Unpacking the Latest Options Trading Trends in Shopify

Author: Benzinga Insights | October 29, 2025 12:01pm

Financial giants have made a conspicuous bullish move on Shopify. Our analysis of options history for Shopify (NASDAQ:SHOP) revealed 87 unusual trades.

Delving into the details, we found 47% of traders were bullish, while 39% showed bearish tendencies. Out of all the trades we spotted, 28 were puts, with a value of $1,382,599, and 59 were calls, valued at $67,921,783.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $90.0 to $260.0 for Shopify over the recent three months.

Volume & Open Interest Development

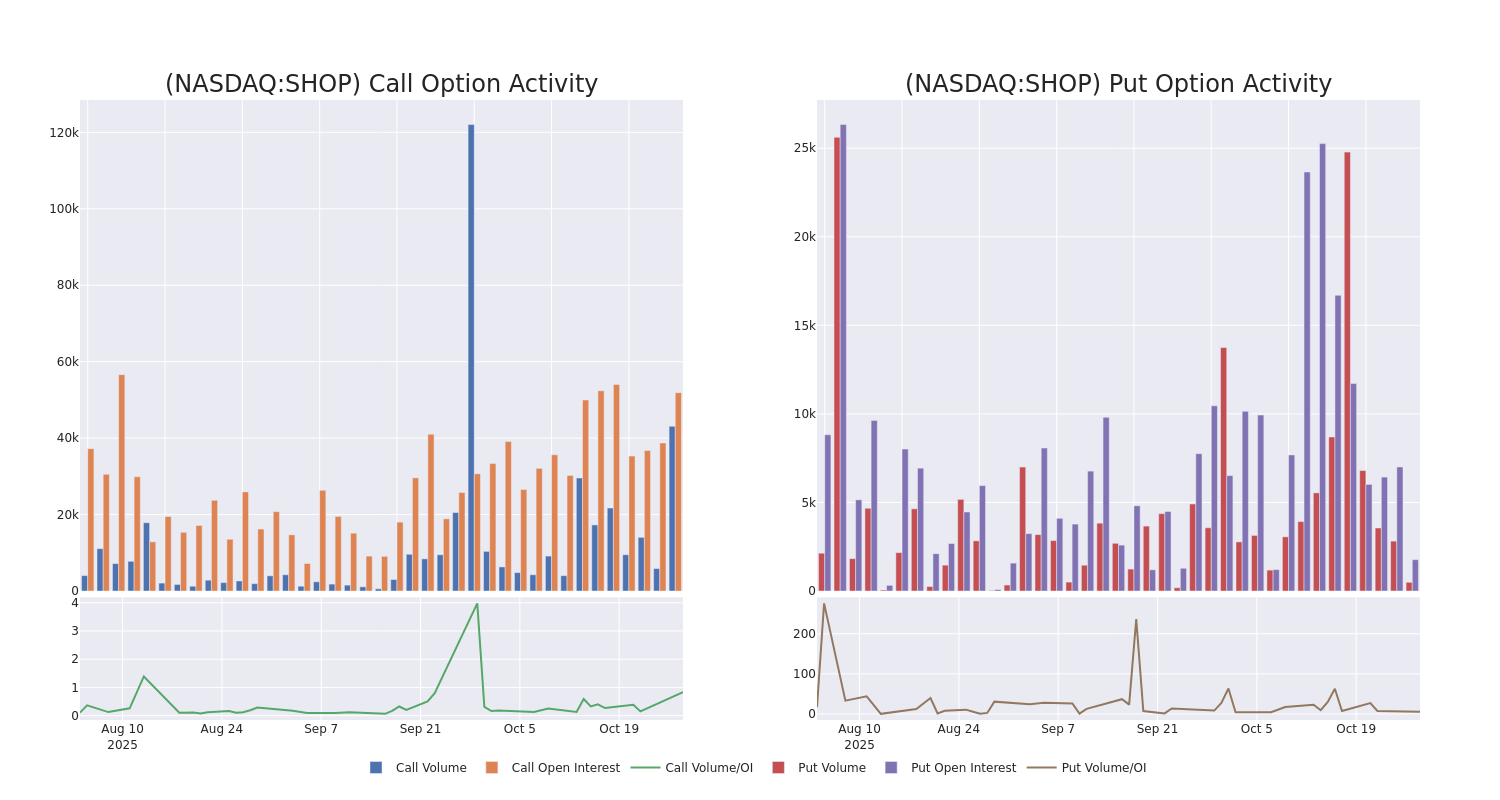

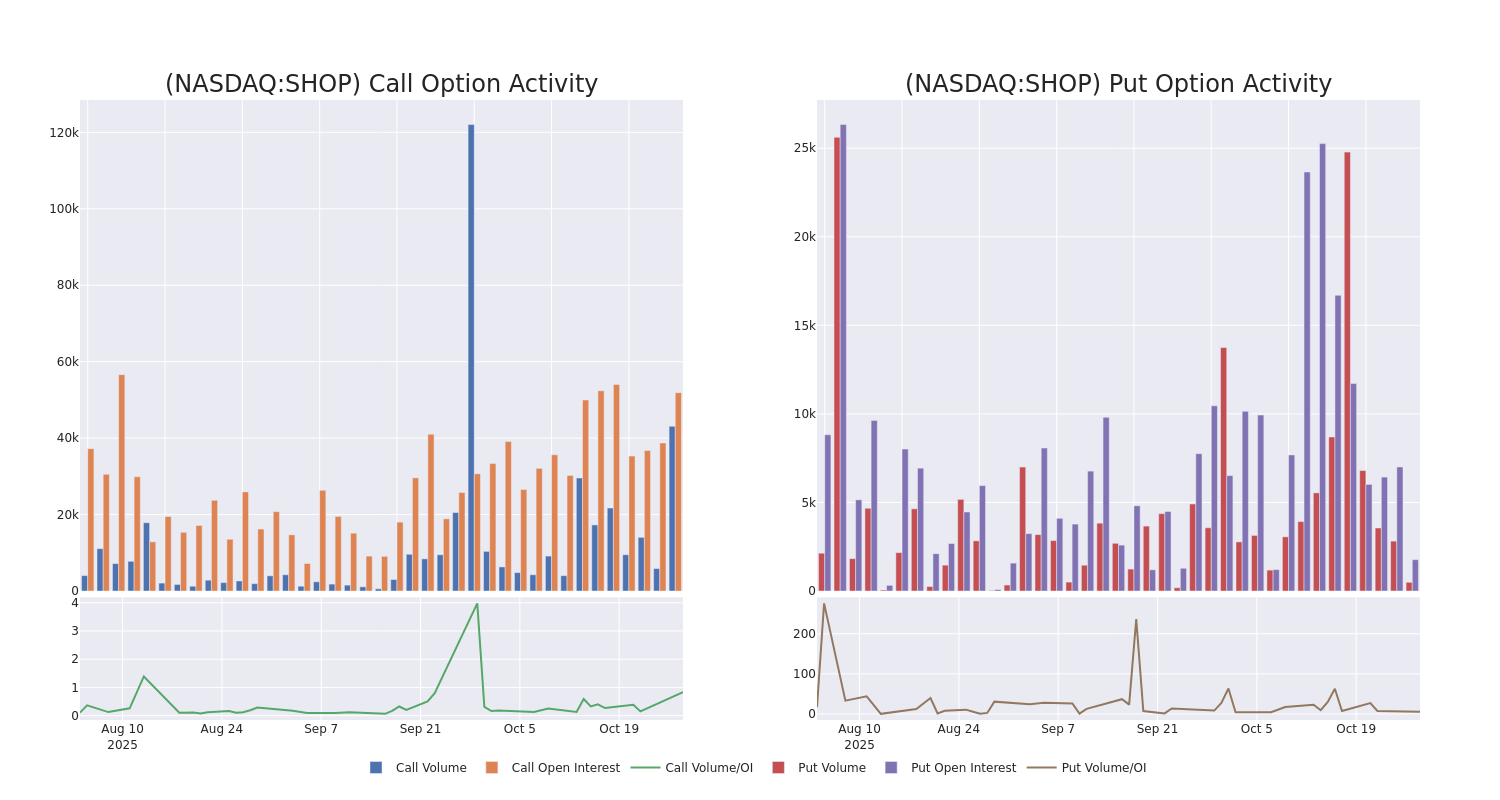

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Shopify's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Shopify's whale trades within a strike price range from $90.0 to $260.0 in the last 30 days.

Shopify Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| SHOP |

CALL |

TRADE |

BULLISH |

01/16/26 |

$31.85 |

$29.3 |

$31.8 |

$160.00 |

$63.6M |

1.3K |

20.0K |

| SHOP |

CALL |

TRADE |

BEARISH |

06/18/26 |

$26.4 |

$26.25 |

$26.25 |

$200.00 |

$131.2K |

376 |

133 |

| SHOP |

CALL |

TRADE |

BULLISH |

02/20/26 |

$7.05 |

$6.85 |

$7.05 |

$240.00 |

$119.8K |

131 |

181 |

| SHOP |

CALL |

TRADE |

BULLISH |

01/16/26 |

$27.75 |

$27.75 |

$27.75 |

$165.00 |

$97.1K |

1.1K |

36 |

| SHOP |

CALL |

TRADE |

BEARISH |

03/20/26 |

$48.0 |

$47.05 |

$47.21 |

$145.00 |

$94.4K |

269 |

54 |

About Shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

Shopify's Current Market Status

- Currently trading with a volume of 5,564,565, the SHOP's price is up by 0.69%, now at $180.19.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 6 days.

What Analysts Are Saying About Shopify

4 market experts have recently issued ratings for this stock, with a consensus target price of $178.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from RBC Capital has decided to maintain their Outperform rating on Shopify, which currently sits at a price target of $200.

* An analyst from Oppenheimer has decided to maintain their Outperform rating on Shopify, which currently sits at a price target of $200.

* In a cautious move, an analyst from TD Cowen downgraded its rating to Hold, setting a price target of $156.

* In a cautious move, an analyst from TD Securities downgraded its rating to Hold, setting a price target of $156.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Shopify with Benzinga Pro for real-time alerts.

Posted In: SHOP