Earnings Preview For Mondelez International

Author: Benzinga Insights | October 27, 2025 09:02am

Mondelez International (NASDAQ:MDLZ) will release its quarterly earnings report on Tuesday, 2025-10-28. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Mondelez International to report an earnings per share (EPS) of $0.72.

Anticipation surrounds Mondelez International's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

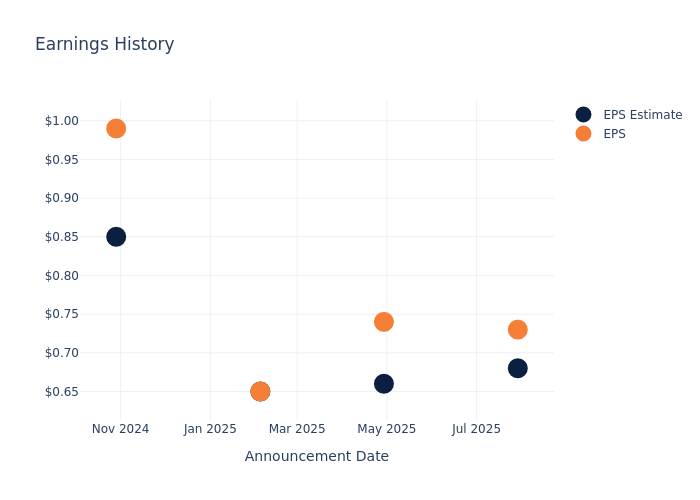

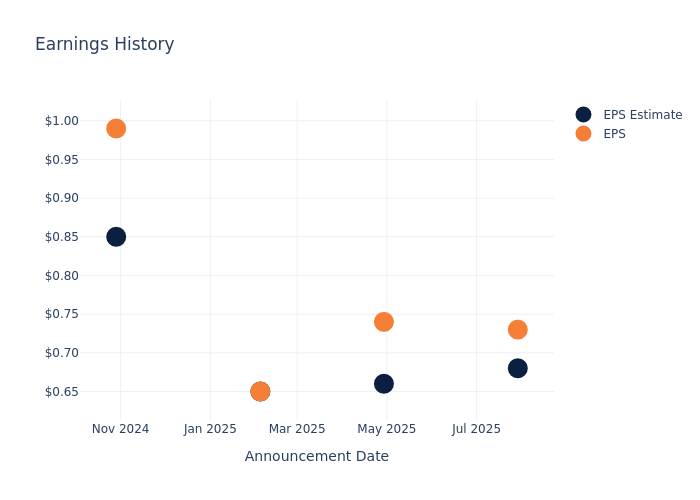

Earnings Track Record

In the previous earnings release, the company beat EPS by $0.05, leading to a 6.61% drop in the share price the following trading session.

Here's a look at Mondelez International's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

0.68 |

0.66 |

0.65 |

0.85 |

| EPS Actual |

0.73 |

0.74 |

0.65 |

0.99 |

| Price Change % |

-7.00 |

4.00 |

2.00 |

1.00 |

Tracking Mondelez International's Stock Performance

Shares of Mondelez International were trading at $60.77 as of October 24. Over the last 52-week period, shares are down 12.23%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analysts' Take on Mondelez International

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Mondelez International.

Analysts have given Mondelez International a total of 11 ratings, with the consensus rating being Outperform. The average one-year price target is $73.45, indicating a potential 20.87% upside.

Comparing Ratings with Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Hershey, Kraft Heinz and Kellanova, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Hershey, with an average 1-year price target of $183.43, suggesting a potential 201.84% upside.

- Analysts currently favor an Neutral trajectory for Kraft Heinz, with an average 1-year price target of $28.0, suggesting a potential 53.92% downside.

- Analysts currently favor an Neutral trajectory for Kellanova, with an average 1-year price target of $83.5, suggesting a potential 37.4% upside.

Overview of Peer Analysis

The peer analysis summary provides a snapshot of key metrics for Hershey, Kraft Heinz and Kellanova, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Mondelez International |

Outperform |

7.68% |

$2.94B |

2.47% |

| Hershey |

Neutral |

26.04% |

$796.27M |

1.36% |

| Kraft Heinz |

Neutral |

-1.91% |

$2.18B |

-17.23% |

| Kellanova |

Neutral |

0.34% |

$1.09B |

7.45% |

Key Takeaway:

Mondelez International ranks highest in revenue growth among its peers. It also leads in gross profit margin. However, it has the lowest return on equity compared to its peers.

Unveiling the Story Behind Mondelez International

Mondelez has operated independently since its split from the former Kraft Foods North American grocery business in October 2012. The firm is a leading player in the global snack enclave with a presence in the biscuit (49% of sales as of the end of fiscal 2024), chocolate (31%), gum/candy (11%), beverage (3%), and cheese and grocery (6%) aisles. Mondelez's portfolio includes well-known brands like Oreo, Chips Ahoy, Halls, and Cadbury. The firm derives around one-third of its revenue from developing markets, just more than one-third from Europe, and the remainder from North America.

Understanding the Numbers: Mondelez International's Finances

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Positive Revenue Trend: Examining Mondelez International's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 7.68% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Staples sector.

Net Margin: Mondelez International's net margin excels beyond industry benchmarks, reaching 7.13%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Mondelez International's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 2.47%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Mondelez International's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.92%, the company showcases efficient use of assets and strong financial health.

Debt Management: Mondelez International's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.82.

To track all earnings releases for Mondelez International visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: MDLZ