Looking At Vertiv Holdings's Recent Unusual Options Activity

Author: Benzinga Insights | October 28, 2025 01:01pm

Investors with a lot of money to spend have taken a bullish stance on Vertiv Holdings (NYSE:VRT).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with VRT, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 84 uncommon options trades for Vertiv Holdings.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 35%, bearish.

Out of all of the special options we uncovered, 13 are puts, for a total amount of $814,295, and 71 are calls, for a total amount of $5,404,694.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $270.0 for Vertiv Holdings, spanning the last three months.

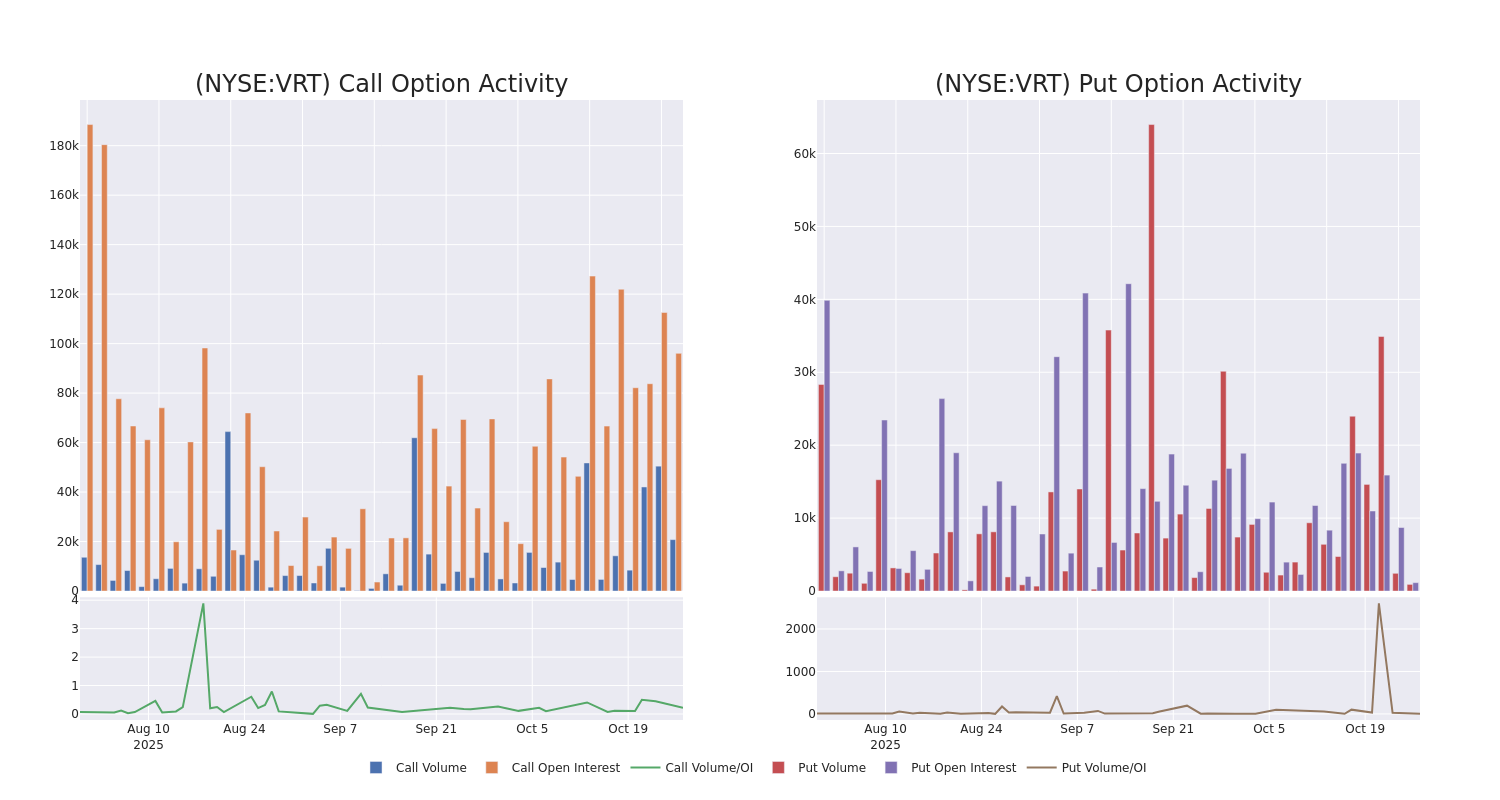

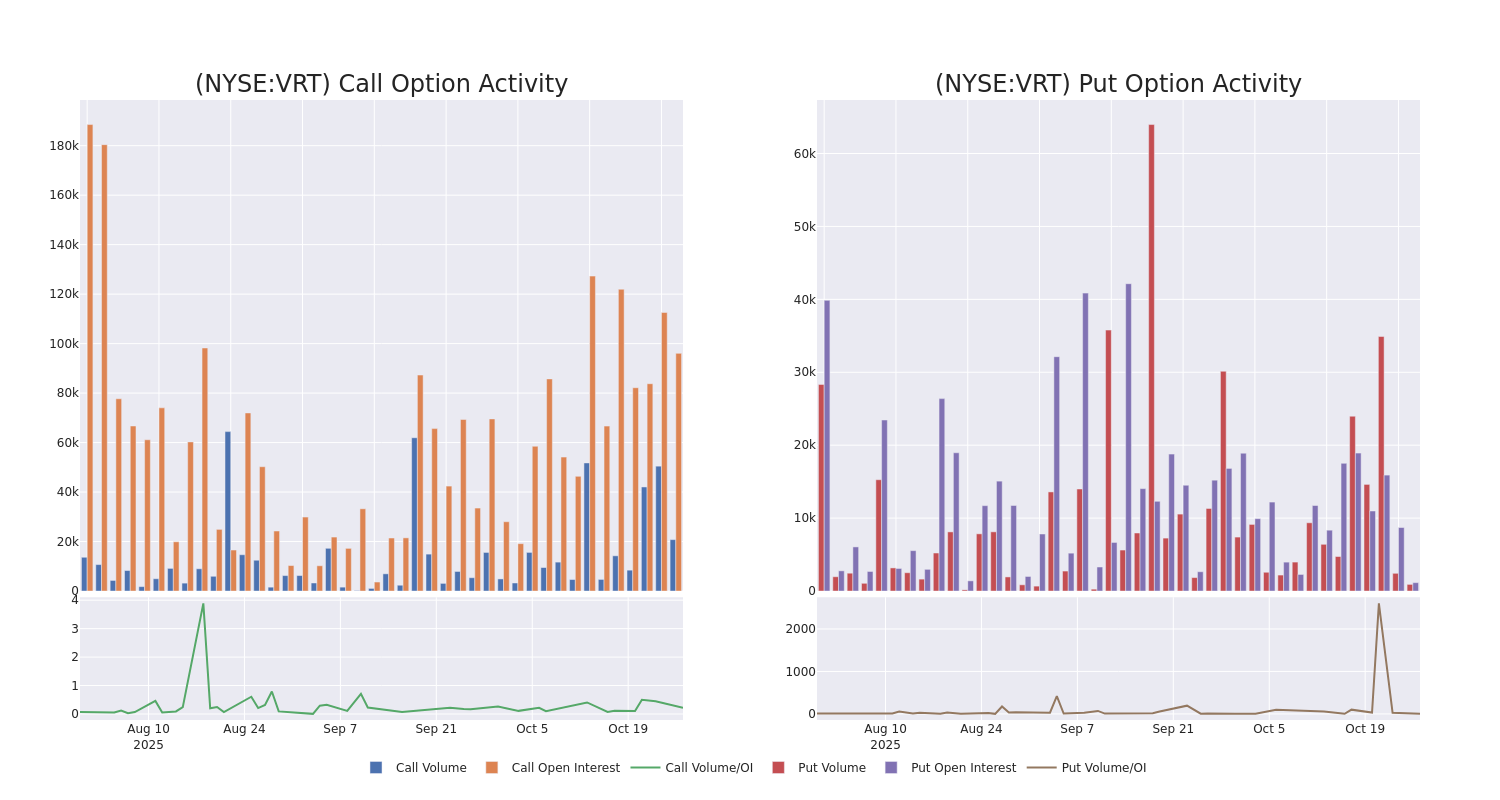

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Vertiv Holdings options trades today is 1135.8 with a total volume of 10,378.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Vertiv Holdings's big money trades within a strike price range of $50.0 to $270.0 over the last 30 days.

Vertiv Holdings 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| VRT |

CALL |

SWEEP |

BULLISH |

11/21/25 |

$27.05 |

$24.85 |

$26.3 |

$170.00 |

$262.5K |

1.3K |

127 |

| VRT |

CALL |

TRADE |

BULLISH |

12/19/25 |

$28.1 |

$25.1 |

$27.01 |

$175.00 |

$216.0K |

1.2K |

97 |

| VRT |

CALL |

TRADE |

BEARISH |

03/20/26 |

$74.6 |

$73.5 |

$73.5 |

$120.00 |

$183.7K |

1.1K |

25 |

| VRT |

CALL |

TRADE |

NEUTRAL |

02/20/26 |

$18.65 |

$17.7 |

$18.1 |

$210.00 |

$181.0K |

173 |

118 |

| VRT |

CALL |

TRADE |

BEARISH |

01/16/26 |

$140.4 |

$138.9 |

$138.9 |

$50.00 |

$138.9K |

265 |

10 |

About Vertiv Holdings

