Fox's Earnings: A Preview

Author: Benzinga Insights | October 29, 2025 01:01pm

Fox (NASDAQ:FOXA) is gearing up to announce its quarterly earnings on Thursday, 2025-10-30. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Fox will report an earnings per share (EPS) of $1.08.

Investors in Fox are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

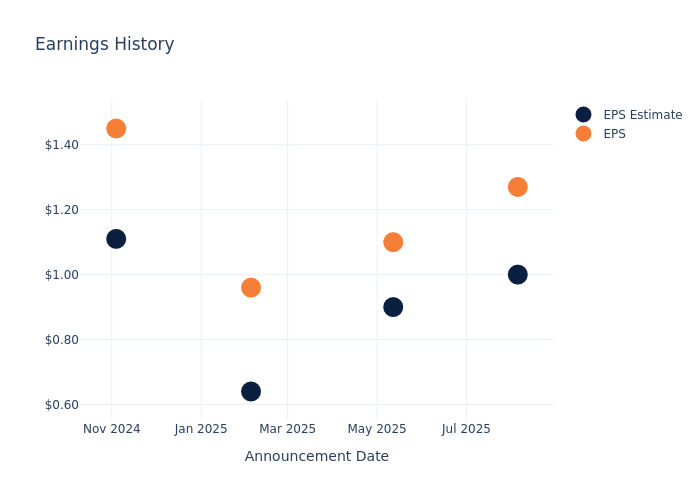

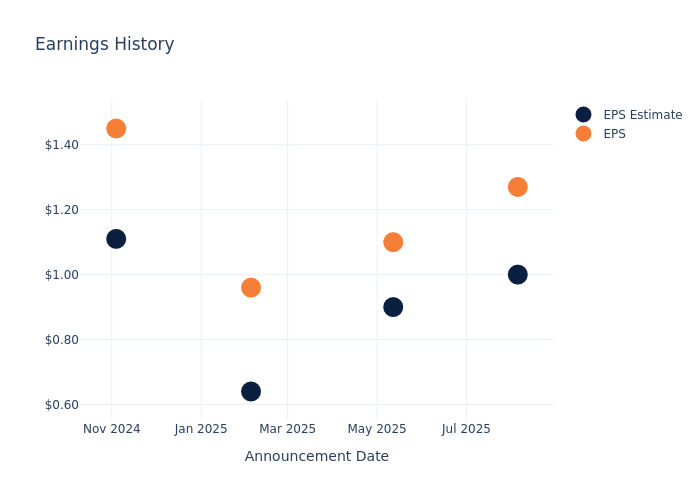

Earnings History Snapshot

In the previous earnings release, the company beat EPS by $0.27, leading to a 1.26% drop in the share price the following trading session.

Here's a look at Fox's past performance and the resulting price change:

| Quarter |

Q4 2025 |

Q3 2025 |

Q2 2025 |

Q1 2025 |

| EPS Estimate |

1.00 |

0.9 |

0.64 |

1.11 |

| EPS Actual |

1.27 |

1.1 |

0.96 |

1.45 |

| Price Change % |

-1.00 |

5.0 |

0.00 |

1.00 |

Tracking Fox's Stock Performance

Shares of Fox were trading at $61.11 as of October 28. Over the last 52-week period, shares are up 44.64%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Take on Fox

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Fox.

The consensus rating for Fox is Buy, derived from 7 analyst ratings. An average one-year price target of $66.43 implies a potential 8.71% upside.

Understanding Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Nexstar Media Gr, Tegna and Newsmax, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Nexstar Media Gr, with an average 1-year price target of $235.0, suggesting a potential 284.55% upside.

- Analysts currently favor an Neutral trajectory for Tegna, with an average 1-year price target of $20.5, suggesting a potential 66.45% downside.

- Analysts currently favor an Outperform trajectory for Newsmax, with an average 1-year price target of $23.0, suggesting a potential 62.36% downside.

Key Findings: Peer Analysis Summary

The peer analysis summary presents essential metrics for Nexstar Media Gr, Tegna and Newsmax, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Paramount Skydance |

Neutral |

0.53% |

$2.23B |

0.34% |

| Nexstar Media Gr |

Outperform |

-3.15% |

$672M |

4.13% |

| Tegna |

Neutral |

-4.97% |

$252.15M |

2.21% |

| Newsmax |

Outperform |

18.39% |

$17.64M |

-52.90% |

Key Takeaway:

Fox is positioned in the middle among its peers for revenue growth, with one peer showing positive growth and two peers showing negative growth. In terms of gross profit, Fox ranks at the top among its peers. For return on equity, Fox is also at the top compared to its peers.

Unveiling the Story Behind Fox

Fox operates in two segments: cable networks and television. Cable networks primarily includes Fox News, Fox Business, and several pay TV sports stations. Television primarily includes the Fox broadcast network, 29 owned and operated local television stations, of which 18 are affiliated with the Fox network, and streaming platform Tubi, which is not subscription-based and is completely ad-supported. Fox effectively sold most of its entertainment assets to Disney in 2019, so it no longer creates entertainment content and relies heavily on live news and sports, with nearly all tied to the pay TV bundle. The Murdoch family controls Fox.

Understanding the Numbers: Fox's Finances

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Fox's remarkable performance in 3 months is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 6.31%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Communication Services sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Fox's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 21.81% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Fox's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.11% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Fox's ROA excels beyond industry benchmarks, reaching 3.08%. This signifies efficient management of assets and strong financial health.

Debt Management: Fox's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.62.

To track all earnings releases for Fox visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: FOXA