Insights Ahead: Roku's Quarterly Earnings

Author: Benzinga Insights | October 29, 2025 11:01am

Roku (NASDAQ:ROKU) will release its quarterly earnings report on Thursday, 2025-10-30. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Roku to report an earnings per share (EPS) of $0.08.

The market awaits Roku's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

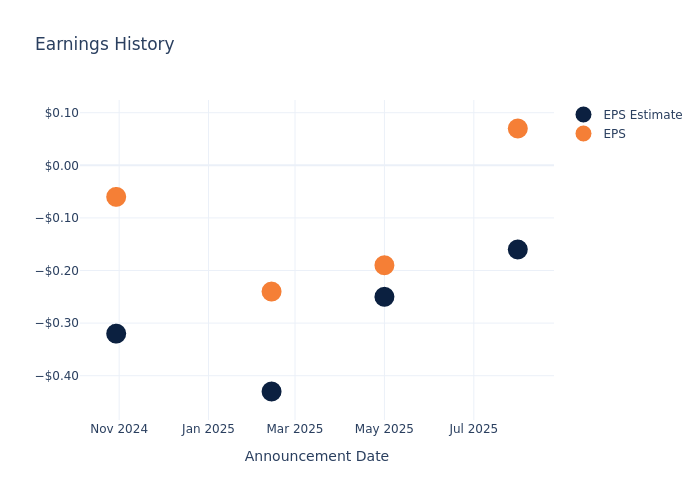

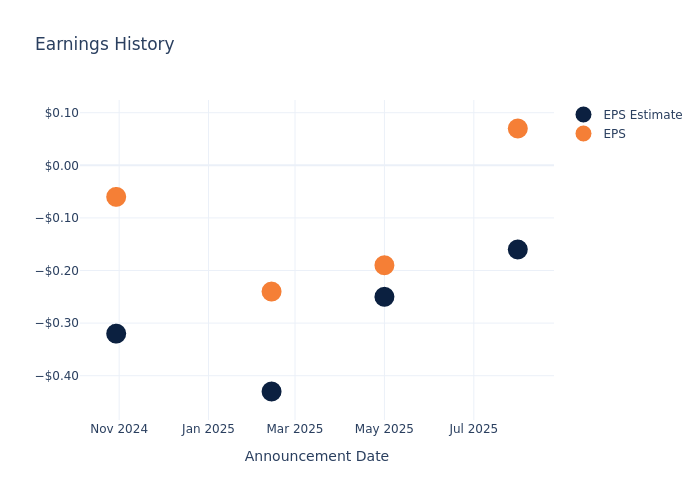

Performance in Previous Earnings

During the last quarter, the company reported an EPS beat by $0.23, leading to a 15.06% drop in the share price on the subsequent day.

Here's a look at Roku's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

-0.16 |

-0.25 |

-0.43 |

-0.32 |

| EPS Actual |

0.07 |

-0.19 |

-0.24 |

-0.06 |

| Price Change % |

-15.00 |

-9.00 |

14.00 |

-17.00 |

Roku Share Price Analysis

Shares of Roku were trading at $99.01 as of October 28. Over the last 52-week period, shares are up 53.76%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Insights Shared by Analysts on Roku

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Roku.

Roku has received a total of 15 ratings from analysts, with the consensus rating as Outperform. With an average one-year price target of $112.33, the consensus suggests a potential 13.45% upside.

Peer Ratings Comparison

The following analysis focuses on the analyst ratings and average 1-year price targets of TKO Group Holdings, Warner Music Gr and Cinemark Holdings, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for TKO Group Holdings, with an average 1-year price target of $221.07, suggesting a potential 123.28% upside.

- Analysts currently favor an Buy trajectory for Warner Music Gr, with an average 1-year price target of $38.25, suggesting a potential 61.37% downside.

- Analysts currently favor an Outperform trajectory for Cinemark Holdings, with an average 1-year price target of $35.17, suggesting a potential 64.48% downside.

Analysis Summary for Peers

The peer analysis summary outlines pivotal metrics for TKO Group Holdings, Warner Music Gr and Cinemark Holdings, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Roku |

Outperform |

14.76% |

$497.66M |

0.41% |

| TKO Group Holdings |

Buy |

9.66% |

$832.06M |

2.33% |

| Warner Music Gr |

Buy |

8.69% |

$776M |

-2.77% |

| Cinemark Holdings |

Outperform |

28.10% |

$596.60M |

13.76% |

Key Takeaway:

Roku ranks first in revenue growth among its peers. It ranks lowest in gross profit margin. It has the lowest return on equity.

All You Need to Know About Roku

Roku enables consumers to stream television programming. It has more than 90 million streaming households and provided 127 billion streaming hours in 2024. Roku is the top streaming operating system in the US, reaching more than half of broadband households, according to the company. Roku's OS is built into streaming devices and televisions that Roku sells and on connected televisions from other manufacturers that license Roku's name and software. Roku also operates the Roku Channel, a free, ad-supported streaming television platform that offers a mix of on-demand and live television programming. Roku generates revenue primarily from selling devices, licensing, and advertising, and it receives fees from subscription streaming platforms that sell subscriptions through Roku.

Understanding the Numbers: Roku's Finances

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Roku's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 14.76% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Communication Services sector.

Net Margin: Roku's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 0.95%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Roku's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.41%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Roku's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.25%, the company may face hurdles in achieving optimal financial returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.22.

To track all earnings releases for Roku visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: ROKU