Mid-America Apartment's Earnings: A Preview

Author: Benzinga Insights | October 28, 2025 01:02pm

Mid-America Apartment (NYSE:MAA) is preparing to release its quarterly earnings on Wednesday, 2025-10-29. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Mid-America Apartment to report an earnings per share (EPS) of $1.38.

Investors in Mid-America Apartment are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

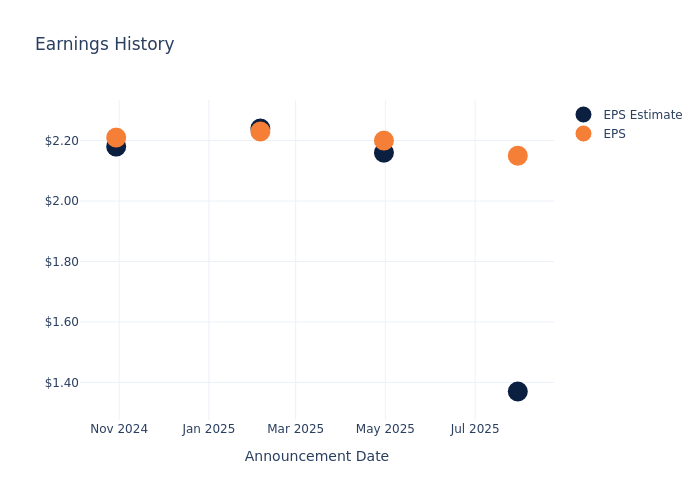

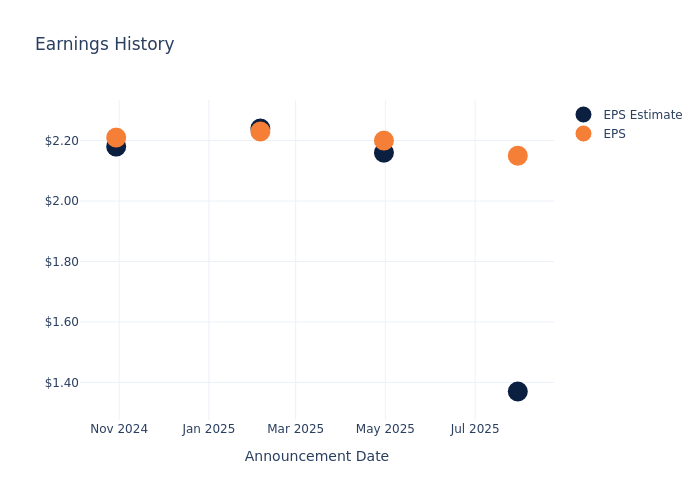

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.78, leading to a 4.27% drop in the share price on the subsequent day.

Here's a look at Mid-America Apartment's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

1.37 |

2.16 |

2.24 |

2.18 |

| EPS Actual |

2.15 |

2.20 |

2.23 |

2.21 |

| Price Change % |

-4.00 |

2.00 |

1.00 |

-1.00 |

Market Performance of Mid-America Apartment's Stock

Shares of Mid-America Apartment were trading at $133.01 as of October 27. Over the last 52-week period, shares are down 14.01%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Insights Shared by Analysts on Mid-America Apartment

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Mid-America Apartment.

Analysts have provided Mid-America Apartment with 15 ratings, resulting in a consensus rating of Neutral. The average one-year price target stands at $157.0, suggesting a potential 18.04% upside.

Understanding Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Essex Property Trust, UDR and Camden Prop Trust, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Essex Property Trust, with an average 1-year price target of $289.96, suggesting a potential 118.0% upside.

- Analysts currently favor an Outperform trajectory for UDR, with an average 1-year price target of $43.88, suggesting a potential 67.01% downside.

- Analysts currently favor an Neutral trajectory for Camden Prop Trust, with an average 1-year price target of $119.34, suggesting a potential 10.28% downside.

Peers Comparative Analysis Summary

In the peer analysis summary, key metrics for Essex Property Trust, UDR and Camden Prop Trust are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Mid-America Apartment |

Neutral |

0.63% |

$164.22M |

1.80% |

| Essex Property Trust |

Neutral |

6.21% |

$322.42M |

3.95% |

| UDR |

Outperform |

2.43% |

$115.84M |

1.11% |

| Camden Prop Trust |

Neutral |

2.42% |

$242.50M |

1.75% |

Key Takeaway:

Mid-America Apartment ranks in the middle among peers for revenue growth. It is at the bottom for gross profit and return on equity.

Unveiling the Story Behind Mid-America Apartment

Mid-America Apartment Communities Inc or MAA, is a real estate investment trust engaged in the acquisition, operation, and development of multifamily apartment communities located in the southeastern and southwestern United States. The company operates two reportable segments; Same Store includes communities that the Company has owned and have been stabilized for at least a full 12 months as of the first day of the calendar year and Non-Same Store and Other includes recently acquired communities, communities being developed or in lease-up, communities that have been disposed of or identified for disposition, communities that have experienced a casualty loss and stabilized communities that do not meet the requirements to be Same Store communities.

Key Indicators: Mid-America Apartment's Financial Health

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Positive Revenue Trend: Examining Mid-America Apartment's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.63% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Mid-America Apartment's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 19.48%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.8%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.91%, the company showcases effective utilization of assets.

Debt Management: Mid-America Apartment's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.85.

To track all earnings releases for Mid-America Apartment visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: MAA