Preview: Estee Lauder Cos's Earnings

Author: Benzinga Insights | October 29, 2025 12:02pm

Estee Lauder Cos (NYSE:EL) is gearing up to announce its quarterly earnings on Thursday, 2025-10-30. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Estee Lauder Cos will report an earnings per share (EPS) of $0.17.

The announcement from Estee Lauder Cos is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

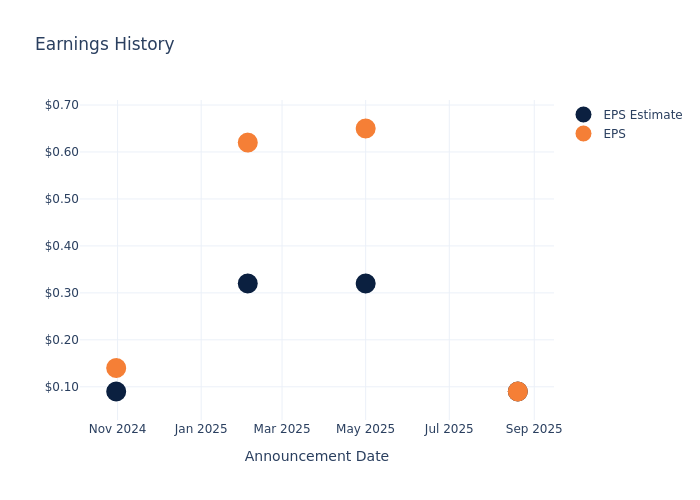

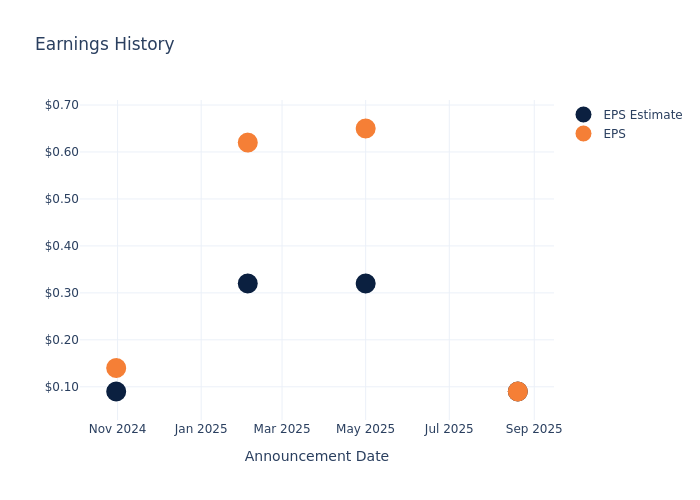

Past Earnings Performance

The company's EPS missed by $0.00 in the last quarter, leading to a 1.33% increase in the share price on the following day.

Here's a look at Estee Lauder Cos's past performance and the resulting price change:

| Quarter |

Q4 2025 |

Q3 2025 |

Q2 2025 |

Q1 2025 |

| EPS Estimate |

0.09 |

0.32 |

0.32 |

0.09 |

| EPS Actual |

0.09 |

0.65 |

0.62 |

0.14 |

| Price Change % |

1.00 |

1.00 |

-5.00 |

-3.00 |

Stock Performance

Shares of Estee Lauder Cos were trading at $98.76 as of October 28. Over the last 52-week period, shares are up 43.2%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Take on Estee Lauder Cos

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Estee Lauder Cos.

With 13 analyst ratings, Estee Lauder Cos has a consensus rating of Neutral. The average one-year price target is $102.23, indicating a potential 3.51% upside.

Comparing Ratings Among Industry Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of Kenvue, e.l.f. Beauty and Coty, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Kenvue, with an average 1-year price target of $20.07, suggesting a potential 79.68% downside.

- Analysts currently favor an Buy trajectory for e.l.f. Beauty, with an average 1-year price target of $146.17, suggesting a potential 48.01% upside.

- Analysts currently favor an Neutral trajectory for Coty, with an average 1-year price target of $5.39, suggesting a potential 94.54% downside.

Analysis Summary for Peers

In the peer analysis summary, key metrics for Kenvue, e.l.f. Beauty and Coty are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Estee Lauder Cos |

Neutral |

-11.88% |

$2.46B |

-13.30% |

| Kenvue |

Neutral |

-4.03% |

$2.26B |

4.04% |

| e.l.f. Beauty |

Buy |

9.02% |

$244.54M |

4.26% |

| Coty |

Neutral |

-8.14% |

$779.70M |

-2.05% |

Key Takeaway:

Estee Lauder Cos ranks highest in Revenue Growth among its peers. It is in the middle for Gross Profit. For Return on Equity, it is at the bottom compared to its peers.

Discovering Estee Lauder Cos: A Closer Look

Estée Lauder is a leader in the global prestige beauty market, participating across skin care (49% of fiscal 2025 sales), makeup (29%), fragrance (17%), and hair care and others (5%), with top-selling brands such as Estée Lauder, Clinique, M.A.C, La Mer, Jo Malone London, Aveda, Bobbi Brown, and Origins. The firm operates in more than 150 countries, generating 31% of revenue from the Americas, 37% from Europe, the Middle East and Africa (including travel retail), and 32% from Asia-Pacific. Estée Lauder sells its products through department stores, travel retail, specialty multibrand beauty stores, brand-dedicated freestanding stores, e-commerce, salons/spas, and perfumeries.

Financial Insights: Estee Lauder Cos

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Negative Revenue Trend: Examining Estee Lauder Cos's financials over 3 months reveals challenges. As of 30 June, 2025, the company experienced a decline of approximately -11.88% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: Estee Lauder Cos's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -16.01%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -13.3%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Estee Lauder Cos's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -2.75%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 2.45, caution is advised due to increased financial risk.

To track all earnings releases for Estee Lauder Cos visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: EL