Check Out What Whales Are Doing With MELI

Author: Benzinga Insights | October 29, 2025 03:01pm

Investors with a lot of money to spend have taken a bearish stance on MercadoLibre (NASDAQ:MELI).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MELI, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 99 uncommon options trades for MercadoLibre.

This isn't normal.

The overall sentiment of these big-money traders is split between 39% bullish and 40%, bearish.

Out of all of the special options we uncovered, 36 are puts, for a total amount of $1,610,835, and 63 are calls, for a total amount of $4,966,925.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $1600.0 and $3200.0 for MercadoLibre, spanning the last three months.

Analyzing Volume & Open Interest

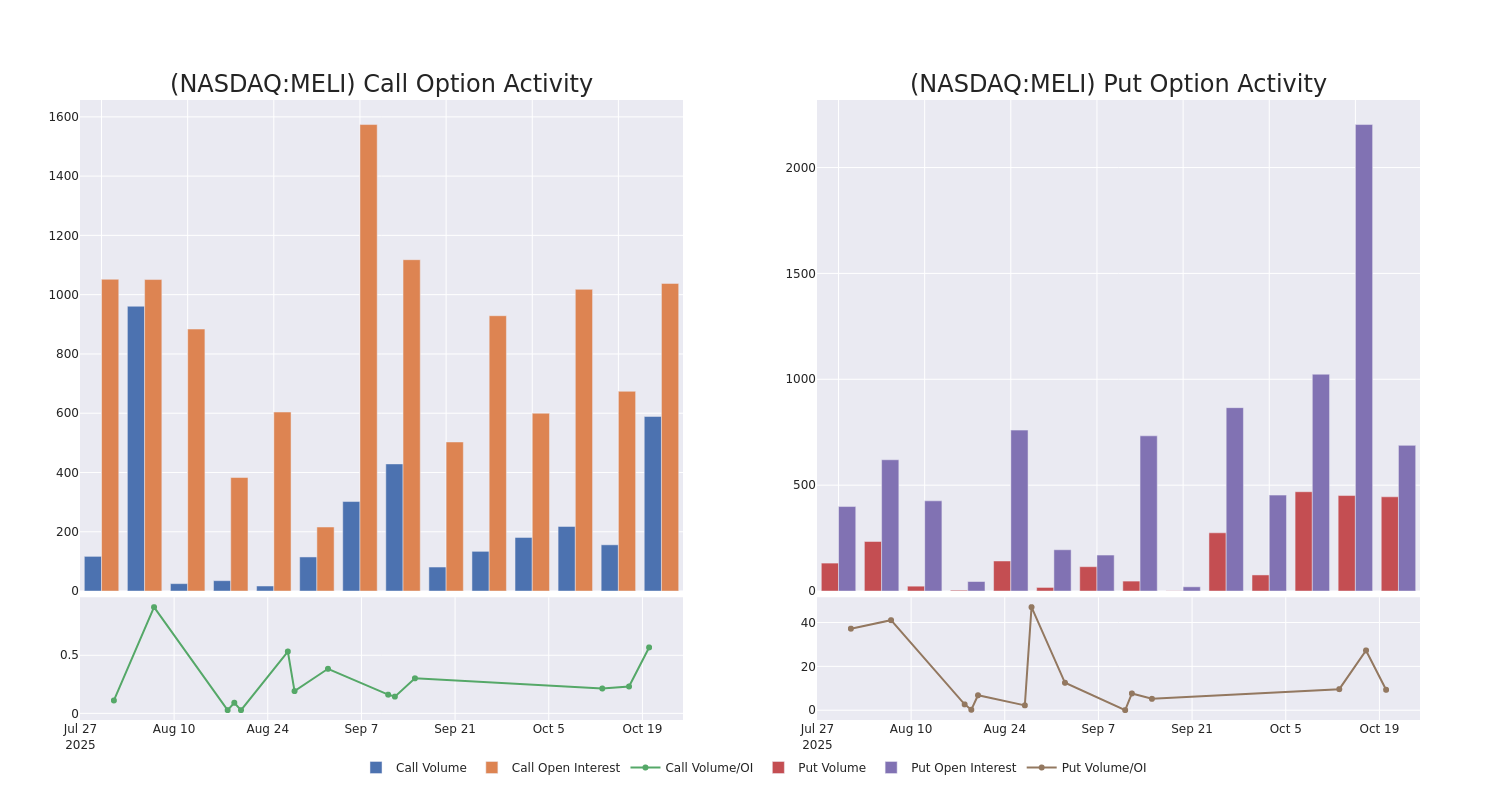

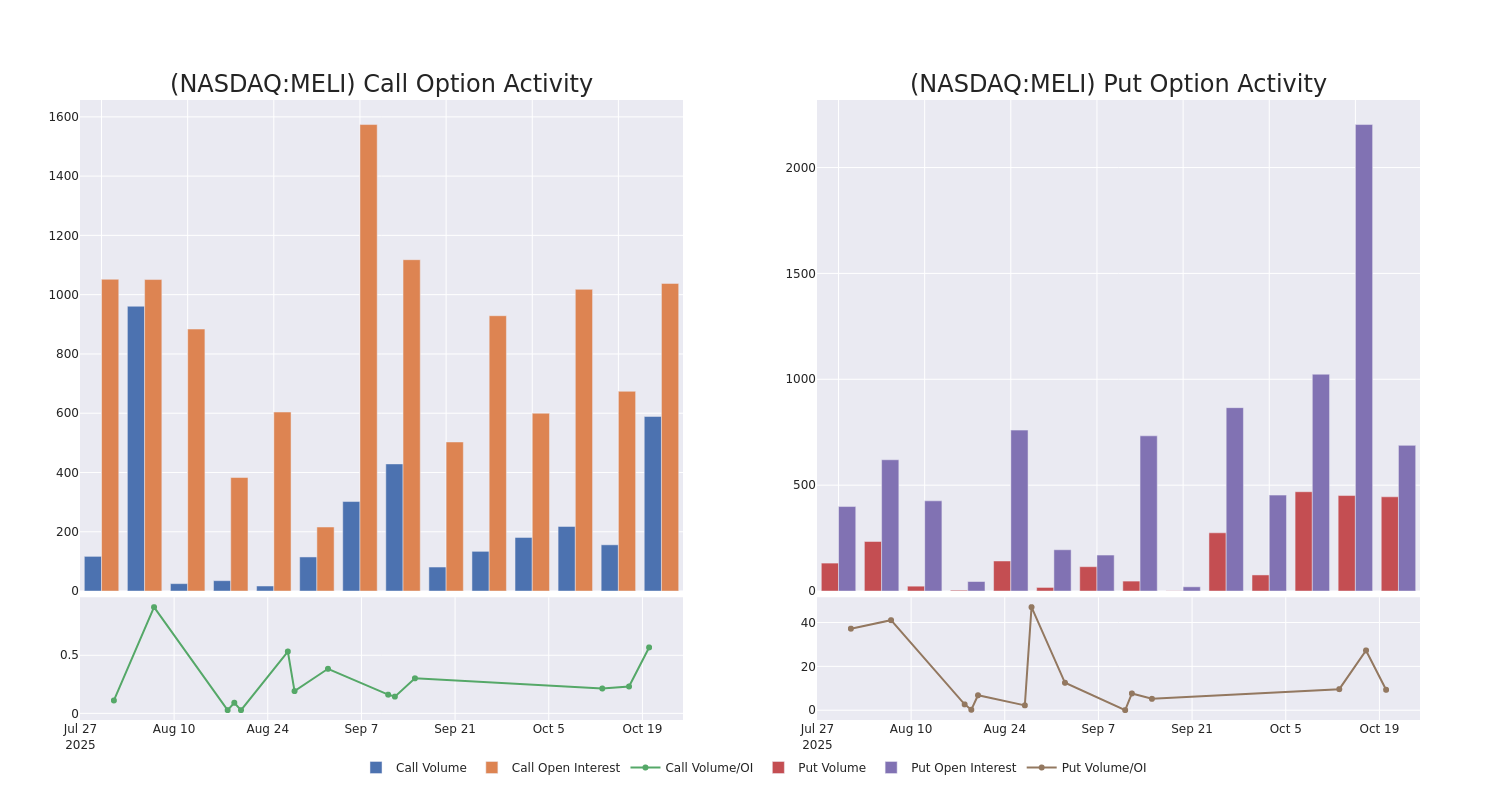

In today's trading context, the average open interest for options of MercadoLibre stands at 100.46, with a total volume reaching 2,083.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in MercadoLibre, situated within the strike price corridor from $1600.0 to $3200.0, throughout the last 30 days.

MercadoLibre 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MELI |

CALL |

SWEEP |

BEARISH |

11/21/25 |

$38.6 |

$20.2 |

$27.5 |

$2600.00 |

$354.2K |

140 |

156 |

| MELI |

PUT |

SWEEP |

BULLISH |

01/16/26 |

$120.0 |

$115.0 |

$115.0 |

$2200.00 |

$115.0K |

486 |

16 |

| MELI |

CALL |

SWEEP |

BULLISH |

10/31/25 |

$22.0 |

