Earnings Outlook For Agios Pharmaceuticals

Author: Benzinga Insights | October 29, 2025 02:02pm

Agios Pharmaceuticals (NASDAQ:AGIO) is gearing up to announce its quarterly earnings on Thursday, 2025-10-30. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Agios Pharmaceuticals will report an earnings per share (EPS) of $-1.92.

The announcement from Agios Pharmaceuticals is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

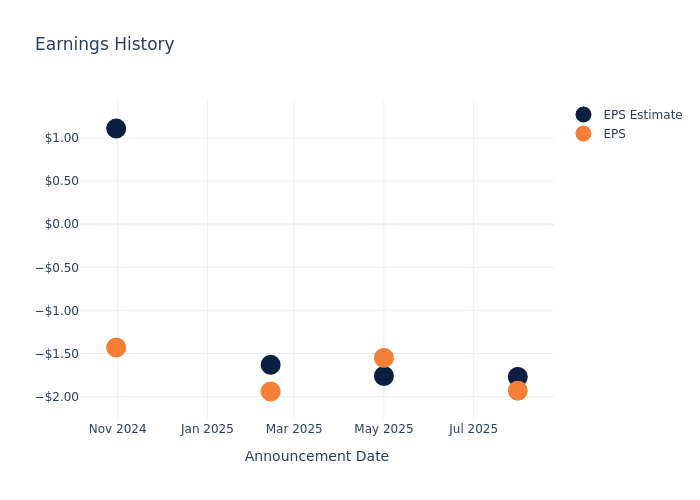

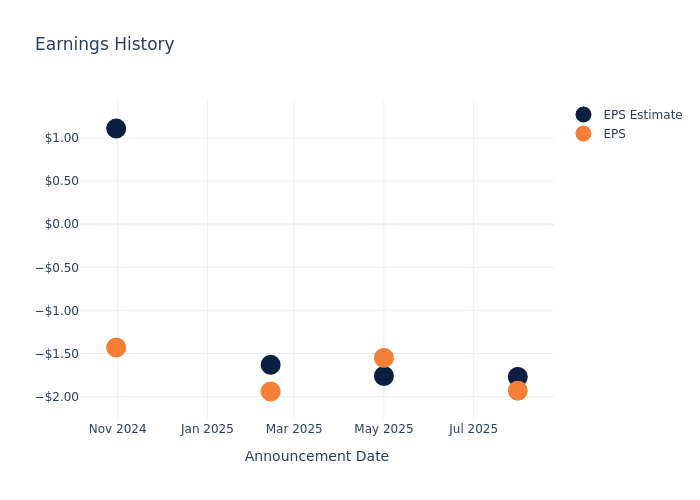

Earnings Track Record

Last quarter the company missed EPS by $0.16, which was followed by a 5.96% drop in the share price the next day.

Here's a look at Agios Pharmaceuticals's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

-1.77 |

-1.76 |

-1.63 |

1.11 |

| EPS Actual |

-1.93 |

-1.55 |

-1.94 |

-1.43 |

| Price Change % |

-6.00 |

-3.00 |

0.00 |

1.00 |

Market Performance of Agios Pharmaceuticals's Stock

Shares of Agios Pharmaceuticals were trading at $43.43 as of October 28. Over the last 52-week period, shares are down 4.5%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analysts' Perspectives on Agios Pharmaceuticals

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Agios Pharmaceuticals.

Analysts have given Agios Pharmaceuticals a total of 1 ratings, with the consensus rating being Buy. The average one-year price target is $56.0, indicating a potential 28.94% upside.

Comparing Ratings Among Industry Peers

The below comparison of the analyst ratings and average 1-year price targets of Sarepta Therapeutics, Recursion Pharmaceuticals and Travere Therapeutics, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Sarepta Therapeutics, with an average 1-year price target of $22.89, suggesting a potential 47.29% downside.

- Analysts currently favor an Buy trajectory for Recursion Pharmaceuticals, with an average 1-year price target of $8.0, suggesting a potential 81.58% downside.

- Analysts currently favor an Buy trajectory for Travere Therapeutics, with an average 1-year price target of $38.88, suggesting a potential 10.48% downside.

Overview of Peer Analysis

The peer analysis summary presents essential metrics for Sarepta Therapeutics, Recursion Pharmaceuticals and Travere Therapeutics, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Agios Pharmaceuticals |

Buy |

44.57% |

$10.75M |

-7.90% |

| Sarepta Therapeutics |

Neutral |

68.38% |

$458.53M |

15.75% |

| Recursion Pharmaceuticals |

Buy |

32.62% |

$-1.06M |

-18.55% |

| Travere Therapeutics |

Buy |

111.49% |

$112.93M |

-38.91% |

Key Takeaway:

Agios Pharmaceuticals ranks at the bottom for Revenue Growth and Gross Profit, while it ranks in the middle for Return on Equity.

About Agios Pharmaceuticals

Agios Pharmaceuticals Inc is a biopharmaceutical company focused on the field of cellular metabolism to create differentiated medicines for rare diseases, with a focus on classical hematology. The company's primary focus is to develop potentially transformative small-molecule medicines. Its product candidate, Pyrukynd (mitapivat), is an activator of both wild-type and mutant pyruvate kinase enzymes, developed for the treatment of hemolytic anemias. The other drug candidates in its pipeline include Tebapivat (PK activator), being developed as a potential treatment for MDS-associated anemia and sickle cell disease, AG-181 (PAH stabilizer), AG-236, and others.

A Deep Dive into Agios Pharmaceuticals's Financials

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Agios Pharmaceuticals's revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 44.57%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Agios Pharmaceuticals's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -899.4% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -7.9%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Agios Pharmaceuticals's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -7.4%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Agios Pharmaceuticals's debt-to-equity ratio is below the industry average. With a ratio of 0.04, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Agios Pharmaceuticals visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: AGIO