in the design, development, and commercialization of solutions to improve the health and quality of life of insulin-requiring people with diabetes (PWD) by utilizing adaptive closed-loop algorithms to simplify and improve the treatment of their disease. The company product includes the iLet Bionic Pancreas (iLet). The Company operates as a single segment, focused on the development, manufacture and sale of the iLet.

Understanding the Numbers: Beta Bionics's Finances

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Beta Bionics's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 54.45%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Net Margin: Beta Bionics's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -72.59%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of -5.48%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Beta Bionics's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -5.05%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Beta Bionics's debt-to-equity ratio is below the industry average at 0.02, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: BBNX