$19.8 |

$22.0 |

$2470.00 |

$110.8K |

11 |

0 |

| MELI |

CALL |

TRADE |

BULLISH |

11/21/25 |

$131.0 |

$120.3 |

$131.0 |

$2280.00 |

$104.8K |

37 |

13 |

| MELI |

CALL |

SWEEP |

BEARISH |

10/31/25 |

$86.7 |

$76.1 |

$76.1 |

$2320.00 |

$98.9K |

5 |

67 |

About MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions when last reported. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

Where Is MercadoLibre Standing Right Now?

- Currently trading with a volume of 367,490, the MELI's price is up by 0.38%, now at $2298.8.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 0 days.

What Analysts Are Saying About MercadoLibre

5 market experts have recently issued ratings for this stock, with a consensus target price of $2775.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Benchmark downgraded its rating to Buy, setting a price target of $2875.

* An analyst from Susquehanna persists with their Positive rating on MercadoLibre, maintaining a target price of $2900.

* An analyst from Citigroup has decided to maintain their Buy rating on MercadoLibre, which currently sits at a price target of $2700.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for MercadoLibre, targeting a price of $2600.

* An analyst from Barclays persists with their Overweight rating on MercadoLibre, maintaining a target price of $2800.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for MercadoLibre, Benzinga Pro gives you real-time options trades alerts.

Posted In: MELI