This Is What Whales Are Betting On Walmart

Author: Benzinga Insights | October 31, 2025 12:01pm

Financial giants have made a conspicuous bearish move on Walmart. Our analysis of options history for Walmart (NYSE:WMT) revealed 28 unusual trades.

Delving into the details, we found 35% of traders were bullish, while 60% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $482,934, and 21 were calls, valued at $3,895,948.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $55.0 and $110.0 for Walmart, spanning the last three months.

Analyzing Volume & Open Interest

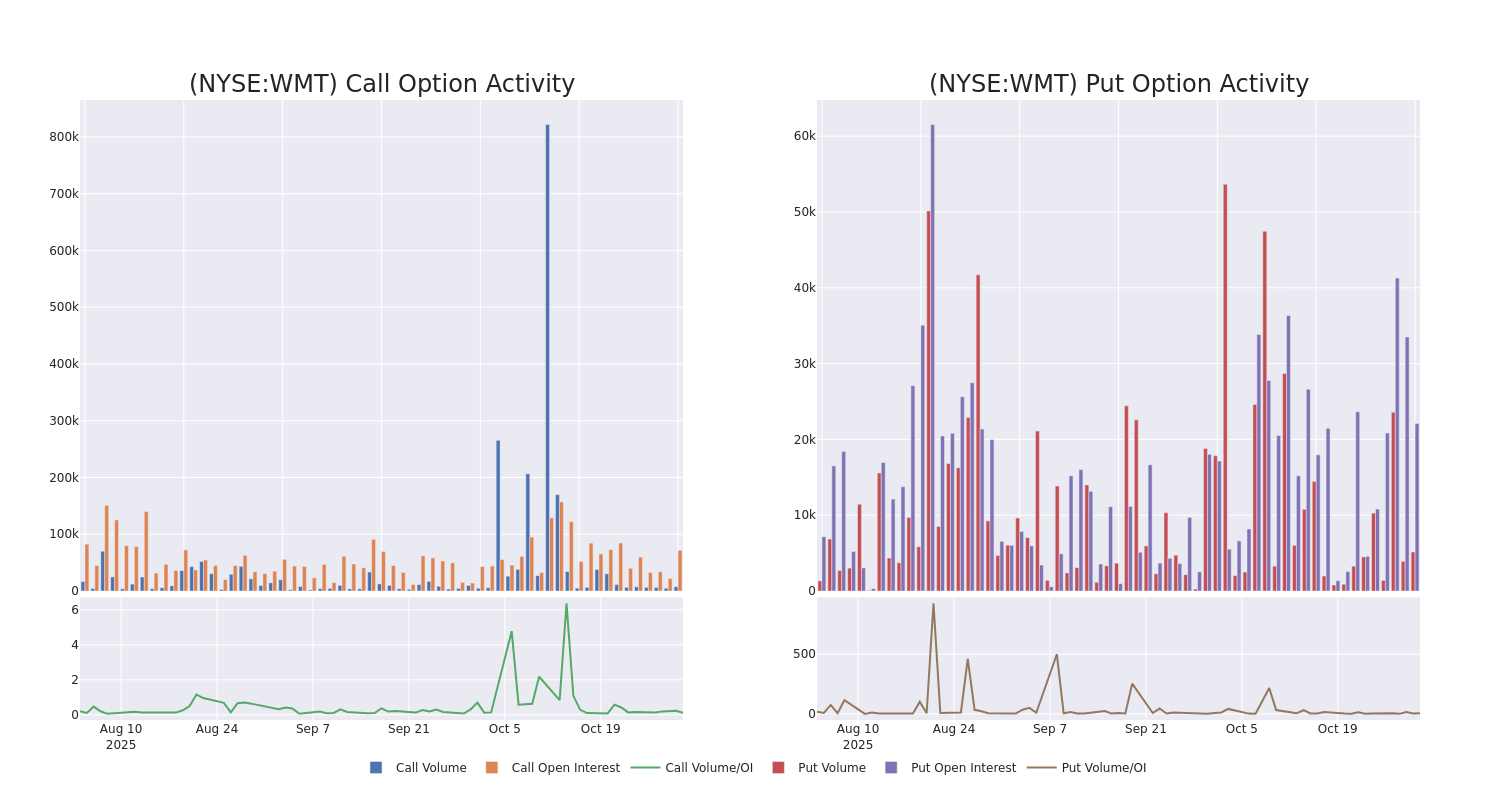

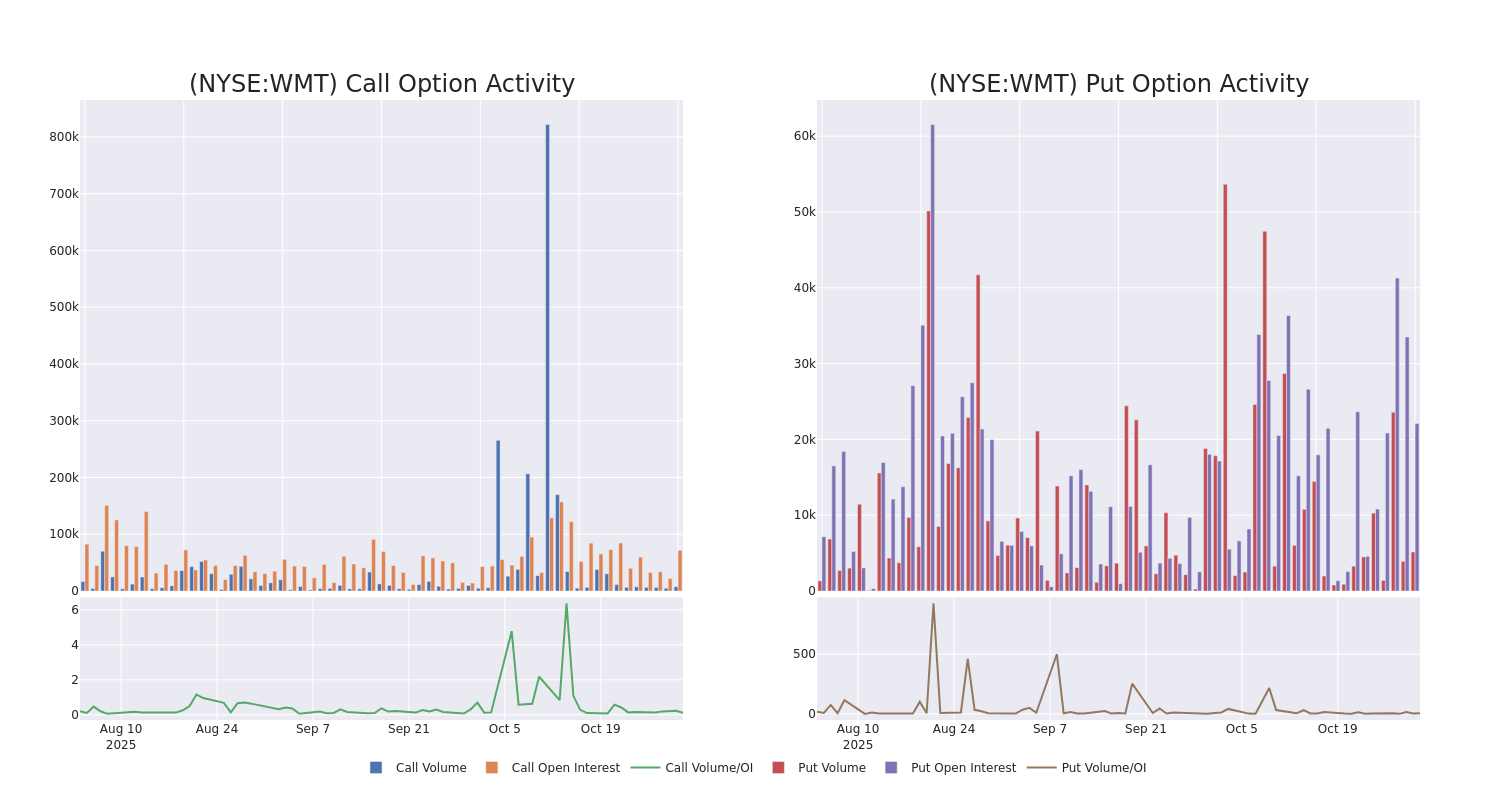

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Walmart's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Walmart's whale trades within a strike price range from $55.0 to $110.0 in the last 30 days.

Walmart Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| WMT |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$22.05 |

$21.4 |

$21.65 |

$80.00 |

$1.2M |

5.9K |

581 |

| WMT |

CALL |

TRADE |

BEARISH |

12/19/25 |

$19.05 |

$18.9 |

$18.9 |

$82.50 |

$1.2M |

765 |

644 |

| WMT |

CALL |

TRADE |

BEARISH |

01/16/26 |

$14.25 |

$13.1 |

$13.1 |

$90.00 |

$307.8K |

11.5K |

235 |

| WMT |

CALL |

SWEEP |

BEARISH |

01/15/27 |

$49.35 |

$48.0 |

$48.0 |

$55.00 |

$254.4K |

1.0K |

53 |

| WMT |

PUT |

SWEEP |

BEARISH |

03/20/26 |

$5.7 |

$5.65 |

$5.7 |

$100.00 |

$199.5K |

3.2K |

400 |

About Walmart

Walmart is a leading retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam's Club) and over 10,000 locations globally. Walmart generated over $460 billion in domestic namesake sales in fiscal 2025, with Sam's Club contributing another $90 billion to the company's top line. Internationally, Walmart generated $120 billion in sales. The retailer serves around 270 million customers globally each week.

Having examined the options trading patterns of Walmart, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Walmart's Current Market Status

- With a trading volume of 8,212,832, the price of WMT is down by -1.53%, reaching $100.67.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 20 days from now.

What Analysts Are Saying About Walmart

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $117.25.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on Walmart with a target price of $116.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Walmart with a target price of $111.

* An analyst from BTIG has revised its rating downward to Buy, adjusting the price target to $120.

* An analyst from UBS has decided to maintain their Buy rating on Walmart, which currently sits at a price target of $122.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Walmart, Benzinga Pro gives you real-time options trades alerts.

Posted In: WMT