A Closer Look at Meta Platforms's Options Market Dynamics

Author: Benzinga Insights | October 31, 2025 09:03am

Financial giants have made a conspicuous bearish move on Meta Platforms. Our analysis of options history for Meta Platforms (NASDAQ:META) revealed 132 unusual trades.

Delving into the details, we found 31% of traders were bullish, while 49% showed bearish tendencies. Out of all the trades we spotted, 51 were puts, with a value of $6,964,907, and 81 were calls, valued at $7,841,912.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $380.0 and $1300.0 for Meta Platforms, spanning the last three months.

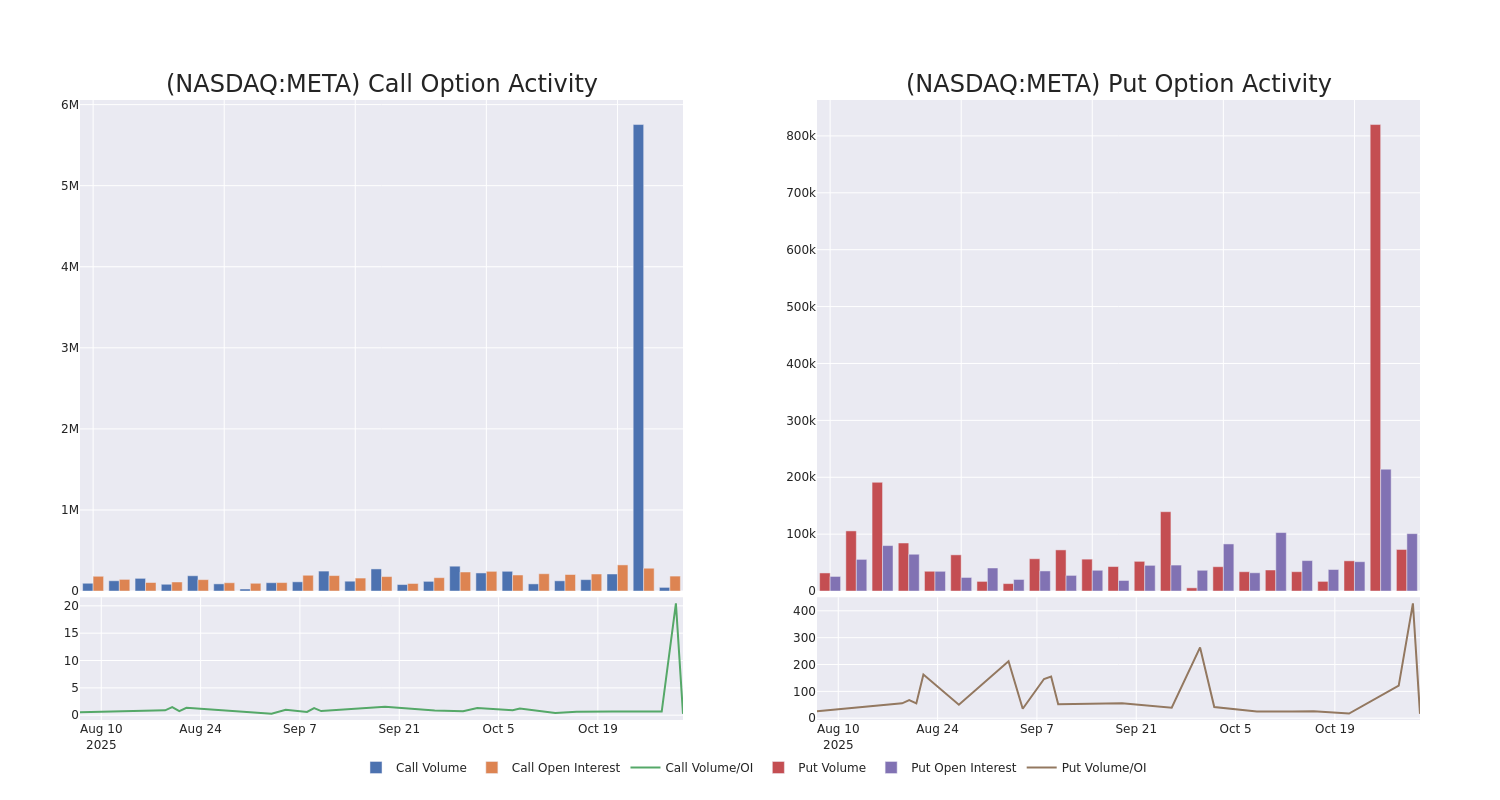

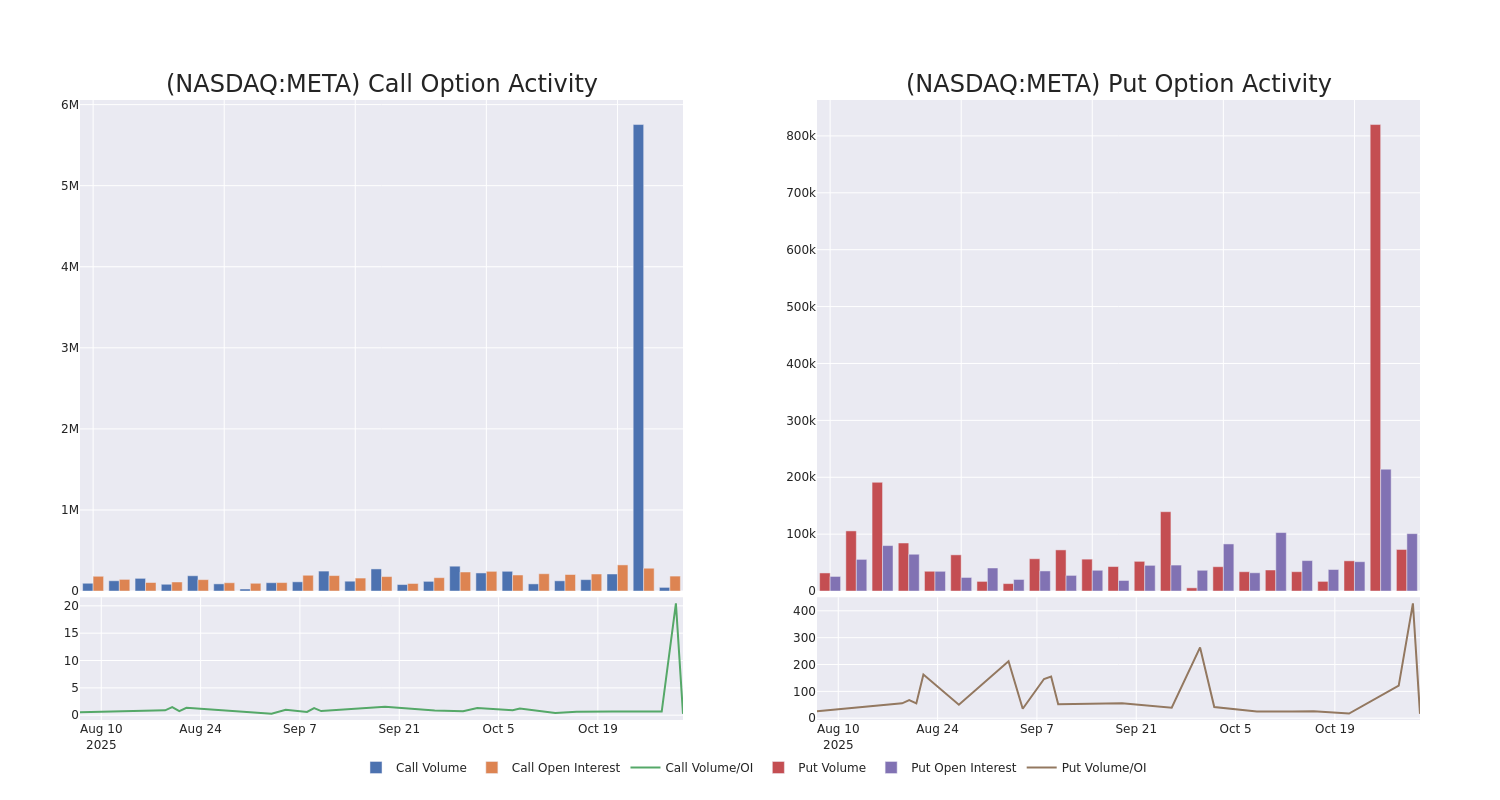

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Meta Platforms's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Meta Platforms's substantial trades, within a strike price spectrum from $380.0 to $1300.0 over the preceding 30 days.

Meta Platforms Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| META |

PUT |

SWEEP |

BULLISH |

01/16/26 |

$40.7 |

$40.3 |

$40.3 |

$660.00 |

$3.2M |

4.0K |

855 |

| META |

PUT |

TRADE |

BEARISH |

12/19/25 |

$30.25 |

$30.1 |

$30.2 |

$650.00 |

$604.0K |

5.6K |

497 |

| META |

CALL |

TRADE |

NEUTRAL |

02/20/26 |

$285.7 |

$279.65 |

$282.66 |

$380.00 |

$423.9K |

307 |

27 |

| META |

CALL |

SWEEP |

BEARISH |

04/17/26 |

$20.2 |

$20.15 |

$20.2 |

$850.00 |

$304.1K |

597 |

63 |

| META |

CALL |

SWEEP |

BEARISH |

11/21/25 |

$23.3 |

$23.2 |

$23.2 |

$660.00 |

$278.4K |

1.3K |

505 |

About Meta Platforms

