Unpacking the Latest Options Trading Trends in Constellation Energy

Author: Benzinga Insights | October 24, 2025 02:00pm

Deep-pocketed investors have adopted a bullish approach towards Constellation Energy (NASDAQ:CEG), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CEG usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 57 extraordinary options activities for Constellation Energy. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 49% leaning bullish and 29% bearish. Among these notable options, 6 are puts, totaling $221,879, and 51 are calls, amounting to $2,897,667.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $270.0 to $580.0 for Constellation Energy over the last 3 months.

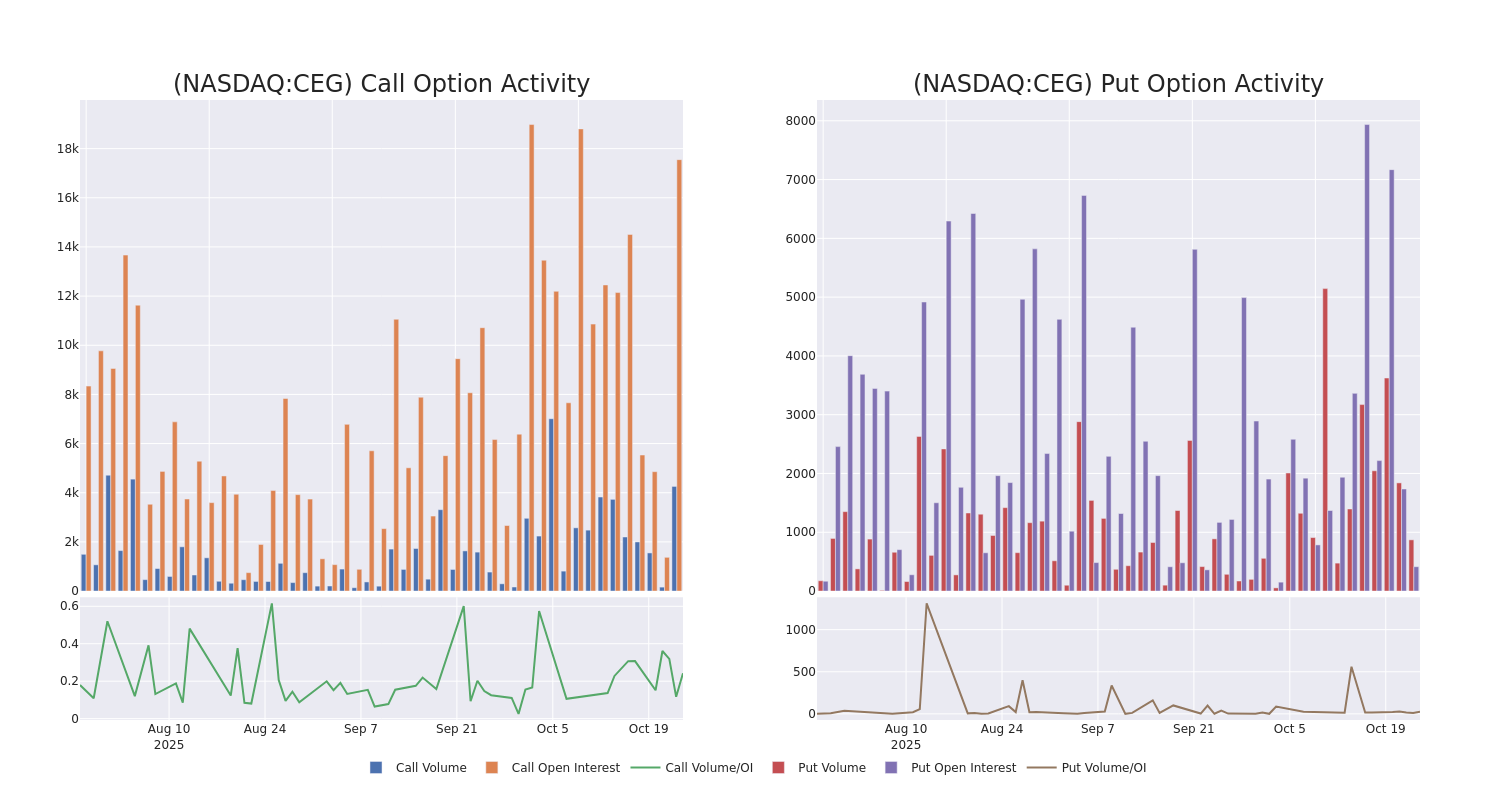

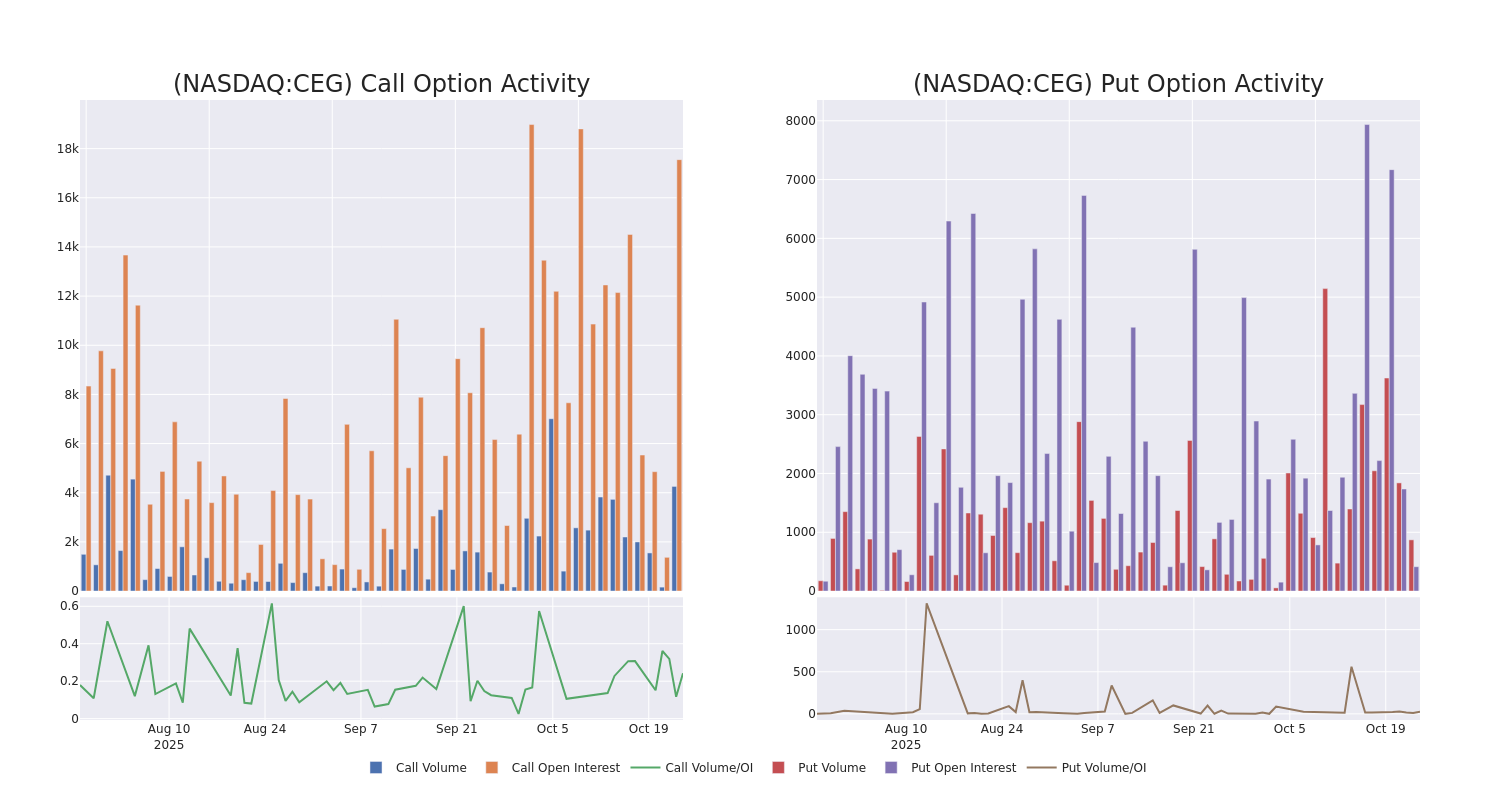

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Constellation Energy options trades today is 598.3 with a total volume of 5,014.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Constellation Energy's big money trades within a strike price range of $270.0 to $580.0 over the last 30 days.

Constellation Energy 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CEG |

CALL |

TRADE |

NEUTRAL |

01/16/26 |

$43.7 |

$42.3 |

$43.05 |

$380.00 |

$430.5K |

1.0K |

122 |

| CEG |

CALL |

TRADE |

BEARISH |

11/28/25 |

$43.0 |

$41.0 |

$41.0 |

$360.00 |

$205.0K |

112 |

104 |

| CEG |

CALL |

TRADE |

NEUTRAL |

09/18/26 |

$55.0 |

$51.0 |

$53.21 |

$450.00 |

$148.9K |

498 |

28 |

| CEG |

CALL |

SWEEP |

NEUTRAL |

11/28/25 |

$46.2 |

$44.0 |

$44.16 |

$360.00 |

$119.0K |

112 |

52 |

| CEG |

CALL |

TRADE |

BULLISH |

03/20/26 |

$21.0 |

$20.2 |

$20.83 |

$490.00 |

$104.1K |

39 |

147 |

About Constellation Energy

Constellation Energy Corp producer of carbon-free energy and a supplier of energy products and services. The company offers generating capacity that includes nuclear, wind, solar, natural gas, and hydroelectric assets. It sells electricity, natural gas, and other energy-related products and sustainable solutions to various types of customers, including distribution utilities, municipalities, cooperatives, and commercial, industrial, public sector, and residential customers in markets across multiple geographic regions. Its operating segments and reporting units are Mid-Atlantic, Midwest, New York, ERCOT, and Other Power Regions.

After a thorough review of the options trading surrounding Constellation Energy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Constellation Energy

- With a volume of 1,998,999, the price of CEG is up 6.06% at $387.96.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 14 days.

Expert Opinions on Constellation Energy

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $415.33.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Keybanc has decided to maintain their Overweight rating on Constellation Energy, which currently sits at a price target of $417.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Constellation Energy, which currently sits at a price target of $422.

* Showing optimism, an analyst from Seaport Global upgrades its rating to Buy with a revised price target of $407.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Constellation Energy, Benzinga Pro gives you real-time options trades alerts.

Posted In: CEG