Vertiv has roots tracing back to 1946 when its founder, Ralph Liebert, developed an air-cooling system for mainframe data rooms. As computers started making their way into commercial applications in 1965, Liebert developed one of the first computer room air conditioning, or CRAC, units, enabling the precise control of temperature and humidity. The firm has slowly expanded its data center portfolio through internal product development and the acquisition of thermal and power management products like condensers, busways, and switches. Vertiv has global operations today; its products can be found in data centers in most regions throughout the world.

Current Position of Vertiv Holdings

- Currently trading with a volume of 3,816,369, the VRT's price is down by -0.23%, now at $192.45.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 106 days.

Professional Analyst Ratings for Vertiv Holdings

5 market experts have recently issued ratings for this stock, with a consensus target price of $199.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Vertiv Holdings with a target price of $195.

* An analyst from Morgan Stanley persists with their Overweight rating on Vertiv Holdings, maintaining a target price of $200.

* An analyst from RBC Capital has decided to maintain their Outperform rating on Vertiv Holdings, which currently sits at a price target of $196.

* An analyst from TD Cowen persists with their Buy rating on Vertiv Holdings, maintaining a target price of $210.

* An analyst from Mizuho has decided to maintain their Outperform rating on Vertiv Holdings, which currently sits at a price target of $198.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Vertiv Holdings, Benzinga Pro gives you real-time options trades alerts.

Posted In: VRT