Meta is the largest social media company in the world, boasting close to 4 billion monthly active users worldwide. The firm's "Family of Apps," its core business, consists of Facebook, Instagram, Messenger, and WhatsApp. End users can leverage these applications for a variety of different purposes, from keeping in touch with friends to following celebrities and running digital businesses for free. Meta packages customer data, gleaned from its application ecosystem and sells ads to digital advertisers. While the firm has been investing heavily in its Reality Labs business, it remains a very small part of Meta's overall sales.

Following our analysis of the options activities associated with Meta Platforms, we pivot to a closer look at the company's own performance.

Current Position of Meta Platforms

- Trading volume stands at 7,594,943, with META's price down by -0.61%, positioned at $662.4.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 89 days.

Professional Analyst Ratings for Meta Platforms

In the last month, 5 experts released ratings on this stock with an average target price of $835.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from UBS has decided to maintain their Buy rating on Meta Platforms, which currently sits at a price target of $900.

* Reflecting concerns, an analyst from Piper Sandler lowers its rating to Overweight with a new price target of $840.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Meta Platforms, which currently sits at a price target of $800.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on Meta Platforms with a target price of $810.

* An analyst from Raymond James downgraded its action to Strong Buy with a price target of $825.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Meta Platforms, Benzinga Pro gives you real-time options trades alerts.

Posted In: META