Earnings Outlook For OneMain Holdings

Author: Benzinga Insights | October 30, 2025 10:02am

OneMain Holdings (NYSE:OMF) will release its quarterly earnings report on Friday, 2025-10-31. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate OneMain Holdings to report an earnings per share (EPS) of $1.59.

Investors in OneMain Holdings are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

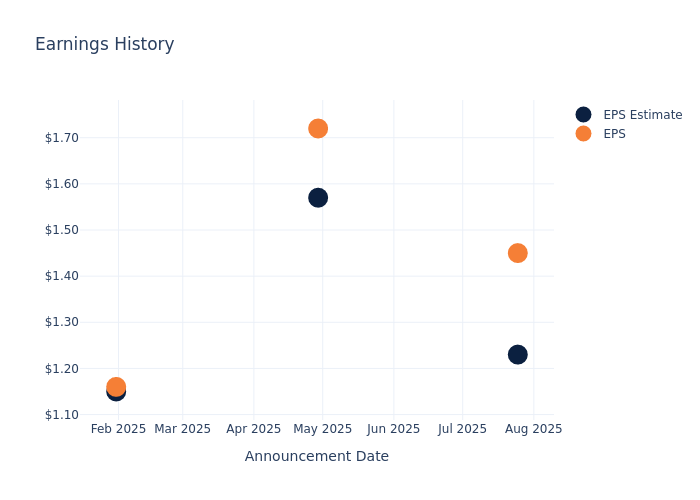

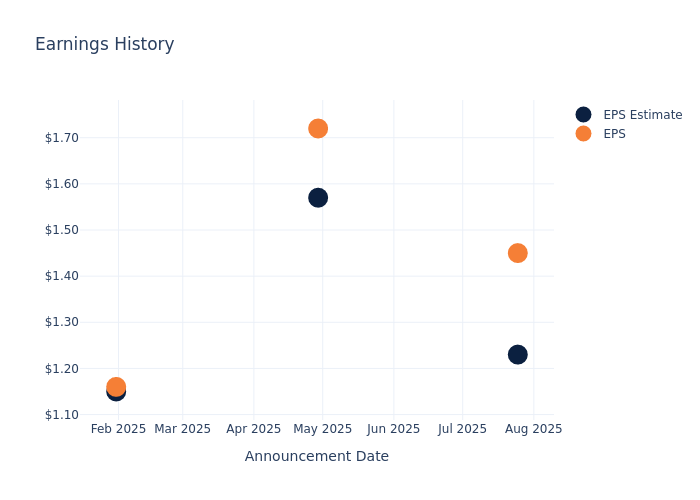

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.22, leading to a 0.0% drop in the share price on the subsequent day.

Here's a look at OneMain Holdings's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

1.23 |

1.57 |

1.15 |

1.14 |

| EPS Actual |

1.45 |

1.72 |

1.16 |

1.26 |

| Price Change % |

1.00 |

-3.00 |

-3.00 |

-4.00 |

Tracking OneMain Holdings's Stock Performance

Shares of OneMain Holdings were trading at $56.02 as of October 29. Over the last 52-week period, shares are up 14.4%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Opinions on OneMain Holdings

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on OneMain Holdings.

A total of 2 analyst ratings have been received for OneMain Holdings, with the consensus rating being Neutral. The average one-year price target stands at $60.0, suggesting a potential 7.1% upside.

Analyzing Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Figure Technology, Dave and Enova International, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Figure Technology, with an average 1-year price target of $46.25, suggesting a potential 17.44% downside.

- Analysts currently favor an Outperform trajectory for Dave, with an average 1-year price target of $284.83, suggesting a potential 408.44% upside.

- Analysts currently favor an Buy trajectory for Enova International, with an average 1-year price target of $146.5, suggesting a potential 161.51% upside.

Comprehensive Peer Analysis Summary

Within the peer analysis summary, vital metrics for Figure Technology, Dave and Enova International are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| FirstCash Hldgs |

Buy |

-0.05% |

$412.82M |

2.85% |

| Figure Technology |

Outperform |

52.91% |

$88.53M |

7.92% |

| Dave |

Outperform |

64.46% |

$114.47M |

4.34% |

| Enova International |

Buy |

5.06% |

$373.75M |

6.39% |

Key Takeaway:

OneMain Holdings ranks at the top for Revenue Growth with 64.46%, outperforming peers. It is in the middle for Gross Profit at $114.47M. OneMain Holdings is at the bottom for Return on Equity with 4.34%.

Unveiling the Story Behind OneMain Holdings

OneMain Holdings Inc is a consumer finance company providing loan products to customers through its branch network and the internet. The company provides personal loan products; offers credit cards; offers optional credit insurance and others; offers a customer-focused financial wellness program, and acquisitions and dispositions of assets and businesses. It provides origination, underwriting, and servicing of personal loans to non-prime customers. The company's reportable segment is Consumer and Insurance. The main source of revenue is net interest income.

Key Indicators: OneMain Holdings's Financial Health

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, OneMain Holdings showcased positive performance, achieving a revenue growth rate of 10.02% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: OneMain Holdings's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 13.7%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): OneMain Holdings's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 5.06%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): OneMain Holdings's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.63%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a high debt-to-equity ratio of 6.63, OneMain Holdings faces challenges in effectively managing its debt levels, indicating potential financial strain.

To track all earnings releases for OneMain Holdings visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: OMF